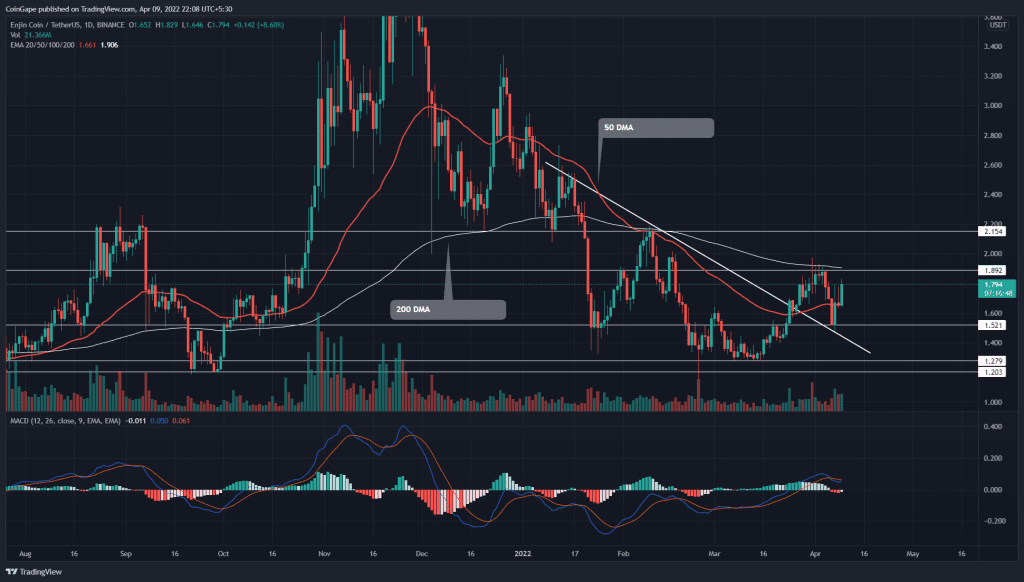

The Enjin Coin(ENJ) price rebounded from the breached resistance trendline, suggesting the trader’s sentiment has turned from selling on rallies to buying on the dips. Furthermore, the post-retest rally drove the altcoin by 17.5%, nearing the combined resistance of $1.9 and 200 DMA. Can traders breach this overhead resistance?

Key points:

- The daily-MACD indicator performs a bearish crossover.

- The intraday trading volume in ENJ price is $354.7 Million, indicating a 40.6% gain.

Source- Tradingview

The double bottom breakout resulted in the promoted bullish recovery of 44% in the ENJ price in the third week of March. The inflating prices hit the 200-day EMA after surpassing the bearish aligned 50 and 100-day EMAs and the resistance trendline.

However, the ENJ price failed to rise above the 200-day EMA resulting in the retest of the broken trendline. The retest phase declined the prices by 20% within 96 hours and created consecutive bearish engulfing candlesticks.

The buyers stepping in at the right moment resulted in the post-retest reversal and inflated the prices to the $1.75 mark. The bullish continuation aims to retest the 200-day EMA, and if the buyers sustain trend control, an upside move to $2.16 is possible.

However, the higher price rejection near the 100-day EMA opposes the bullish growth. Hence, closing below the 50-day EMA ($1.66) will undermine the bullish doctrine and result in a price fall to the $1.50 mark.

Technical analysis

The MACD line shows a reversal after the bearish crossover reflecting the bulls sabotaging the increased selling pressure. Hence, the MACD and signal lines are ready for a bullish crossover and initiate an uptrend in histograms.

The 100-day EMA suppresses the bullish growth, while the 50-day EMA has supported a Doji formation. However, the 20-day EMA remains a critical resistance that the buyers need to surpass for a sustained uptrend.

- Resistance levels- $1.9 and $2.15.

- Support levels- $1.5 and $1.28