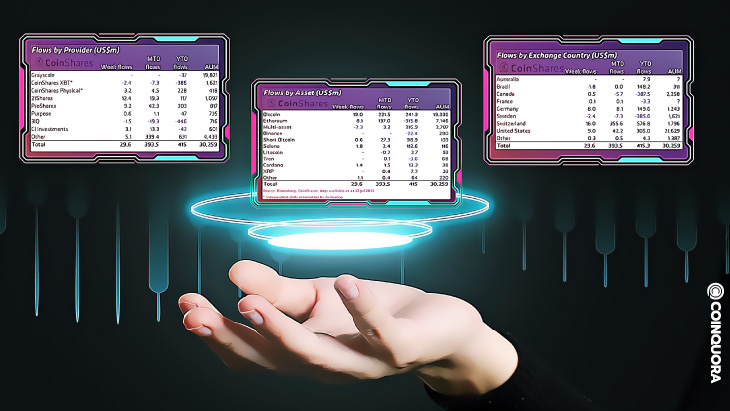

- CoinShare’s latest bulletin indicated that the aggregate inflow into digital asset investment products last week was $30 million.

- Bitcoin EFTs totaled $19 million last week, with the prior week’s inflows corrected to $206 million.

- Most inflows were from Switzerland, up to $16 million, with minor inflows from the United States and Germany but were below $15 million.

Research shows that the aggregate inflow into digital asset investment products last week was $30 million. In contrast, late reporting of trades from the prior week saw inflows corrected from U$12 million to $343 million, which marked the most significant single week of inflows since last November.

CoinShare Group, a digital asset broker, communicated these figures in its latest bulletin published July 26, 2022. This weekly publication is a brief synopsis covering investment inflows and outflows in popular exchange-traded products (ETPs), mutual funds, and over-the-counter (OTC) trusts referencing Bitcoin (BTC), Ethereum (ETH), and other digital assets.

According to the report, the inflow of BTC exchange-traded funds (EFTs) totaled $19 million last week, with the prior week’s inflows corrected to $206 million, the largest single-week inflows since May this year.

Ethereum ETF, on the other hand, witnessed inflows of $8 million, compared to $120 million in the prior week’s figures. These inflows mark the most significant single week of inflows since June 2021.

Bitcoin ETFs are pools of bitcoin-related assets traded on traditional exchanges. It is similar to crypto futures contracts, where retail investors uncomfortable investing in cryptocurrencies can access them without actually owning them.

With the recent figures, the month-to-date inflows of digital assets are $394 million, and total assets under management (AuM) are back to early June 2022 at $30 billion.

The report also noted that most inflows were from Switzerland, up to $16 million, with the prior week seeing inflows totaling $35 million. The year-to-date inflows consequently sat at $577 million, making Switzerland the favored region for digital asset investors. However, minor inflows came from the United States and Germany but were below $15 million.