Data shows despite the latest surge in the price of Bitcoin, the market sentiment has still been that of fear recently.

Bitcoin Fear And Greed Index Still Continues To Point At “Fear”

As per the latest weekly report from Arcane Research, the BTC market is still fearful despite recent movement up in the coin’s price.

The “fear and greed index” is an indicator that tells us about the general sentiment among investors in the Bitcoin market.

To represent the sentiment, this metric uses a numeric scale that goes from one to hundred. Values higher than fifty fall into the “greed” territory, while those below the threshold signal “fear.”

Values toward the ends of the range (that is, above 75 or below 25) indicate a sentiment of either extreme greed or extreme fear.

An interesting thing about these extreme values is that tops and bottoms tend to happen when the market is in these regions.

Because of this, some investors think selling during extreme greed is the best, while periods of extreme fear are ideal for buying.

Related Reading | US, EU, Or Asia? Here’s Which Of These Has Dominated Bitcoin Sell-Side Recently

An investing technique that follows this idea is called “contrarian trading.” This famous quote from Warren Buffet encapsulates the philosophy: “be fearful when others are greedy, and greedy when others are fearful.”

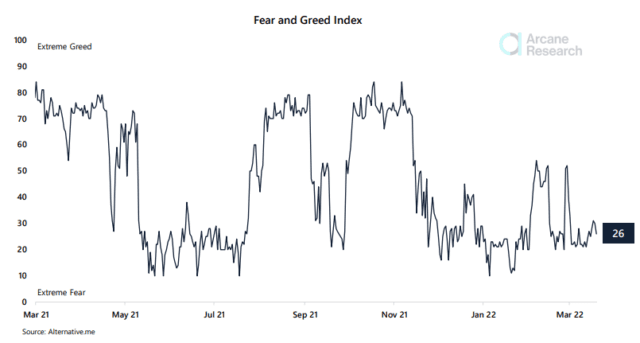

Now, here is a chart that shows the trend in the Bitcoin fear and greed index over the past year:

Looks like the value of the indicator has been low recently | Source: Arcane Research's The Weekly Update - Week 11, 2022

As you can see in the above graph, the Bitcoin fear and greed index has been hovering in fear territory for many months now, and still continues to do so.

Currently, the indicator’s value is 26, which is just above the extreme fear threshold. Usually, during bull rallies the index observes an uplift, but this fearful sentiment is there despite the recent surge in the price of the coin above the $42k mark.

Related Reading | Top Three Crypto Facts with – FIREPIN Token (FRPN), Bitcoin (BTC), Shiba Inu (SHIB), and Binance Coin (BNB)

A factor behind these fear values is the various macro uncertainties looming over the market right now, one of which is the Russian invasion of Ukraine that is still going on.

BTC Price

At the time of writing, Bitcoin’s price floats around $42k, up 4% in the last seven days. Over the past month, the crypto has gained 10% in value.

The below chart shows the trend in the price of the coin over the last five days.

BTC's price seems to have enjoyed some uptrend in the past couple of days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research