Tesla CEO Elon Musk reportedly proposes buying Twitter for $54.20 per share, sending Dogecoin (DOGE) price soaring 10%.

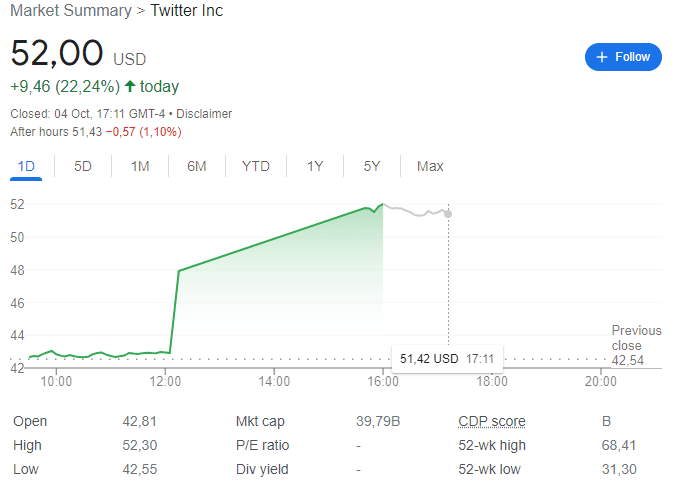

Update 4 Oct. 21:10UTC: Twitter have acknowledged Musk’s offer and appear to be ready to accept the $54.20 per share price. Following the confirmation, Twitter’s share price climbed to $52. A staggering 22% gain on the day

According to Bloomberg, Musk signaled his renewed intentions to purchase the social media giant in a letter to the company. Following the announcement, Twitter’s stock price jumped 18% as trading had to be halted due to the large price surge.

According to a Reddit thread, Musk’s recent phone records reportedly reveal that the billionaire had been discussing moving Twitter to the blockchain, eliminating all bots, and charging 0.1 DOGE to tweet or retweet. The plan was later deemed infeasible.

Following Musk’s announcement, DOGE jumped 10%.

Musk signed on the dotted line to buy Twitter in April 2022 but later pulled out because Twitter had allegedly failed to disclose a problem it had with bots. Bots are automated accounts that can be used on Twitter for tweeting, re-tweeting, liking, and other purposes.

Musk and DOGE are inseparable

The Tesla billionaire has long been a proponent of the world’s largest memecoin by market cap, and his tweets on the coin have often sent prices soaring. In Dec. 2021, Musk announced that his automotive company Tesla would offer merchandise in DOGE. Accordingly, Tesla launched its Cyberwhistle, modeled on its Cybertruck, for 1000 DOGE.

In response to the rumors, Twitter confirmed that it received a letter filed by representatives of Musk with the U.S. Securities and Exchange Commission, confirming the billionaire’s intent to buy the company at $54.20 per share as per the original agreement signed in April 2022.

After falling briefly, DOGE has mostly recovered since the initial announcement, and is now trading at $0.065470. At press time, Twitter shares had rallied further to $52.00.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.