The market for nonfungible tokens, or NFTs, has slowed from its peak, but that doesn’t mean the industry is dead — far from it, actually.

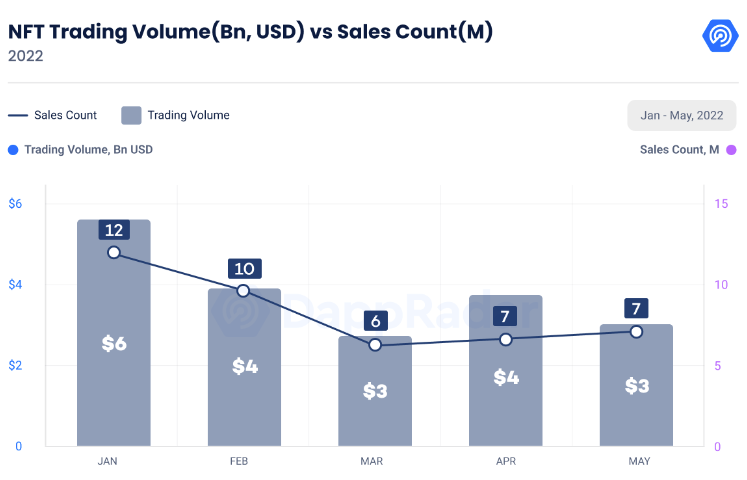

NFT sales volumes came in at a healthy $3.7 billion in May, according to DappRadar’s latest Industry Report, which was released on Wednesday. While volumes were down 20% compared with April, industry activity remains robust considering that crypto assets as a whole are in a bear market.

DappRadar also highlighted the fact that marketplace volumes aren’t down nearly as much when measured in their native tokens such as Ether (ETH). Case in point: OpenSea, the largest NFT marketplace, generated 950,000 ETH in trading volume last month, which was down only 6.5% compared with April. When measured in United States dollars, OpenSea’s monthly volumes decreased by 25%.

Meanwhile, Solana NFTs posted their best trading month, generating $335 million in volume across all marketplaces for an increase of 13% compared with April.

DappRadar’s report cited NFT collections such as Moonbirds and Solana’s Okay Bears as being the biggest catalysts for the industry’s solid performance in May. Meanwhile, the free-to-mint NFT collection Goblintown has generated $31 million in sales since launching on May 22. The high demand pushed the project’s floor price from zero to 6 ETH at the time of publication.

However, the news wasn’t all positive, as so-called “blue-chip” collections such as Bored Ape Yacht Club (BAYC) saw their value decline sharply as buyers shifted to the newly hyped collections. The floor price for BAYC declined 38% in May, falling from 150 ETH to 93 ETH, according to DappRadar.

Related: Nifty News: Robinhood to launch a Web3 wallet, LimeWire inks deal with Universal, and more

Although NFTs are not immune to crypto market volatility, the industry appears to be carving out a strong niche — and gaining mainstream adoption in the process. According to a recent report by crypto data aggregator CoinGecko, the NFT market is projected to move more than $800 billion over the next two years.