The founder and CTO of Algorand both have indirectly made strong remarks about Solana in order to compete for Helium Network’s anticipated migration.

Now, you might ask if this recent development coupled with Algorand’s massive social media interest helped Algorand’s price.

Well, earlier this month, the Helium Network announced in a blog post, that they have proposed to move their network to Solana. This, in a move to improve the efficiency of their network.

Alas, the news didn’t go down well with the folks at Algorand.

In a recent development, the CTO of Algorand, John Woods, took to Twitter to criticize the Helium Network’s move to Solana.

Algorand’s CEO joined in the conversation, stating that Algorand is ready to support the Helium network. Thus, calling their blockchain network secure, scalable, and decentralized.

This development has generated a stir in the crypto community. And, interestingly, it has contributed to Algorand’s already increasing social media presence.

No such thing as bad publicity?

In the past 24 hours of press time, Algorand’s social media activity saw a huge spike. According to LunarCrush, there was a 299.7% increase in ALGO’s social dominance and a 105.8% increase in its social engagements.

But that’s not all, ALGO’s social media mentions as well have grown up by 49% in the last month.

The tweets about the Helium Network could be one of the reasons for the spike in daily social media activity. But Algorand has been in the news for quite some time. Not to forget, recently, they had a $35 million exposure to the crypto lender Hodlnaut.

Despite the negativity surrounding the token, Algorand has been dominating social media. Its street cred might as well help the price of the token grow in the near future.

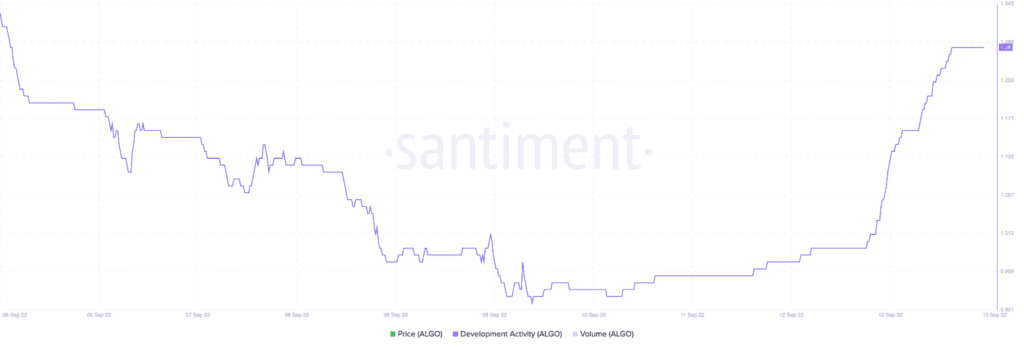

Another encouraging development that has occurred in recent days is the increase in ALGO’s development activity.

The metric has seen an incremental rise since 10 September. Thereby, suggesting that developers are working on new updates and improvements.

However, one of the major concerns for Algorand’s investors could be its volume.

ALGO’s volume has seen quite a lot of volatility in the past seven days. It depreciated by 63.68% in the last week.

The token’s marketcap dominance too has taken a toll by going down 5.18% in the past week.

Algorand, at press time, was trading at $0.3205 with a price appreciation of 12.51% in the last seven days.

Despite the fact that there are multiple positive factors in Algorand’s support, readers should be cautious before entering a trade. Researching Algorand’s new upgrades to get a better understanding of the asset would be a wise decision.