As the global crypto market capitalization took off with Bitcoin establishing above the $20,000 mark, DeFi tokens were at the forefront of market gains.

Uniswap (UNI), Aave (AAVE), Near Protocol (NEAR), and Curve DAO Token (CRV) were a few tokens that traded in green.

The extended crypto bear market has left HODLers in despair as top digital assets either present negative returns or highly volatile price action. Surprisingly, DeFi tokens have managed to stay afloat despite the ongoing crypto winter.

In fact, data from Messari showed that UNI, NEAR, CRV, and AAVE had relatively better short-term and mid-short-term ROIs than Bitcoin, Ethereum, and some of the other higher-ranked cryptos.

A look at CoinMarketCap’s top gainers in the last 24 hours showed that UNI led market gains with 4.51% while NEAR, CRV, and AAVE followed with similar short-term gains.

So, can market participants continue betting on these DeFi tokens?

DeFi projects nearing key resistance levels

Uniswap traded at $6.88 at press time and was up 8.93% over the last week. As the token neared its key support/resistance level at the $7 mark, a decisive close above the same could aid further bullish momentum.

Furthermore, a healthy uptick in RSI making higher highs presented sustained buying pressure as UNI price recovered above the $6.45 mark.

Notably, while UNI’s three-month ROI stood at +17.77%, BTC and ETH had a -6.66% and +12.00% ROI respectively over the same period.

From an on-chain perspective, Uniswap seemed to be doing well as transaction volumes spiked alongside healthy active addresses on the network. A fall in supply on exchanges further highlighted how UNI could be moving away to HODLers’ wallets as confidence rose.

Next to UNI on the top gainers’ chart was Near Protocol’s NEAR token, which saw a 4% pump after news about the partnership with Google Cloud to support Web3 developers in building and scaling their projects and dApps.

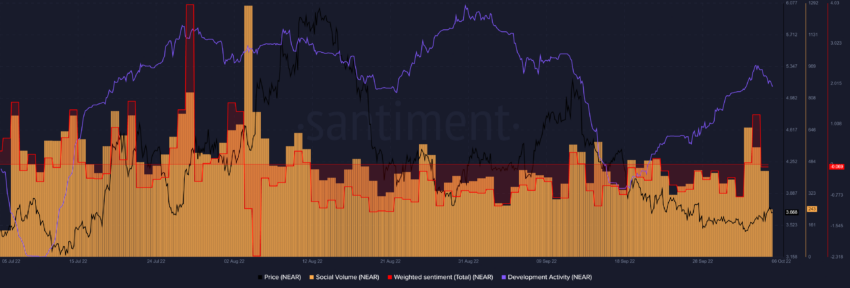

While NEAR’s price noted a decent uptick on Oct. 6, fading social anticipation was seen in the lower social volumes and a drop in weighted social sentiment further highlighted that retail euphoria could be fading away.

Additionally, a drop in NEAR’s development activity presented that holding NEAR price above the key $3.60 resistance could be tough for bulls.

CRV and AAVE following UNI’s lead

Curve DAO Token (CRV) traded at $0.917 charting a 3.05% rise on the daily, as 24-hour volumes stood at $65 million noting a 17.22% rise. On the other hand, AAVE followed suit with 2.67% daily and 3.33% weekly gains.

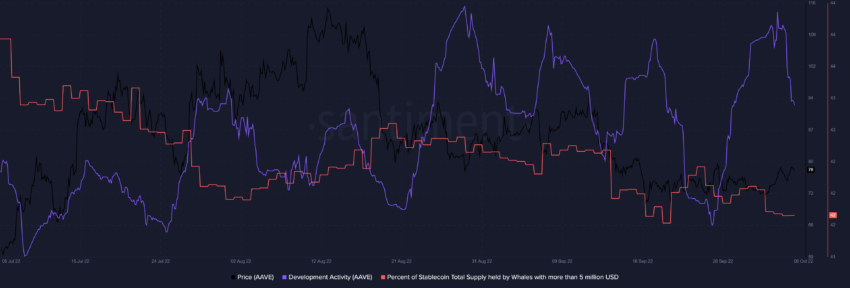

However, AAVE’s on-chain indicators flashed no major changes as active addresses, transaction volumes, as well as whale addresses, were stuck in the same range bound momentum.

Furthermore, a drop in development activity acted as a concerning sign for the DeFi token.

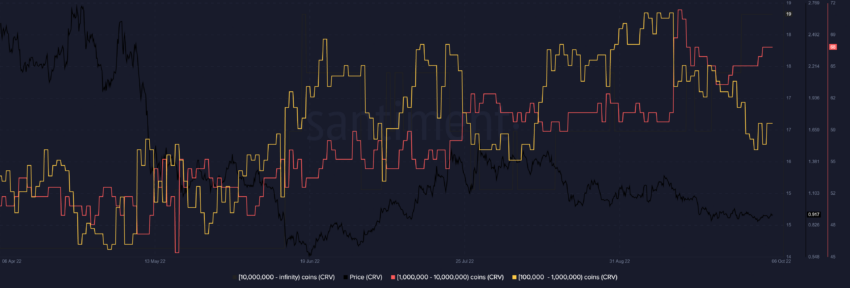

Similarly, CRV’s on-chain metrics showed no major deflection. However, a sustained rise in supply distribution by the number of addresses showed that bigger entities still accumulated which could aid some positive momentum to the token going forward.

Disclaimer: Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.