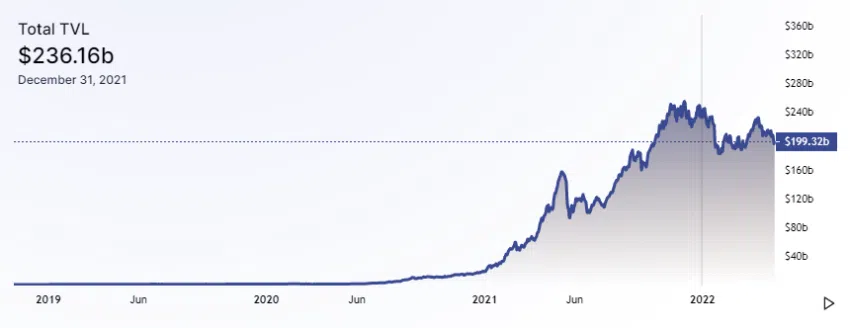

The decentralized finance (DeFi) market has seen a sharp drop in total value locked (TVL) from the start of the year, down over 18%. Nearly all major DeFi projects and platforms have suffered losses in TVL, and it’s unclear why this is happening.

The DeFi market is seeing a drop in total value, according to various data platforms on the niche. Since the start of the year, the total value locked in DeFi has dropped by over 18%, down from $236 billion at the end of 2021 to $199 billion as of May 2.

It’s not that any single platform has suffered such a tremendous drop. Rather, most big protocols and platforms have seen a sharp drop in TVL, often in the double digits. This includes Curve, Lido, MakerDAO, Aave, Compound, and PancakeSwap.

It’s not clear why there has been such a noticeable drop in the DeFi space. The crypto market, in general, has been going through a tough time, but the DeFi market has often been somewhat more resistant to a pulling out of funds. Investors often take to it to make passive income by contributing to liquidity pools, among other features.

The last two months have been particularly brutal for the sector. DEX trading volumes also fell during the month of April. Last month, those volumes were around $92.1 billion, compared to the $117 billion in March.

The DeFi market has increasingly become the subject of attention of regulators. It’s unlikely to be the case that this is why the niche is down, but it’s worth bearing in mind that it could be in store for a lot more in the near future.

What will the rest of 2022 be like for DeFi?

DeFi is a cornerstone of the crypto market and as such, any developments in it tend to be important for the rest of the market. At the very least, it is among the most active sectors in crypto, both in terms of usage and development activity.

So far, 2022 has not been kind to DeFi. There have been several hacks, and 2022 alone has seen over $1.2 billion stolen from projects working in the industry.

Then there’s the matter of regulation. Global authorities are looking at unhosted wallets and DeFi in general. They are looking to rein in the market, which the International Monetary Fund (IMF) believes poses financial risks. How exactly regulators plan to control a decentralized market remains to be seen, but they are taking preliminary steps.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.