Key Takeaways

- Tokemak is an emerging protocol that aims to offer deep and sustainable liquidity to DeFi projects.

- Using Tokemak, DeFi projects can reduce the costs for securing and sourcing liquidity by three to four times.

- For liquidity providers, Tokemak provides higher yields and impermanent loss protection through single-sided staking pools.

Share this article

Tokemak is DeFi’s first Liquidity-as-a-Service product. It is designed to mitigate impermanent loss for liquidity providers and secure deep and sustainable liquidity for DeFi protocols. Tokemak reactors can help projects reduce their costs for securing and spending liquidity by roughly three to four times.

DeFi’s Liquidity Problem

Since launching in the summer of 2021, Tokemak has quickly established itself as one of DeFi’s most promising projects. Its early success is thanks mainly to its unique value proposition and approach to capturing liquidity.

To understand how Tokemak functions, it’s worth looking into the issue of liquidity and liquidity management in crypto. In simple terms, liquidity refers to the quantity of crypto assets available for trading on a particular protocol or trading venue. Liquidity is important because it determines how easily an asset can be converted to cash or another another without affecting its market price.

When a protocol or trading venue has deep or high liquidity, traders can efficiently execute high-value trades without incurring slippage—a market phenomenon referring to the price difference between the asset’s order price and the paid price of the trade. When liquidity on a particular exchange is low, the slippage is higher, meaning traders typically receive fewer tokens than they ordered with each trade.

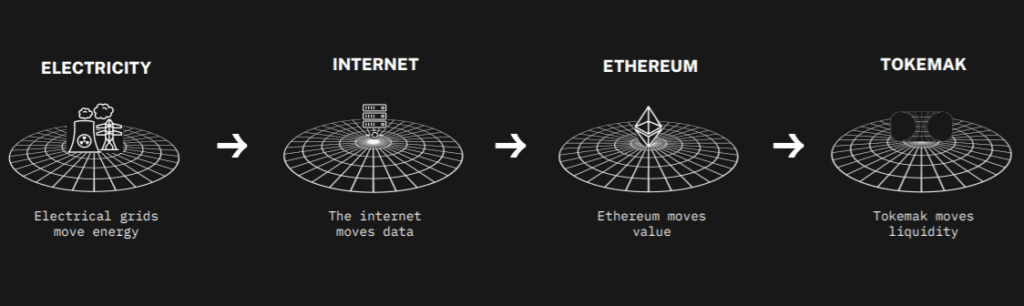

Markets cannot exist without liquidity, which is why Tokemak likes to think of liquidity as infrastructure. As Tokemak puts it, electrical grids allow for the transfer of energy, the Internet allows for the transfer of information, and blockchains like Ethereum allow for the transfer of value. Tokemak founder Carson Cook sat down with Crypto Briefing to discuss the project, and he explained that it was built with the aim of having “an additional layer that moves liquidity between blockchains.”

Cook describes Tokemak’s service as a “liquidity utility.” Eventually, the project is aiming to become a fully-fledged liquidity sourcing and management protocol that allows developers to build their projects without worrying about liquidity. “In this new world of Web3, you basically have value flow replacing the data flow of Web2,” he said. “So in a world where value flow is moving around, liquidity really plays the role of bandwidth within the system.”

Liquidity sourcing in crypto is currently suboptimal. Centralized exchanges rely on centralized market-makers, while decentralized exchanges rely on automated market-makers to secure and manage liquidity. For projects looking to source liquidity for their native tokens, the process can cost a significant amount of time and money. In DeFi today, the ability to solve the liquidity problem can make or break a project. Commenting on this problem, Carson said:

“One of the main signals we saw for building Tokemak is that all of these builders were living and dying based on whether they’ve figured out liquidity or market-making, which seemed like a strange thing for a builder of a gaming token, for example—to have their vision live or die based on whether they figured out something as opaque sounding as liquidity or market-making.”

According to calculations Tokemak shared with Crypto Briefing, DeFi project founders can spend anywhere between 25% and 75% of their timeshare on issues concerning liquidity sourcing, management, and market-making. On top of that, projects pay an average of around $1.25 in their native tokens for every $1 of liquidity secured. With Tokemak’s sustainable, on-demand liquidity sourcing and management solution, Carson says that this figure could be reduced by three to four times.

