Donald Trump wants another dance with the American presidency. Last month, he gave the strongest hint of his intentions yet. Bitcoin (BTC) and crypto may be primely positioned in the event one of America’s most divisive presidents in recent memory wins re-election.

“In order to make our country successful, safe and glorious again, I will probably have to do it again,” Trump told a campaign rally in Sioux City, Iowa. Americans are voting in the midterm elections on Nov. 8. They are choosing new members of Congress to lead them until 2024.

Some polls predict a Republican victory. An announcement of Trump’s bid for the 2024 presidency will then be revealed. That’s according to mainstream media reports quoting the former’s president’s close associates and will reportedly be announced on Nov. 14.

Trump remains very popular within the Republican party, insiders say. The ramifications of a potential bid from Donald Trump may not yet be clear.

Donald Trump: the unconventional president influencing markets

Trump served as America’s 45th president between 2017 and 2021. It was an eventful term. The real estate billionaire broke almost every convention in the straight-laced U.S. presidency. He used Twitter to communicate policy positions.

Barack Obama left office with the Iran nuclear deal as one of his masterful diplomatic strokes and a peace effort for his otherwise war-weary tenure. Trump was not eager to inherit the deal, renewing sanctions against Tehran with a nod from Tel Aviv.

Trump undid crucial climate agreements such as the Paris Agreement of 2015. He directly confronted those he disagreed with. The former president’s out-of-the-norm way of doing things was criticized by many.

Except perhaps by those in cryptocurrency and traditional financial markets. During his reign, the Bitcoin market appeared to flourish. The price of BTC rose over 2,600% during Trump’s four years in office. It soared from about $1,100 to under $30,000, entering the mainstream.

Better markets under Trump?

Meanwhile, US stock markets hit record highs during this period, in part spurred by stimulus spending in the wake of the coronavirus pandemic. For example, the value of the S&P 500 climbed 20% days after Trump’s unexpected win in November 2016.

Stock markets continued to rise after this. Disregarding “all pre-election fears about a Trump presidency [which were realized] – he [was] erratic and has promoted autarky,” according to Bryn Lim of the University of Melbourne’s Business and Economics department.

While Trump was unpredictable, the market found a way to make a profit within the sensitive environment, said Lim. This is an outcome of the second reading of market efficiency, being applied by capital, he added.

“The first interpretation says that if markets are efficient, prices in markets accurately reflect all available information. The second says that if markets are efficient, investors cannot make abnormal profits by trading on available information,” he argued in a past blog post.

Trump’s complicated relationship with Bitcoin

Trump didn’t care about those perceptions. “All of those millions of people with 401(k)s and pensions are doing far better than they have ever done before with increases of 60, 70, 80, 90 and 100% and even more,” he boasted in an address to Congress in 2020, Reuters reported.

He was referring to the impact that rising stock prices during his presidency had on pension and retirement funds. But comparing the impact of politics on the broader financial market and, specifically, the crypto ecosystem is a very subtle exercise, experts say.

“Considering his antecedents for implementing cash-based palliatives, the crypto ecosystem may stand a better chance for targeted growth in the long term under the former president,” Ben Sharon, CEO of gold-backed crypto platform Illumishare, told BeInCrypto.

Still, Trump has a complicated relationship with crypto. While he tended to affect markets, he never pretended to like Bitcoin. “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” he tweeted in 2019.

“Unregulated crypto assets can facilitate unlawful behavior, including drug trade and other illegal activity,” Trump added. The tweet has since been deleted, along with Trump’s account, which was suspended in January 2021. Later that year, he called BTC “very dangerous.”

On the campaign trail

More recently, Trump has appeared in political debates, helping celebrity doctor Mehmet Oz in his campaign by campaigning beside him. Oz, like Donald Trump, is pushing a campaign narrative on which America’s supremacy is central.

He is competing against John Fetterman for the Senate seat in Pennsylvania. Oz has had to resort to ad-hominem attacks, a trick straight from the Trump playbook. This may point to a lot of things, including that the former president is still feeling eccentric.

In that sense, a Trump win in 2024 could mark a return of unpredictable separatist politics, which appeared to impact Bitcoin and traditional financial markets positively during his first era. There are no straight answers as to why markets behaved this way.

“Given the first interpretation, were markets inefficient if at one time they feared a Trump presidency but shortly thereafter came to embrace it?” Bryn Lim, the University of Melbourne expert, queried.

