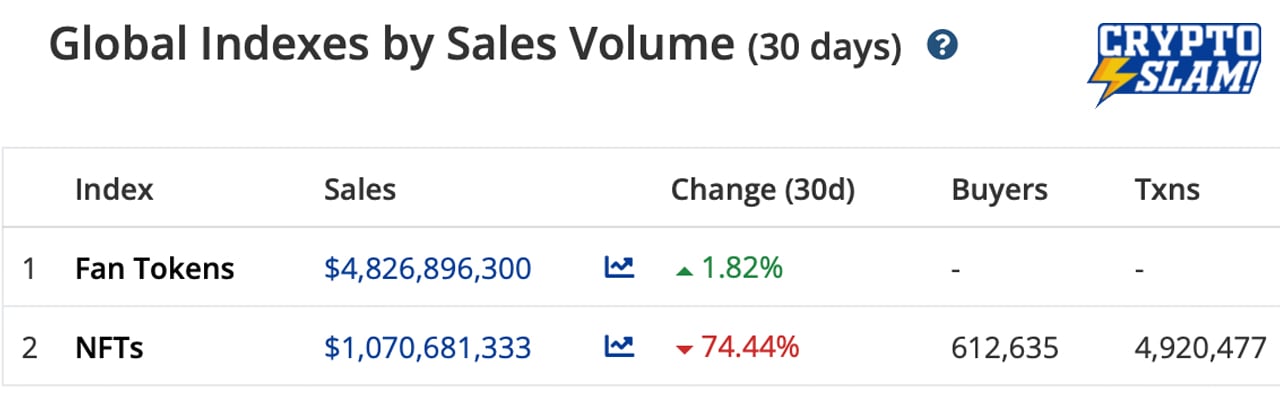

While digital currencies suffered this past month, non-fungible token (NFT) sales dropped by 74.44% during the last 30 days. Data shows that during the last seven days, NFT sales have slipped 17.33% lower than the sales recorded the week prior. NFT floor values for popular collections have rebounded this week in terms of ethereum value, but with ether’s exchange rate so low, blue chip NFTs are selling for a lot less than they did last month.

Data Shows NFT Sales Continue to Sink Lower

Coinciding with the crypto bear market, NFT sales and interest have been dragging. Google Trends (GT) worldwide data shows that this week the search term “NFT” has a score of 21 out of 100. The last time the search term “NFT” saw a GT score of 100 was the week of January 16-22, 2022. The past month has been brutal for NFT sales as the month prior saw $4.18 billion and 30 days later, $1.07 billion in sales has been recorded by cryptoslam.io metrics.

This past week’s NFT sales across 18 different blockchains saw approximately $184,417,851 in sales, but that’s 17.33% lower than the $223,085,710 recorded the week prior. $151 million of the NFTs sold this past week stemmed from the Ethereum blockchain network but ETH-based NFT sales slipped over 18% this week. Monthly ETH-based NFT sales are down 76.38%.

Solana took the second largest number of sales this past week with $22.31 million sold, up 3.56% higher than the week before. Binance Smart Chain (BSC) was the third largest in terms of sales with $3.16 million, but BSC-based NFT sales slipped 32.45% lower this past week.

Meanwhile, the NFT collection with the highest floor value is Bored Ape Yacht Club (BAYC) as the floor value is currently 90 ETH. 30 days ago, the BAYC floor value was 95.5 ETH, which is relatively the same amount in terms of ether price. However, 95.5 ether was $204K last month and 90 ETH today is worth roughly $97K.

The floor value of the Cryptopunks NFT collection jumped 40% during the past 24 hours to 66.65 ETH. The Cryptopunks floor value 30 days ago was 51.9 ETH worth $111K and today’s 66.65 ETH floor is worth $71K.

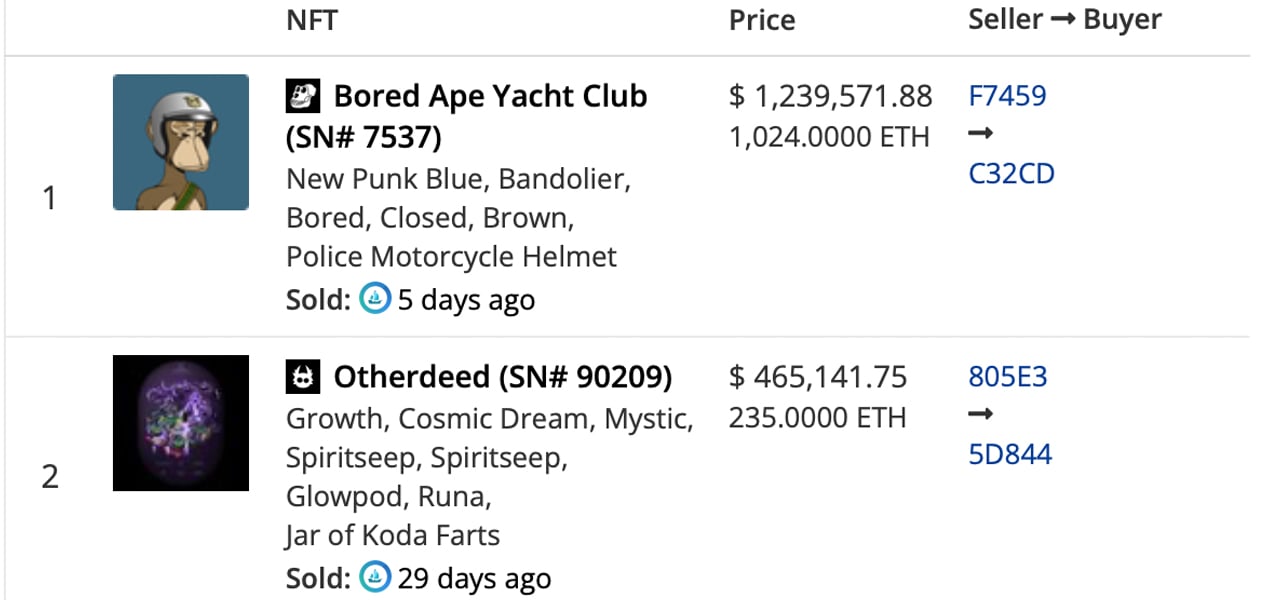

The most expensive NFT sale this past month was BAYC 7,537 which sold for 1,024 ETH five days ago. BAYC 7,537 was followed by Otherdeed 90,209 which sold for 235 ETH or $465K. The top 40 most expensive NFTs sold this past month stemmed from only three collections which include BAYC, Cryptopunks, and Otherdeed.

While BAYC 7,537 took the top position this week as well as the entire month, the second most expensive NFT sale during the last seven days was Cryptopunk 2,964 for 444 ETH or $440K.

What do you think about the NFT market sales this past month and how the crypto bear market has been affecting the NFT industry? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Photo Contributor Mundissima/ Shutterstock

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer