In the last 24-hours, Bitcoin has slipped another 7% with the BTC price crashing all the way to $40,650 levels as of press time. Bitcoin and the broader crypto market continue to show strong volatility amid macro effects striking in such as the fear of rising interest rates and the Russia-Ukraine crisis.

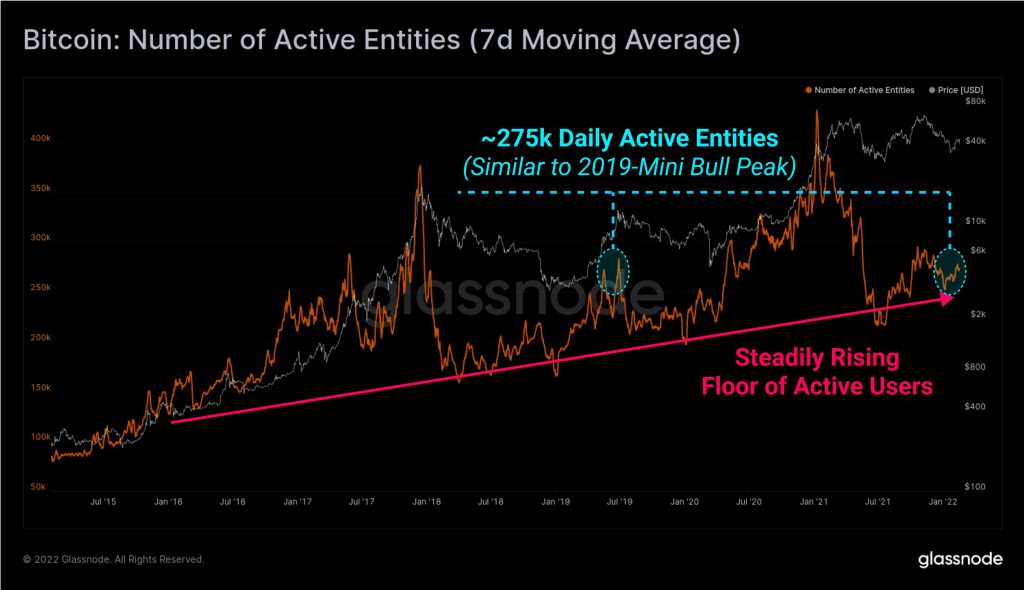

Although Bitcoin seems to be currently in the bearish cycle, there’s a steady surge in the floor of active users when compared to previous bear cycles. As on-chain data provider Glassnode reports:

There are currently ~275k daily active entities on the #Bitcoin network. This level of activity is far below bull market highs, indicative of tepid demand from new users. However, the activity floor continues to climb in bearish markets, reflecting longer-term network effects.

While investors remain bearish, the top-tier whale addresses continue to accumulate. On-chain data provider Santimnet notes:

Bitcoin’s top addresses with 100k+ coins currently hold 664k $BTC after sitting at just 260k $BTC in Feb, 2021. There are currently 3 addresses of at least this size. They held an #AllTimeHigh of 693k $BTC in late June, just prior to prices surging.

advertisement

Bitcoin Lengthy Correction Cycle

Over the last few weeks, Bitcoin has remained range-bound consolidating between $40K-$45K. Although some people have been predicting that the Bitcoin price can touch $100K levels by the end of 2022, it could still be a distant possibility.

Popular market trader Peter Brandt hints that this could be the beginning of the lengthy consolidation cycles. Historical trends suggest that such cycles have lasted for 40 months until Bitcoin hits a new all-time high. In his latest Twitter post, Peter Brandt writes:

Bitcoin $BTC – major highs and length to exceed them Cheerleaders who constantly beat the drums of “to the moon” are doing a huge disservice to $BTC investors Corrections can be lengthy Long endurance, not constant hype, should be the message.