“Maybe yes, maybe no, depending on whether you believe ‘accurately’ requires investors’ beliefs to be consistent. What the Trump presidency has made clear is that the second interpretation of market efficiency is almost certainly true.”

Trump win, Bitcoin win

Presidents “have rarely had much influence on stock prices, given the limits of the office,” Lim said. But, “for better or worse, Donald Trump is no ordinary president.” Indeed, Bitcoin reported some impressive growth during the Trump presidency.

However, it was during his successor, president Joe Biden’s tenure, that BTC soared to its all-time high of more than $69,000 in November 2021.

Ben Sharon, the Illumishare CEO, told BeInCrypto there’s speculation that some voters will favor “crypto-savvy politicians irrespective of their party affiliations.”

“When investors realize the potential for Trump to come back, the prices of digital assets may reflect this news in the mid-term, forcing some of the flagship cryptocurrencies to close this year marginally more positively than already envisaged,” he said.

“Should these projections come true, Bitcoin may close the year above $30,000 and Ethereum above $2,000,” Sharon predicted.

Crypto policy: Democrats vs. Republicans

Across the political divide, Bitcoin has won admirers from both Democrats and Republicans. Representatives such as Ritchie Torres and Jim Himes from the Democratic camp have talked up crypto frequently.

“Crypto is the future,” Rep. Torres stated in an opinion article in March. “It could enable the poor to make payments and remittances without long delays and high fees. It could enable artists and musicians to earn a living. This could challenge the concentrated power of Big Tech and Wall Street,” he added.

The same party hails crypto-skeptics like Sen. Elizabeth Warren. Warren has criticized Bitcoin’s volatility “compounded by its susceptibility to the whims of just a handful of influencers.”

She was speaking in reference to a decision by Fidelity that allowed pensioners to invest a part of their money in crypto. Democrats are generally considered to be Bitcoin opposed. This indicates the direction that crypto policy could follow under Democrats, one of polarization.

Republicans friendly to crypto?

By comparison, Republicans are viewed as crypto-friendly. In April, Representatives Patrick McHenry and Bill Huizenga criticized the US Securities and Exchange Commission (SEC) for overstepping its mandate.

“We are particularly concerned the proposed rules can be interpreted to expand the SEC’s jurisdiction beyond its existing statutory authority to regulate market participants in the digital asset ecosystem, including in DeFi,” they wrote in an open letter to SEC chair Gary Gensler.

On Nov. 8, Americans will choose 435 House of Representatives and only 35 Senators from the total 100 seats available.

Democrats currently hold a narrow 8-seat majority in the House of Representatives. The Senate, on the other hand, is split along party lines. Democrats hold a narrow majority. Polls predict Republicans will romp to victory.

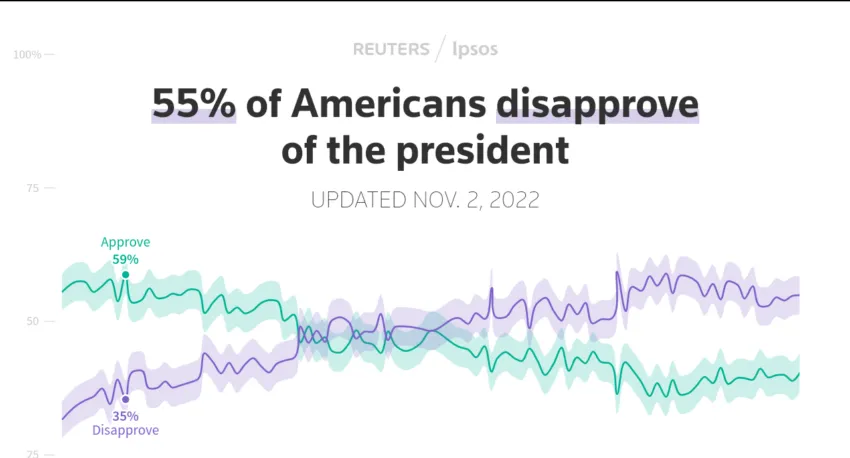

As inflation hit a 40-year high of 8.2%, president Joe Biden’s ratings have plummeted. Around 55% of Americans disapprove of the president, according to a Reuters poll. It seems Biden will lose the House of Representatives under the weight of mounting economic pressures.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.