Industries across the globe have acknowledged the innovative power of cryptocurrencies over a couple of years. Some even incorporated these digital assets in their respective portfolios. However, a certain segment of businesses seems to nurture the voice of dissent.

Yes to cross-border payments but…

A new survey conducted by Invoiced and PaymentsNEXT explored the crypto sentiment amongst the business-to-business (B2B) panelists. The study was based on online survey responses from 269 finance professionals. Further, the report was entitled “The State of B2B Payment Acceptance.”

Latest @invoicedapp B2B report is out: 62% of businesses already adopting cross-border #payments; one-third ready or implementing virtual cards; cryptocurrency lagging; faster, easier, cheaper payments a priority | PaymentsNEXT #fintech https://t.co/ERYgbvS7In

— PaymentsNEXT (@Payments_NEXT) November 11, 2021

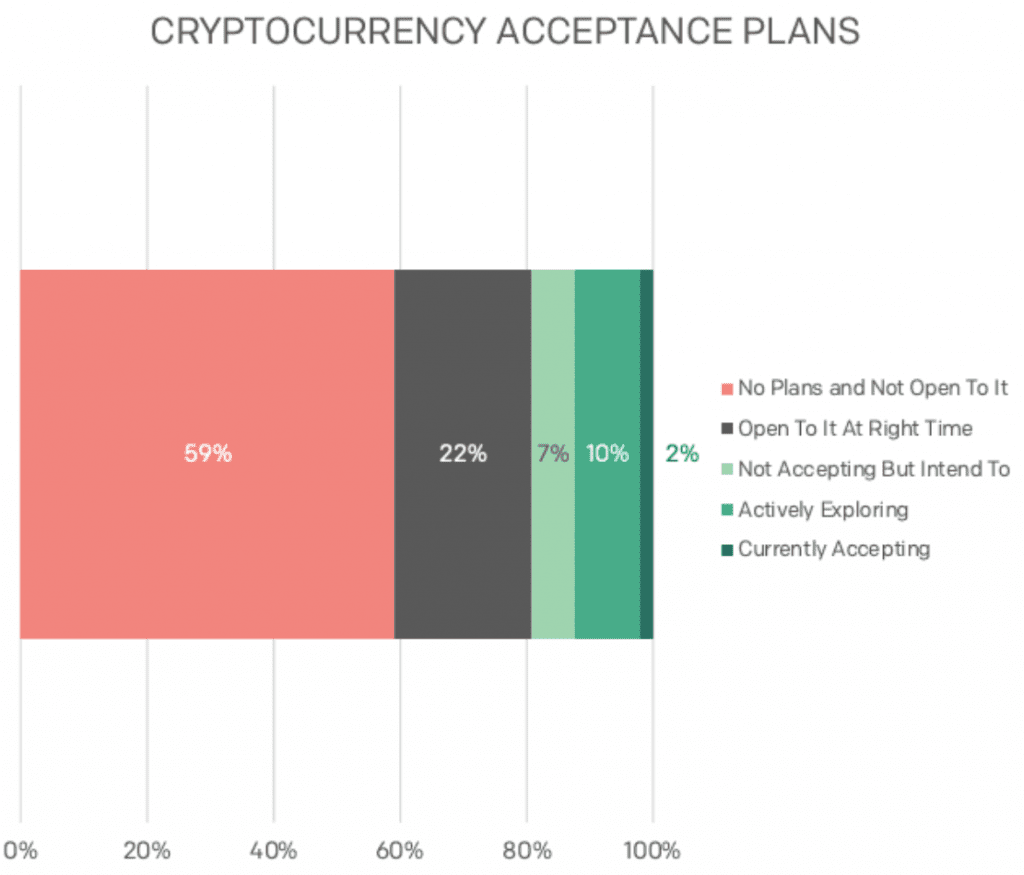

According to the report, 59% of U.S. finance and accounting professionals at B2B companies were not open to the idea of accepting cryptocurrency as a form of payment. Only 2% of respondents adopted crypto payments, while 39% portrayed interest to accept cryptocurrency in the future.

Source: PaymentsNEXT

Interestingly, other modes of payments were preferred over digital tokens. In fact, checks were still the most common way B2B companies accepted payments.

Around 77% of respondents voted in favor followed by 72% for other payment methods like debit cards. Virtual cards and cryptocurrency payments were way down the popularity list. The plot below highlights the discussed narrative.

Source: Survey

One might wonder, what was the possible reason(s) behind the low acceptance rate. Well, lack of convenience was the key factor for B2B firms to neglect crypto assets. Around 30% of respondents indicated this in the mentioned survey. Another reason, 26% of the panelists believed that cryptocurrency payments needed to “appreciate in value for the business.”

Other reasons included issues related to transaction fees, customer demand and demonstrable innovation.

Here’s an interesting aspect mentioned in the report

A majority of these (anti-crypto) companies reportedly faced a significant demand for virtual cards and cross-border payments. 64% and 62% of respondents expressed interest in the discussed segment respectively. However, one could argue on this.

For instance, fintech firm, Ripple is one of the leaders when it comes to cross-border payments across the globe. The San Fransico-based firm using its native token, XRP, provides the same using RippleNet’s On-Demand Liquidity.

Nevertheless, of late, firms across the U.S. even added a few tokens as a mode of payments. Just recently, AMC officially became the first theater chain to accept Bitcoin, Ethereum, and cryptocurrency payments on its platform.

Big newsflash! As promised, many new ways NOW to pay online at AMC. We proudly now accept: drumroll, please… Bitcoin, Ethereum, Bitcoin Cash, Litecoin. Also Apple Pay, Google Pay, PayPal. Incredibly, they already account for 14% of our total online transactions! Dogecoin next. pic.twitter.com/a7pqYBm7HB

— Adam Aron (@CEOAdam) November 12, 2021

Meanwhile, other workplaces too have showcased a similar enthusiasm.

Overall, crypto tokens are increasing in value daily. Sooner or later, different firms would look into crypto adoption.