Market Data Forecast’s report on the FinTech industry predicts that by the end of 2026, the market value of DeFi will be $324 billion.

DeFi or Decentralized Finance in simple words talks about the democratization of finance in the context of the digital domain away from financial institutions. Since its inception, the continuous rise of DeFi has been a game changer in the overall working of the financial world.

Artificial Intelligence or AI has been another major revolution that has taken the world by storm. From being time-effective to providing automation in various aspects, AI has changed the way people think and perform their daily activities. Bringing the two most crucial revolutions together on the same platform can be a massive step toward sustainability and growth.

DeFiLabs has been an important step in this direction. Visualizing the utilization of AI in the financial domain, DeFiLabs came into the limelight. The former not only bends AI and DeFi together but also uses AI to dynamically manage the diversified baskets of cryptocurrency assets.

What is DeFiLabs?

DefiLabs is one of the well-established, fastest-moving Defi-based platforms within the DeFi ecosystem. It’s a one-stop, decentralized, non-custodial asset management platform that aggregates Defi activities in one place. The platform comes in handy for users involved in staking and trading.

Developed by open-source software, along with the utilization of AI technology DeFiLabs brings the financial limitations of AI-managed funds to DeFi. Thereby, resulting in the simplification of complex market navigation. The platform invests in the DeFi industry and actively manages single positions and market risk.

The architecture and economics of DeFiLabs enable the management of portfolios, execution of efficient asset allocations, and promote market-making functions. All these functions are executed to recommend liquidity pools for high-yield returns and predict model asset management strategies.

When it comes to security, Certik and Coinscope, fully audit the platform creating no room for doubts among users trading/staking on the platform. Feeding real-world data to smart contracts on the blockchain, DeFiLabs serves as a link between the unparallel amount of information alternating between crypto DApps.

Incentivizing crypto holdings with DeFi Staking

DeFi Staking being one of the hottest trends in the cryptocurrency industry, incentivizes users to hold on to their crypto holdings. The former is a safer and less risky way of generating passive revenue compared to traditional means. DefiLabs known for its DeFi Staking makes it easier for users to tap into higher interest rates compared to savings accounts and traditional products.

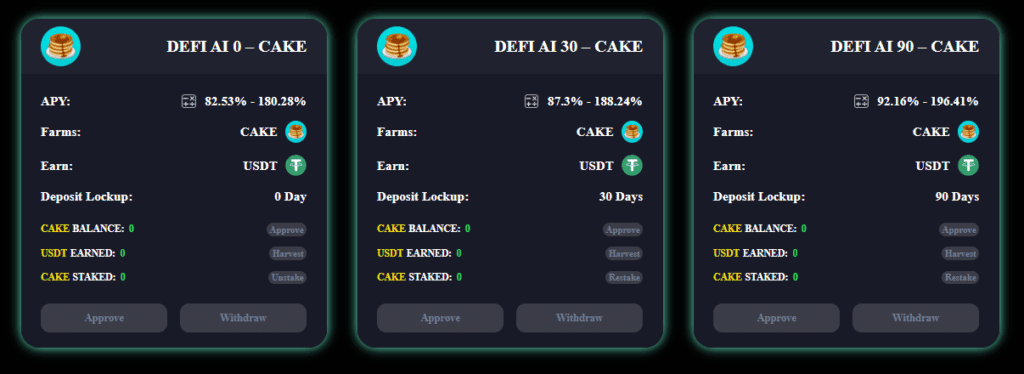

Integrated with AI technology, DeFiLabs offers users an AI aggregator Staking platform where users are entitled to receiving staking rewards. In simple words, DeFi staking is the process of ‘locking’ crypto tokens into a DeFi smart contract to earn more of those tokens in return. By doing so, users become a part of the network’s validators.

Hence for the security of the protocol, every proof-of-stake blockchain protocol relies on these validators. In return, users who have staked a part of their token to secure the network are rewarded for their actions. These results in increasing APYs, thereby DeFiLabs currently accounting for a total of 443% APY.

AI portfolio management

To support trading, DeFiLabs deploys an AI ecosystem to provide liquidity to the DeFi markets by increasing users’ values and returns. The platform takes into consideration various AI experts to provide huge benefits to the token holders by performing different functions in the ecosystem.

- The Portfolio Planner: The planner uses on-chain market data and gets predictions on price trends and volatility. This further helps in planning and building long-term investment strategies for DefiLabs’ users within limited volumes and risk levels.

- The Weighting Agent: This AI agent relies on the same data and predictions indicating short-term weights on the liquidity pool. This helps the Portfolio Balancer to adjust portfolio inventory in given short-term risks.

- The Sentiment Watcher: This feature enables users to monitor news feeds, online media, and social media chatter about specific DeFi projects and overall DeFi-related buzz.

- The Strategy Evaluator: The evaluator uses the same on-chain data and price trend/volatility predictions to evaluate different competitive strategies and the parameters of these strategies. It backtests numerous strategies on historical data and recommends the best one for current market conditions to the Portfolio Balancer applications. These strategies specify the best way for DefiLabs’ users to rebalance their inventory, deploy smart contracts for liquidity provision on the portfolio instruments, and execute corresponding trades.

Final word

The core values of DeFiLabs ensure that users have full control over their funds which are locked in smart contracts. The easy-to-use interface of the platform makes it easy for users to experience transparent trading/staking on the platform.

Additionally, the integration of AI into DeFi opens a gateway for users to experience minimal risk and error along with speedy and unbiased decision-making.

Being a community-owned platform, DeFiLabs looks forward to establishing numerous long-term partnerships. With the mission to bring more profits to everyone, the platform does not compromise on trust and makes it a highly reliable and secure trading/staking platform.

To know more about DeFiLabs, visit the official website or join the Telegram channel for all recent updates.

Disclaimer: This is a paid post and should not be treated as news/advice.