Tokemak Explained

The three functions that traditional market-makers typically centralize are capital provision, strategic market knowledge as to what and where assets can be traded, and trading technology and expertise to price the assets.

Rather than centralizing these three functions, Tokemak disaggregates and crowdsources them across the blockchain. Tokemak is effectively a decentralized liquidity provider. Like centralized market-makers, it executes the same three functions, but it segregates the tasks to three separate participants.

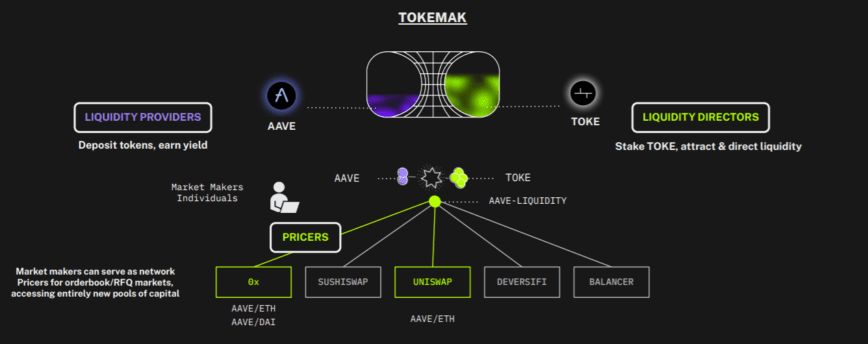

These three participants are the liquidity providers that bring capital into the system, the liquidity directors that manage where liquidity needs to flow, and the pricers that provide trading and asset pricing information when the liquidity needs to go to order book or request-for-quotation-based exchanges. Pricers are excluded from the process when liquidity goes to automated market maker-based exchanges as the protocols themselves use an algorithm to price the assets.

From a systems architecture standpoint, Tokemak is split into two parts: the genesis pools and the reactors. The genesis pools represent single-sided, globalized pools where liquidity providers can add ETH or USDC, which the reactors draw upon to provide double-sided liquidity on different trading venues across the crypto market. These are called globalized pools because ETH and USDC are the most common assets paired with other tokens to bootstrap liquidity pools across automated market makers.

The reactors, on the other hand, represent the liquidity balancing and directing pools. On one side, liquidity providers deposit assets like AAVE, SUSHI, or OHM, and on the other liquidity directors determine where that liquidity will go by depositing Tokemak’s native utility and governance token, TOKE.

One simple way to understand how Tokemak works is to focus on single reactors. To provide $20 million worth of liquidity in the ETH/AAVE pool on Uniswap, for example, the Tokemak protocol would take $10 million worth of AAVE tokens from the AAVE reactor and match it with $10 million worth of ETH from the ETH genesis pool, then automatically deposit the liquidity on Uniswap.

Liquidity directors are responsible for deciding whether that same liquidity should be paired with ETH or USDC, as well as the decentralized exchange it gets deposited to. Liquidity directors accrue voting power based on the amount of TOKE they’ve staked in the system.

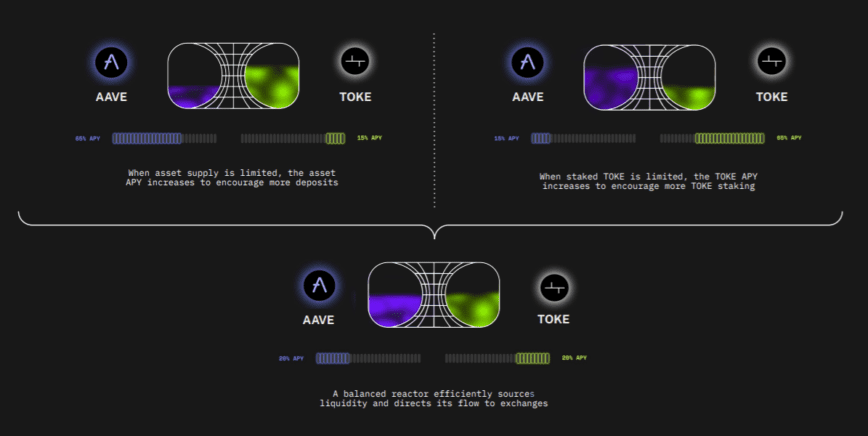

To improve its effectiveness as a liquidity utility, Tokemak leverages TOKE emissions as rewards for liquidity providers and liquidity directors to balance the reactors. When a significant amount of assets have been deposited to a reactor but there is only a minimal amount of TOKE directing the liquidity, the protocol allocates more TOKE rewards to the liquidity director side. This increases the annual percentage yield liquidity directors can earn, which encourages more participants to direct the liquidity.

Conversely, if there’s a significant amount of TOKE staked in a reactor relative to the assets deposited as liquidity, the protocol allocates more TOKE rewards to the asset side of the reactor to encourage liquidity provision. In essence, Tokemak uses TOKE rewards to incentivize a balance between the value of the assets deposited as liquidity and the TOKE staked by liquidity directors through variable rewards emissions.

This disintermediated market-making approach benefits projects looking to source liquidity and users looking to provide liquidity. It helps projects outsource liquidity sourcing and management efficiently and inexpensively. In contrast, liquidity providers can provide single-sided liquidity passively and without the risk of incurring impermanent loss—a process in which liquidity providers temporarily lose funds when providing assets to a liquidity pool due to the price volatility of the assets deposited.

While Tokemak’s design is undoubtedly beneficial for individual stakeholders, it could also be a game-changer for the broader DeFi space. This is because it is aiming to mitigate impermanent loss and move toward what it calls “The Singularity.”

Mitigating Impermanent Loss

Liquidity provision across DeFi exchanges currently requires staking assets in dual token liquidity pools. Because of the way automated market makers function, liquidity providers risk losing money from market-making due to impermanent loss.

Impermanent loss refers to the difference in value between depositing assets in dual token liquidity pools and the value liquidity providers would have had if they passively held onto their assets instead of staking them. It occurs due to the price volatility of assets deposited in a pool.

According to a recent Bancor-backed study, nearly 50% of liquidity providers on Uniswap V3—DeFi’s largest automated market maker—suffer negative returns due to impermanent loss. Consequently, many DeFi participants are reluctant to provide liquidity on decentralized exchanges unless they are confident that the rewards are big enough to cover any potential losses. DeFi projects often allocate large portions of their token supply as rewards to liquidity providers to secure sufficient liquidity, which dilutes the value of their tokens through inflation.

As the model is flawed, Tokemak has taken measures to mitigate impermanent loss for liquidity providers. From the perspective of an individual liquidity provider, depositing assets in single-sided staking pools solves the impermanent loss problem as it allows liquidity providers to withdraw the same quantity of assets they deposited.

On a system-wide level, impermanent loss is still present, but Tokemak absorbs it on behalf of individual liquidity providers by reimbursing their losses. Reimbursements either come from drawing the assets in deficit from the Protocol Controlled Assets reserve, or in the rare instances that the assets in deficit don’t cover the losses, from liquidating the TOKE staked into the affected reactor. This means that liquidity directors are the last backstop for mitigating impermanent loss for liquidity providers.

The Singularity

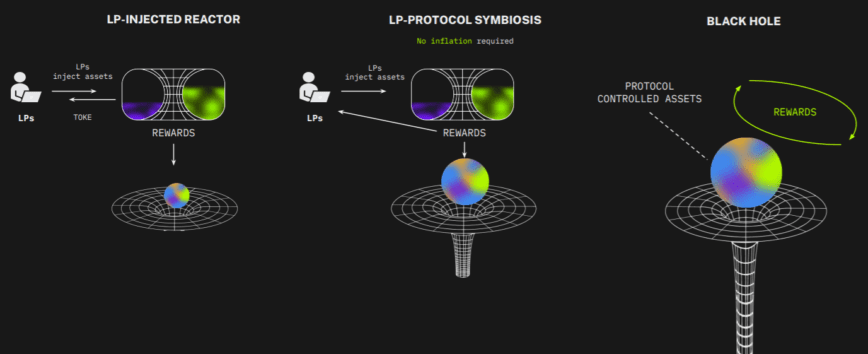

While both liquidity providers and liquidity directors earn high yields from TOKE emissions, the trading fees accrued from providing liquidity also need somewhere to go.

All of the revenue the protocol makes on a whole-systems level go into Tokemak’s treasury pool, dubbed the “Protocol Controlled Assets.” This pool uses the same assets to further provide liquidity on different protocols and cover liquidity providers for impermanent loss.

