Crypto prices seemed to not be the only ones surging after Ethereum Name Service [ENS] spiked per development activity recently. Without a doubt, the open-source naming system needed to recover after months of consolidation and an increase in the development activity did justice to the plea.

Backing the resurgence, the ENS price also followed with a 9.38% rise to trade at $18.38. However, the surge in development activity seemed to be the building block of this increase besides the overall market revival. But what else?

Here’s AMBCrypto’s Price Prediction for Ethereum Name Service [ENS] for 2022-2023

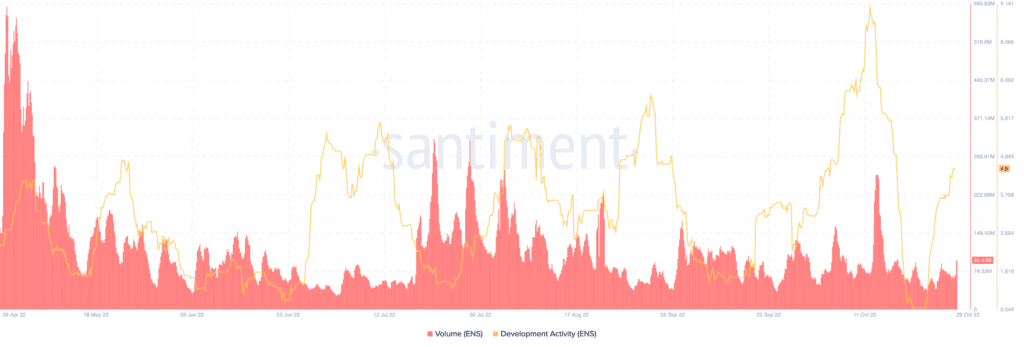

According to Santiment, ENS’ development activity had decreased to 0.54 on 23 October. At this point, it implied that ENS slowed down on polishing its network.

Santiment also revealed that it was the day after that (24 October) ENS decided to resume upgrading its network on-chain. At press time, the development activity had soared to 4.5. The implication of this increase also reflected on the volume with an increase to $96.64 million.

Q3 has everything else to show

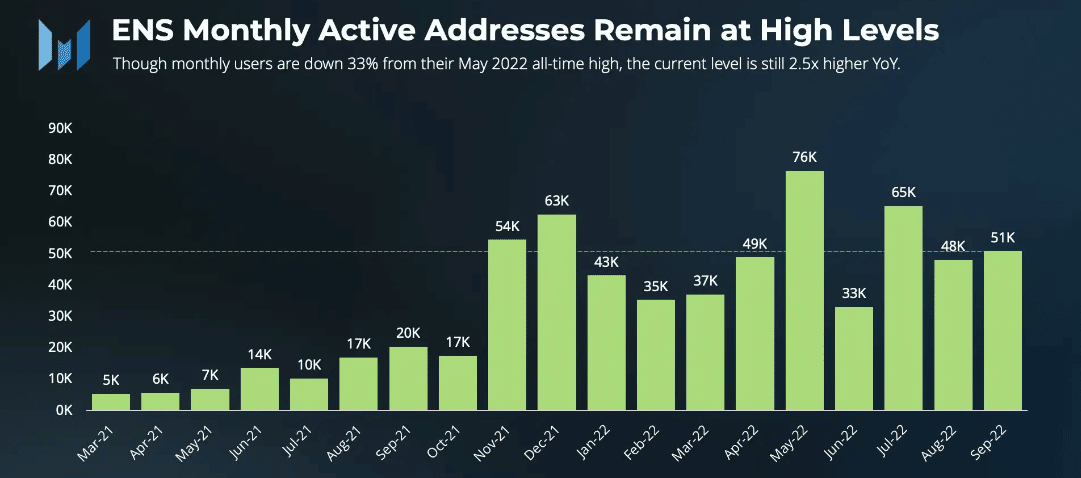

It, however, appeared that this notable uptick was not sudden. According to Messari, the third quarter (Q3) ENS performance might have everything to do with the recent rally. The crypto intelligence platform showed, in a recent Twitter thread, that ENS overall Q3 performance was mostly positive.

Based on Messari’s report, ENS produced better revenue as compared to the previous quarter. This happened with the crypto market making less profits for investors for most of the period.

1/ Solving problems associated with handling error-prone blockchain addresses, @ensdomains has remained healthy during the market downturn.

