Listen To This Episode:

In this episode of Bitcoin Magazine’s “Fed Watch” podcast, Christian Keroles and I sat down to give an update on Federal Reserve news and central bank activity around the world. Topics in this episode included people at the Federal Reserve and their positions, the Fed Stability Report, Treasury curve update and inversions, the inflation narrative, European Central Bank (ECB) and Bank of Japan (BoJ) updates, and of course, bitcoin.

Bitcoin Day Kansas City

First, Keroles and I debriefed on the recent Bitcoin Day event in Kansas City where I spoke about the end of the dollar system as we know it. It was a great event, with another one coming up in Sacramento early next year. I might try getting one down in Jacksonville next year as well, so be watching out for that.

Fed News

Next, we jumped right into Fed news, starting with the resignation of Randy Quarles. This was kind of a surprise since he had over 10 years left in his term. He has recently faced some backlash from progressive members of Congress, along with Fed Chairman Jerome Powell, as slightly more hawkish members of the Fed who ignore MMT (modern monetary theory) nut jobs.

This resignation has a chess move aspect to it. Lael Brainard, who has recently been threatening to take Powell’s job as chairman, was first favored for Quarles’ position as head of supervision. With him gone, Brainard now has an easy path to simply fill that role, leaving Powell basically uncontested for the chairman reappointment.

These moves might seem insignificant to those who are unaware of the shifting tide within the central banking elite. Most central bankers around the world are looking to MMT and CBDCs (central bank digital currencies) as a way to break out of the debt trap and deflationary environment which the world finds itself in. Powell has the most important central bank job in the world. He has been standing in the way of that dangerous agenda. In a similar fashion to a geopolitical realignment, from NATO to AUKUS, Powell appears to represent the same division, from global concerns to national, within the central bank elites.

Source: Predictit.org

Fed Stability Report

This week, the Federal Reserve published its biannual Stability Report. This report is meant to increase transparency of the Fed, to show the public what it is paying attention to, and what could possibly affect its monetary policy going forward. The main highlights from the report is the Fed’s warning about a rising risk to risk assets. Of course, the mainstream financial press is going to hop on that with its usual gusto.

Another interest warning from the report was about Evergrande and the rising risk of contagion out of China. We’ve been way ahead on this, talking about this very situation for months now. We all know the horrible shape that the Chinese economy is in, and that is slowly working its way into the mainstream investor consciousness.

My prediction, based on the fact that this report came at basically the same time as the taper announcement, is that the Fed is setting up a scapegoat for when it has to eventually halt or reverse course on the taper. It will blame its “policy error” on China and the sheer power of its monetary policy. It’s comical. Its monetary policy literally does nothing, else we’d have no problems to worry about.

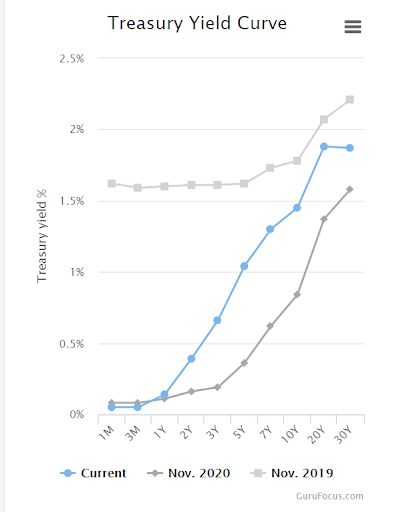

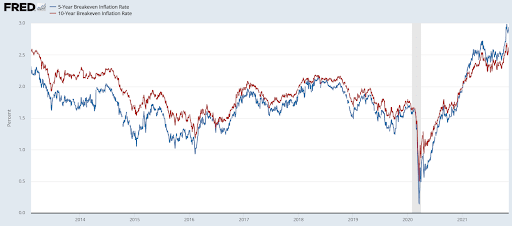

U.S. Yield Curve

Next, we talked about yield curves. We aren’t experts on the bond market, but we know that the bond market is much smarter than we are, and much smarter than the Fed. I highlighted that the 20-year and 30-year yields are still inverted, along with the five-year and 10-year breakevens. The latter being the most inverted in history!

Source: GuruFocus.com

Source: FRED

This should tell us that all is not well with this recent market action. Inflation expectations in the future are mixed, signaling a severe retracement in the “recovery” and the consumer price index (CPI).

The inflation narrative is going rabid. It’s gotten to the point where people are making fun of the transitory stance despite all signs to the contrary. It’s as if the critics haven’t looked at a chart recently. But nevermind, the inflation narrative is a huge bonus for bitcoin in the eyes of investors, while at the same time, the deflationary low growth fundamentals are also great for bitcoin.

CPI comes out today, which we predict will be higher than last month (but still in a slowing trend) and cause even more rabid inflation propaganda benefiting bitcoin.

Global Central Bank Update

By comparison, there is little news from Europe and the ECB, or Japan and the BoJ. First for the ECB; it seems as though the ECB is a few months behind the Fed and is still driving home the transitory nature of this recent CPI spike. Mind you, its headline CPI was only 3% in September, where the U.S.’s was 5%.

The Bank of Japan has even less news to report on. It is stuck with very low inflation. Its headline number is 0.2%, and less food and energy is -0.5%. This is despite promising and actually being irresponsible in the QE and spending department. The BoJ is failing so badly in getting inflation, it has to come out weekly and reaffirm its dedication to being irresponsible and attempting to hit its 2% target.

Next, I asked the audience to answer a question for this episode on Twitter. You have to quote the Bitcoin Magazine tweet for the episode and tag me.

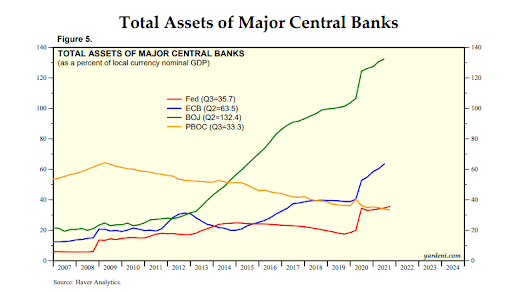

“If the U.S. is exporting inflation, why are the ECB and BOJ’s inflation rates so much lower than the U.S.’s, especially when they have ‘printed’ more money relative to GDP?”

Why is the relationship actually inverse? The more that a central bank seems to expand its balance sheet, the lower the inflation, even when the U.S. is supposedly exporting inflation with the highest trade deficit ever. The best answer wins a copy of the “Bitcoin Dictionary.”

Source: Yardeni

That’s A Wrap

We wrapped up the show by discussing bitcoin in the context of what we are seeing out there in macro, how bitcoin is a source of growth for all who adopt it. We touched on many important topics in this last-minute rip, like velocity of money, bitcoin versus traditional interest rates, surging energy prices, ESG shooting itself in the foot, and Layer 2 fee dynamics with the base layer.

Thanks for listening. If you found this episode informational, please share and give us a rating on iTunes so others can find the show!