The DeFi Pulse Index (DPI) is one of the most preferred options of investment in the DeFi space, thanks to the underlying tokens.

But as the market changes, their performance varies as well. Thus, leading to some changes in these assets with the hopes of improvement over time. But the question is- Can the most recent decision play in favor of DPI?

DeFi Pulse Index rebalanced

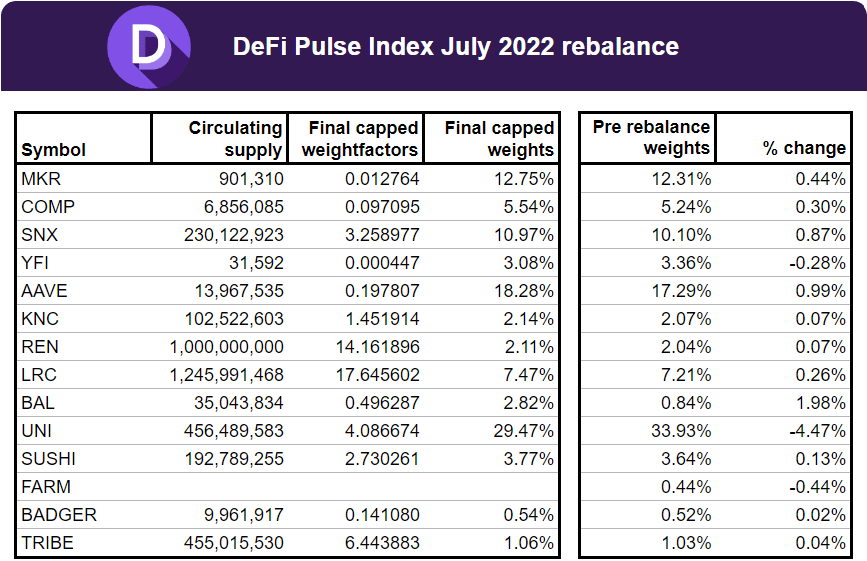

As the first month of the third quarter came to an end, the DeFi Pulse Index announced the 3changes to its roster of underlying assets, which also included the removal of the token FARM.

Citing the minimum weight requirement of 0.5%, the asset was removed since it fell below the threshold.

However, apart from this, no new token was either added or removed. Thus, for the first time in a long while, DPI only consists of 13 cryptocurrencies.

Many other assets’ weightage was also rebalanced, including Uniswap. The final capped weightage of which was reduced to just 29.47% from 33.93%.

On the other hand, the asset to note the highest gains in terms of weightage was Balancer which observed a 1.98% chance of bringing its total weightage to 2.82%.

Surprisingly, despite being one of the worst performers in the last quarter, Kyber Network did not witness any reduction in its weightage.

It gained another 0.07% instead. Thereby, bringing the final cap to 2.14% in spite of falling by over 75% in the month of May alone.

Although the last couple of months had not been the fruitful time of the year, DeFi Pulse Index still has a bunch of major DeFi assets such as Loopring, AAVE, Maker that can set it on the path of a rally.

The investment vehicle has already been successful in regaining the 45.3% losses of June. And, in order to recover what it lost between April and May, DPI needs to increase by more than 108.6%, which is doable only if the 13 assets it constitutes of can rise from the current lows.

DeFi Pulse Index price action | Source: TradingView – AMBCrypto