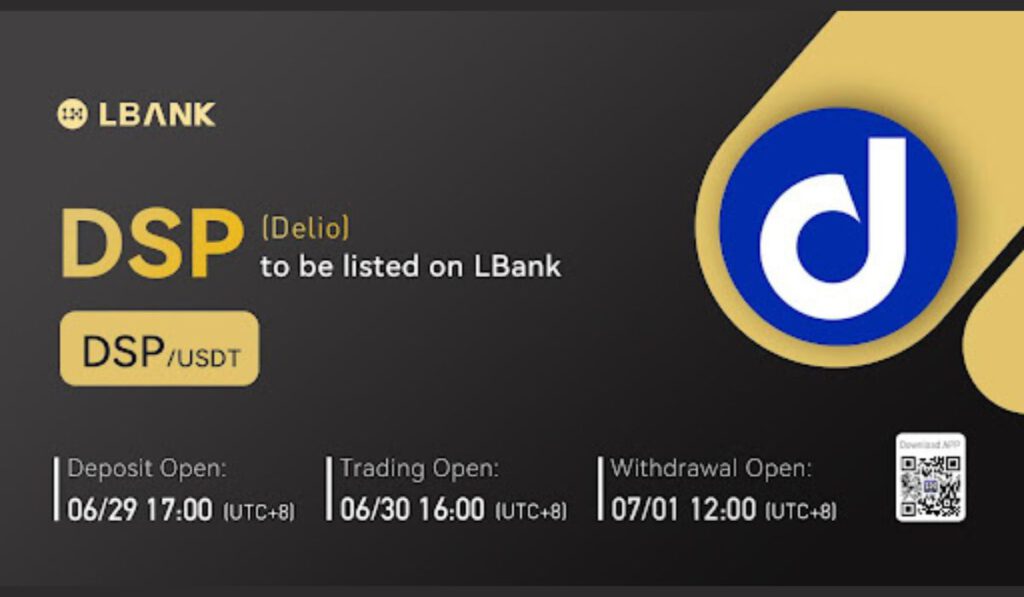

Delio (DSP) has been listed on LBank Exchange, a global trading platform for digital assets. The DSP/USDT trading pair is now formally accessible for trading to all LBank Exchange users.

To enable it further broaden its worldwide reach and realize its vision, on June 30, 2022, at 16:00 (UTC+8), its native token DSP was launched on the LBank Exchange.

- Delio is a pioneering business in South Korea’s Web 3.0 sector.

- The largest cryptocurrency asset financing company, Delio, is regarded by Korean institutions as having a $2 billion total lending and saving volume in 2021.

- Delio is a lawful service provider that was founded in Seoul, Korea, in 2018. It has formally obtained the Financial Services Commission’s Virtual Asset Service Provider (VASP) license (FSC).

- The company’s main services include the NFT marketplace, decentralized exchange (DEX), prime brokerage service (PBS), and crypto-asset savings (01etc.com). Delio is also creating a platform for e-commerce, a blockchain point system (DXpoint), and fiat loans.

Regarding DSP Token

The governance token of the Delio blockchain financial ecosystem is called DSP.

The Delio Services, which include the APY-bearing wallet, cryptocurrency lending, cash loans, NFT marketplace, and virtual asset management, heavily depend on the DSP token. Additionally, it is a governance token for the Delio protocol that enables holders to have a say in and a vote on choices for future advancements.

The DSP owner is eligible to vote, take part in governance, attend different yield farming competitions, and earn transaction fees. The user will have more voting power inside the Delio ecosystem the more DSPs they own. In addition to the ecosystem’s primary governance duties, further, development is being done on DSP rewards and DSP-backed financial products.

500 million (i.e. 500,000,000) DSPs were issued at the time of genesis, of which 60% are given to Delio community members, 20% are given to team members and prospective employees with a 1-year vesting period, and the remaining 20% are given to investors and advisers with a 1-year vesting period.