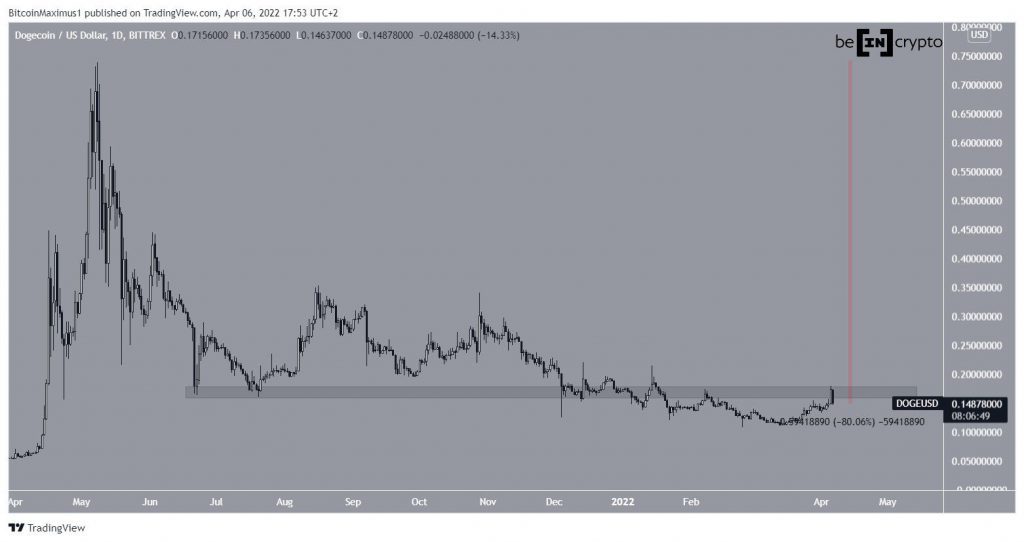

Dogecoin (DOGE) has broken out from a bullish pattern but has so far failed to reclaim an important horizontal area.

DOGE has been falling since reaching an all-time high price of $0.73 on May 8 last year. In June, the price bounced at the $0.165 horizontal support area. However, the bounce was weak and the price broke down at the beginning of Jan.

Afterward, it proceeded to reach a low of $0.107 on Feb 24.

While DOGE has been moving upwards since, it is still trading below the aforementioned $0.165 area, which is now expected to act as resistance. Currently, the price is 80% below its all-time high.

Ongoing DOGE increase

Cryptocurrency trader @CryptoNTez tweeted a chart DOGE which shows an ongoing breakout.

A closer look at the daily time frame shows that DOGE has broken out from a descending resistance line that had been in place since Oct 28.

The price broke out on March 18 and proceeded to reach a high of $0.179 on April 5.

The breakout was preceded by bullish divergences (green lines) in both the RSI and MACD. Such divergences often precede bullish trend reversals.

However, despite the increase, DOGE has failed to even reach the 0.382 Fib retracement resistance level when measuring the entire downward movement.

Therefore, the breakout has so far been very weak.

Wave count analysis

Measuring from the all-time high, DOGE seems to have completed an A-B-C corrective structure. In it, waves A:C had a 1:0.382 ratio, which is somewhat common in such structures.

Wave C developed into an ending diagonal, as is visible by the wedge shape. Such structures are usually retraced swiftly. The sub-wave count is given in black.

If correct, it would mean that the long-term correction for DOGE is complete and the price has begun a substantial upward movement.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.