Dogecoin was among the hardest hit cryptocurrencies during the market crash of May which led to a massive drop in the market capitalization of the popular meme-inspired coin.

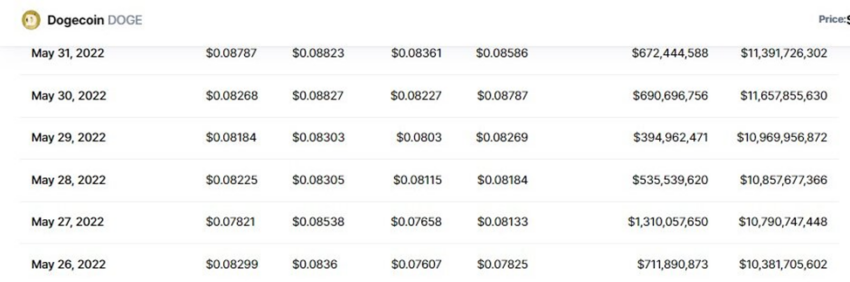

Dogecoin remains the largest meme-inspired digital currency by market capitalization in June 2022. According to Be[In]Crypto research, DOGE closed the fifth month of the year with a market capitalization of around $11.39 billion.

This was a 35% decline from the opening day’s market value. On May 1, DOGE saw an impressive trading volume of $991.71 million which corresponded to a market capitalization of approximately $17.62 billion.

Why the decreasing market capitalization?

An overall bearish market which was deepened in the week of May 9 to 13 led to the sinking market capitalization of Dogecoin. Among others, economic factors that led to the sell-off of DOGE by its holders were rising interest rates, inflation, and the patronage of less volatile assets such as metals.

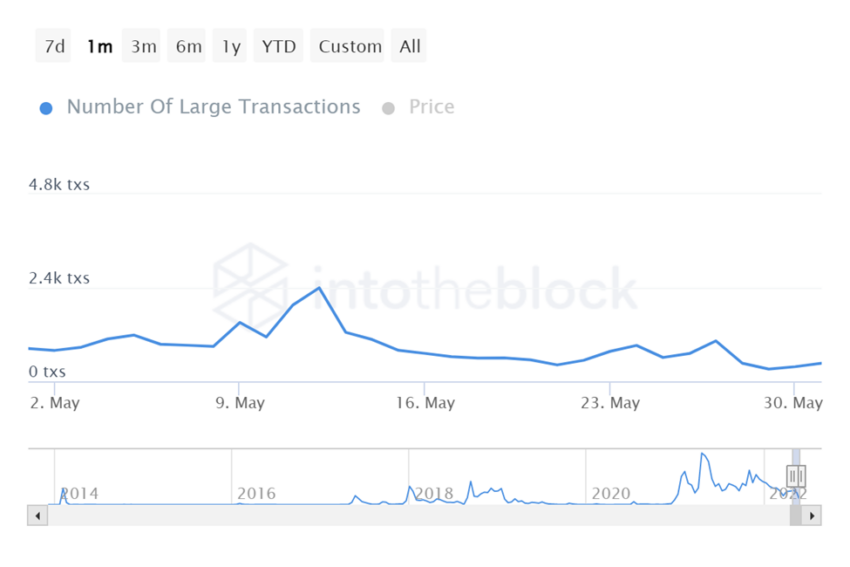

The number of large Dogecoin transactions reached a high of 2,400 at a price of $0.07 on May 12.

This corresponded with a large transaction volume of approximately $2.09 billion.

On May 12, DOGE opened at $0.08464 and reached an intraday low of $0.07004. Trading volume was around $2.63 billion and corresponded to a market capitalization in the region of $10.97 billion. This was a 37% dip in DOGE’s market value from May 1.

Due to the plummet in price that saw DOGE retest less than 10 cents per coin, there were no attempts of a recovery that could have taken its market value to the region of May 1.

DOGE price reaction

Dogecoin opened on May 1, at $0.1276, reached a monthly high of $0.1373 on May 5, tested a monthly low of $0.07004 on May 12, and ended the month at a trading price of $0.08586.

Overall, this equates to a 30% decrease between the opening and closing prices of DOGE in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.