As the Bitcoin fear and greed index jumped by 26 points over last week, XTZ saw staggering gains while seeing an overbought RSI. Also, EOS invalidated its bearish tendencies by marking a close above the up-channel and aiming to retest the $2.6-level. On the other hand, Dogecoin saw a nearly 5% 24-hour loss as it fell towards the half-line of its up-channel.

Dogecoin (DOGE)

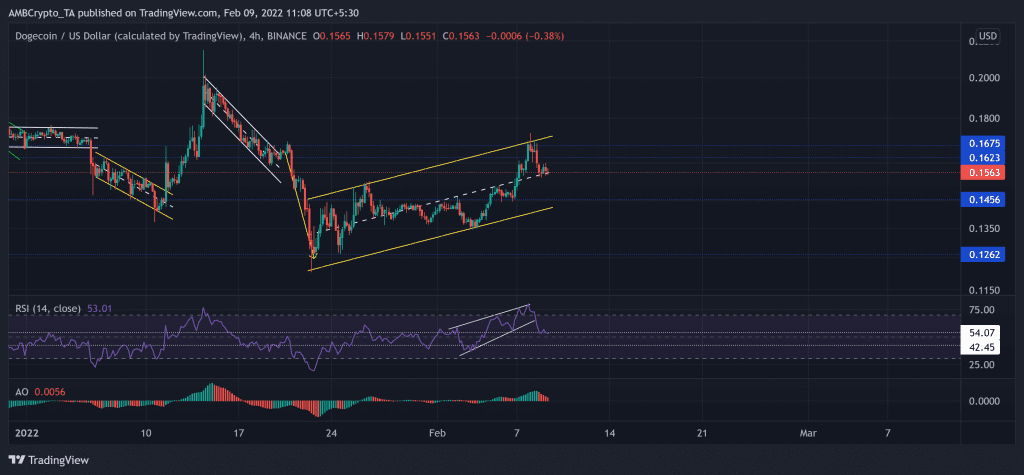

The altcoin saw a 44.03% fall (from 14 January) and hit its nine-month low on 22 January. Since then, DOGE registered over 40 % gains in the last 16 days.

The recovery phase marked an ascending channel (yellow, reversal pattern) on its 4-hour chart. While the $0.167-mark stood sturdy, DOGE saw a 5.09% 24-hour pullback. Now, the immediate hurdle for the bears stood near the half-line of the channel.

At press time, DOGE was trading at $0.1563. After heading into the overbought region, The RSI saw a patterned breakout and lost the 54-mark level. The bulls needed to defend the half-line to avoid a further downfall toward the 42-mark. Further, the AO projected a bullish edge while depicting their decreasing influence over the past day.

Tezos (XTZ)

XTZ witnessed a 51.6% decline (from 5 January) and hit its six-month low on 24 January. However, from the $2.8-level, the alt bounced back to recover the previous losses and reclaimed the vital $3.8-mark support.

The alt witnessed a 75.2% ROI in just the last 16 days (from its six-month low). XTZ also formed an ascending channel (yellow) during this phase. Now, as the sellers seemingly lost the $4.4-mark, the immediate resistance stood at the upper trendline of the channel.

At press time, XTZ was trading at $4.5. Since breaking down from its up-channel (white), the RSI tested the overbought region multiple times and ensured the half-line support. At the time of writing, it hovered around its two-month high, depicting an overbought position. Also, the DMI reaffirmed the bullish vigor while the +DI still looked north.

EOS

The 21 January sell-off saw substantial losses while the alt pierced through vital support levels. As a result, EOS marked a 30.41% decline (from 20 January) and touched its 22-month low on 24 January.

Since then, the alt has seen an up-channel (green) 39.2% recovery in the last 16 days. EOS noted over 11% gains in just two days before reversing from the $2.6-mark resistance. The immediate resistance continued to stand at this mark. Any retracements would find support near the 20 SMA (red).

At press time, EOS was trading above its 20-50 SMA at $2.657. The bullish RSI saw impressive gains as it poked the 80-mark on 8 February. Since then, it found strong support at its trendline.