Over time, the goal is to grow the Protocol Controlled Assets pool reserve big enough for the protocol to tighten up the TOKE monetary supply and start paying out a portion of the revenue rather than TOKE as liquidity provider rewards. Commenting on the big picture idea behind this model, Carson explained:

“The goal is to get to what we call “The Singularity,” which is the moment that we have enough protocol-controlled assets that we don’t even need third-party liquidity providers. So at that point, you have this liquidity infrastructure that provides liquidity and already has enough assets itself to provide that liquidity bandwidth across DeFi.”

Carson anticipates that, in the future, Tokemak’s DAO could vote to pay out the yield generated from the Protocol Controlled Assets treasury pool to TOKE holders or use the yields to burn and redeem TOKE to put deflationary pressure on the token. In either outcome, as members of the Tokemak DAO, TOKE holders effectively have a pro-rata claim on the treasury, which indirectly gives them exposure to a diversified pool of revenue-generating assets.

This is where the idea of seeing liquidity as infrastructure crystalizes. Tokemak effectively wants to become the sole decentralized liquidity provider across the decentralized finance ecosystem. Just as Amazon Web Services revolutionized data hosting by providing on-demand cloud computing to IT businesses, Tokemak hopes to revolutionize blockchain liquidity by providing Liquidity-as-a-Service to DeFi projects.

Tokemak offers a way for DeFi projects to subscribe to its Liquidity-as-a-Service product rather than paying for and managing their own liquidity. This outsourcing greatly reduces costs for projects.

To better illustrate this point, it’s worth looking at how other specific DeFi projects could benefit. Alchemix, for example, could collapse its ALCX/ETH Sushi LP pool and ALCX governance pool into a single Tokemak pool and incentivize only one, which would reduce the costs for securing and sourcing liquidity.

Tokemak estimates that its solution could lead to a three to four times reduction in what projects will need to pay for liquidity. Savings could be even higher as Tokemak approaches The Singularity. By spending less on liquidity incentives, projects can curb token emissions and inflation. Consequently, the token holders experience less dilution, leading to stronger incentives to invest for the long term. Lastly, Tokemak gets to keep collecting fees from its market-making services.

Final Thoughts

With an actively expanding team of around 20 blockchain developers and crypto natives, Tokemak is aiming to disrupt the old, unsustainable paradigm of inflation-based liquidity.

So far, the protocol has been operating with limited capacity, having spun up only five reactors through its Collateralization of Reactors Events (C.O.R.E.), with an additional five already approved and in the process of bootstrapping. Over the next four to six weeks, Tokemak plans to enable permissionless reactors, which will allow DeFi projects to spin up their own reactors without approval from Tokemak’s DAO.

This is when Tokemak will start operating at full capacity and commence the race toward The Singularity. While it’s still unclear whether Tokemak will ever become a self-sustainable liquidity utility, its momentary benefits for both DeFi projects and liquidity providers are undeniable. It is one of very few DeFi protocols that has the potential to revolutionize the DeFi space and usher in a new era based on completely redefined liquidity sourcing and management dynamics.

Disclosure: At the time of writing, the author of this feature owned ETH and several other cryptocurrencies.

Share this article

DeFi Project Spotlight: Abracadabra.Money, DeFi’s Magic Money Sp…

Abracadabra.Money is a lending protocol that allows users to deposit interest-bearing assets as collateral to borrow a stablecoin called Magic Internet Money that can be used across multiple blockchains. Abracadabra.Money…

DeFi Project Spotlight: Orion Money, the Cross-Chain Stablecoin Bank

Orion Money is aiming to become a cross-chain stablecoin bank based on an innovative suite of DeFi products providing seamless and frictionless access to stablecoin saving, lending, and spending. Its…

How Bumper’s Price Protection Helps DeFi Users Earn Yield on Their A…

Is it possible to build a DeFi protocol that counters crypto’s inherent volatility while also letting holders enjoy the upshot of their assets? Bumper Finance is a DeFi price-protection protocol that aims…

DeFi Project Spotlight: Raydium, Solana’s Top Automated Market M…

Raydium is a decentralized exchange on Solana that functions unlike any other exchange. It uses liquidity pools but also acts as the biggest market maker on Solana’s order book-based exchange,…