On Monday, Tesla CEO Elon Musk tweeted that he still won’t be selling his Bitcoin, Ethereum, and Dogecoin despite the rising inflation. The influencer’s words surged the DOGE price to around 10% high today. However, bullish sentiment wore off soon, and the altcoin was rejected by forming a long-wick candle. By the press time, the intraday gain struck to 3%.

Key points:

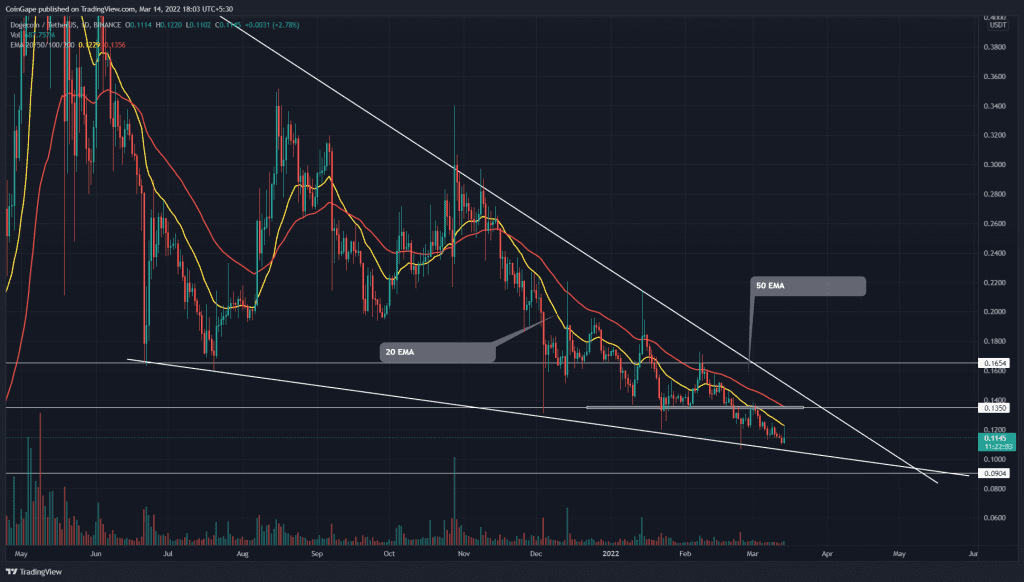

- The 20-day EMA poses dynamic resistance for Dogecoin’s price

- The 24-hour trading volume in the Dogecoin coin is $796,2 Million, indicating a 181.5% gain.

Source-Tradingview

A falling wedge pattern governs the Dogecoin(DOGE) price action. Under the pattern’s influence, the sellers have recently dumped the coin below the $0.135 monthly support. The gradual selling has tumbled the altcoin by 14.6%, nearing the bottom support trendline.

The DOGE/USDT pair surged 10% early on Monday in response to Billionaire Elon Musk’s tweet. However, this celebrity-driven rally didn’t last long and plunged below the descending trendline. The long upper wick attached to the daily candle indicates the buyers failed to sustain a higher level.

The featured image shows the dynamic 20-and-50 EMA emboldened traders in selling the rallies. The altcoin trading below the 100 and 200 EMA indicates an overall bearish trend.

Descending Trendline Pressurized The Bullish Recovery

Source- Tradingview

A stepper descending trendline leads the current bear cycle inside the wedge pattern. The long-wick rejection at this resistance trendline suggests the continuation of a bear attack. The sustained selling would sink the altcoin to the support trendline or $0.1 mark.

Alternatively, a breakout and closing above the stepper trendline would give the first sign to recovery and drive the coin price to $0.135 resistance. Furthermore, an escape from the falling wedge is necessary for expecting a genuine recovery.

The recent price jump has caused a minor depression in the rising ADX slope. However, the indicators maintain a bearish bias and will continue to rally higher if the sell-off resumes.

- Resistance levels- $0.115 and $0.135

- Support levels- $0.01 and $0.009