Q3 saw improvements in both performance and revenue metrics. 🧵 pic.twitter.com/kcqHhTqX4i

— Messari (@MessariCrypto) October 28, 2022

According to the Messari report, ENS recorded a 66% Quarter-on-Quarter (QoQ) revenue growth. This meant that more investors looked in ENS directions and engaged with the network. As for its domain sections, growth initially stunted and decreased later.

This decrease was what led to a 600% increase in expressions and non-renewals. However, renewals from the previous quarter increased three times. Due to this, only a small part of the crypto community had maintained their interest in acquiring the digital collectibles.

To remain excited or not?

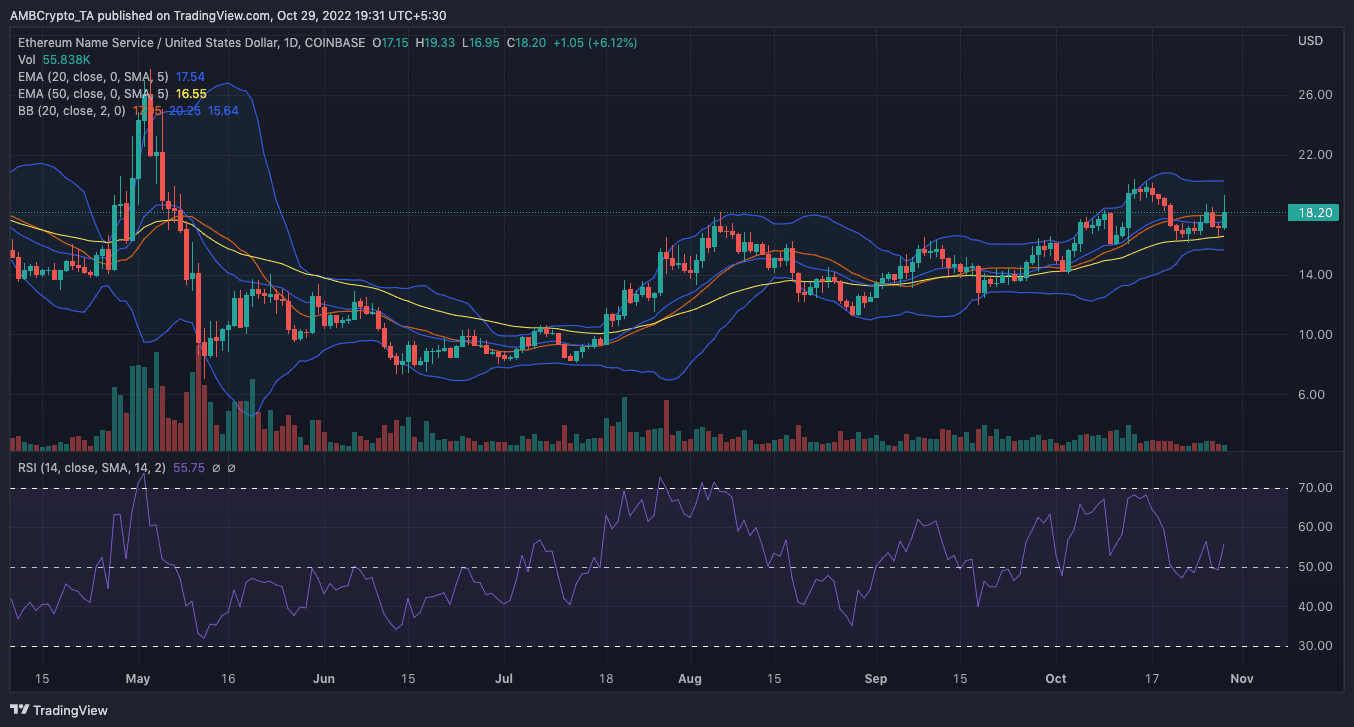

As expected, ENS investors would be glad with the recent uptick. Additionally, staying put by expecting a sustenance of the increase might not be a great undoing. Based on the four-hour chart, the Relative Strength Index (RSI) indicated that ENS had maintained a strong buying momentum.

With its value at 55.75, it was unlikely that ENS would fall to a selling pressure unless it hit an overbought level. This might be bound to happen if there was more volume and traders began to sell. Similarly, the Exponential Moving Average (EMA) showed that the price could maintain the greens for a while.

At press time the 20 EMA (blue) remained above the 50 EMA (yellow). Considering this position, ENS investors might be guaranteed an extended increase in the short term. Nevertheless, the rising volatility indicated by the Bollinger Bands (BB) was another aspect to consider because it could lead it in reverse mode.