Cryptocurrency exchanges are making big inroads into the US derivatives market as demand from retail customers expands.

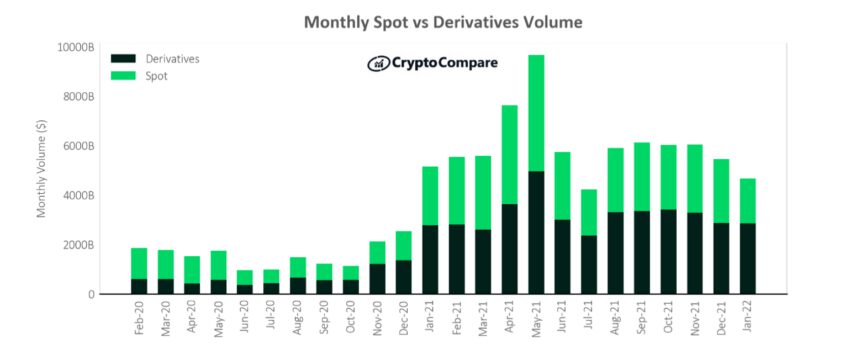

In January, derivative market volume hit almost $3tn. This accounted for almost 60% of total crypto volume, outstripping all other trading for the first time.

Spot volumes fell 30% to $1.81tn, driven down by the market slump.

According to CryptoCompare, the rise in derivatives activity can be attributed to an increase in hedging and speculation.

January saw 1,882 BTC option contracts traded in the CME, up 28.6% from the month prior. This is the highest amount of BTC options traded since Dec 2020, when 3,749 options were traded.

BTC futures contract volumes rose 23.9% in Jan to 181,400. However, it shies in comparison to a 59.4% increase in ETH futures contracts (116,200 ETH) in the same period.

Big exchanges are snapping up smaller ones

Crypto exchanges are ramping up activity in the tightly-regulated US market by acquiring smaller exchanges that already hold licenses.

Last month, Coinbase announced plans to buy Chicago-based FairX. The plan is to use the latter’s infrastructure to bring more consumer customers to the derivatives market. FairX is a small, Chicago-based Commodity Futures Trading Commission-regulated derivates exchange.

Late last year, Singapore-based Crypto.com spent $216m on two assets owned by the UK’s IG Group and licensed in the US.

Additionally, Sam Bankman-Fried’s FTX, added US derivatives platform LedgerX to its roster. Bankman-Fried is a frequent advocate of greater crypto regulation, a stance that sets him apart from many of his competitors.

Larger crypto exchanges are buying CFTC-regulated platforms as a bridge to offer derivative products to retail clients.

“In the US, the crypto exchanges can’t offer leverage on spot crypto without being a regulated futures commission merchant,” Rosario Ingargiola, CEO of crypto settlement firm Bosonic told the FT.com.

Late last year, BitMEX exchange was hit with a $100m fine after allegedly operating a crypto trading platform in the US without regulatory permission. The trial of four of the exchange’s co-founders on money laundering charges is due to start next month.

Got something to say? Write to us or join the discussion in our Telegram channel.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.