Even though EOS (EOS) has bounced considerably since its Dec 4 lows, it has a long way to go in order to confirm a potential bullish trend reversal.

EOS decreased considerable on Dec 4, falling to a low of $2.39. However, the low and ensuing bounce served to validate a long-term ascending support line for the third time (green icons). The line has been in place since March 2020.

Despite the bounce, technical indicators provide a relatively neutral outlook.

The MACD, which is created by a short- and a long-term moving average (MA), is falling and is showing a reading of 0. This means that the short-term and long-term MAs are moving at the same speed, but the short-term one is decelerating. It is a sign of a weakening trend.

Similarly, the RSI is just below 50. The RSI is a momentum indicator, and readings below 50 are considered bearish.

Current range

Cryptocurrency trader @Mesawine1 outlined an EOS chart which shows the token accumulating inside a range, suggesting that it will sweep the June lows.

Since the tweet, EOS has swept the June lows and bounced. While it initially seemed that it broke down below the $3.20 area, it has since reclaimed it, rendering the breakdown as a deviation only (red circle). This is a bullish development that is often followed by an upward movement.

However, the token is still following a descending resistance line. Until it breaks out, the bullish reversal cannot be confirmed.

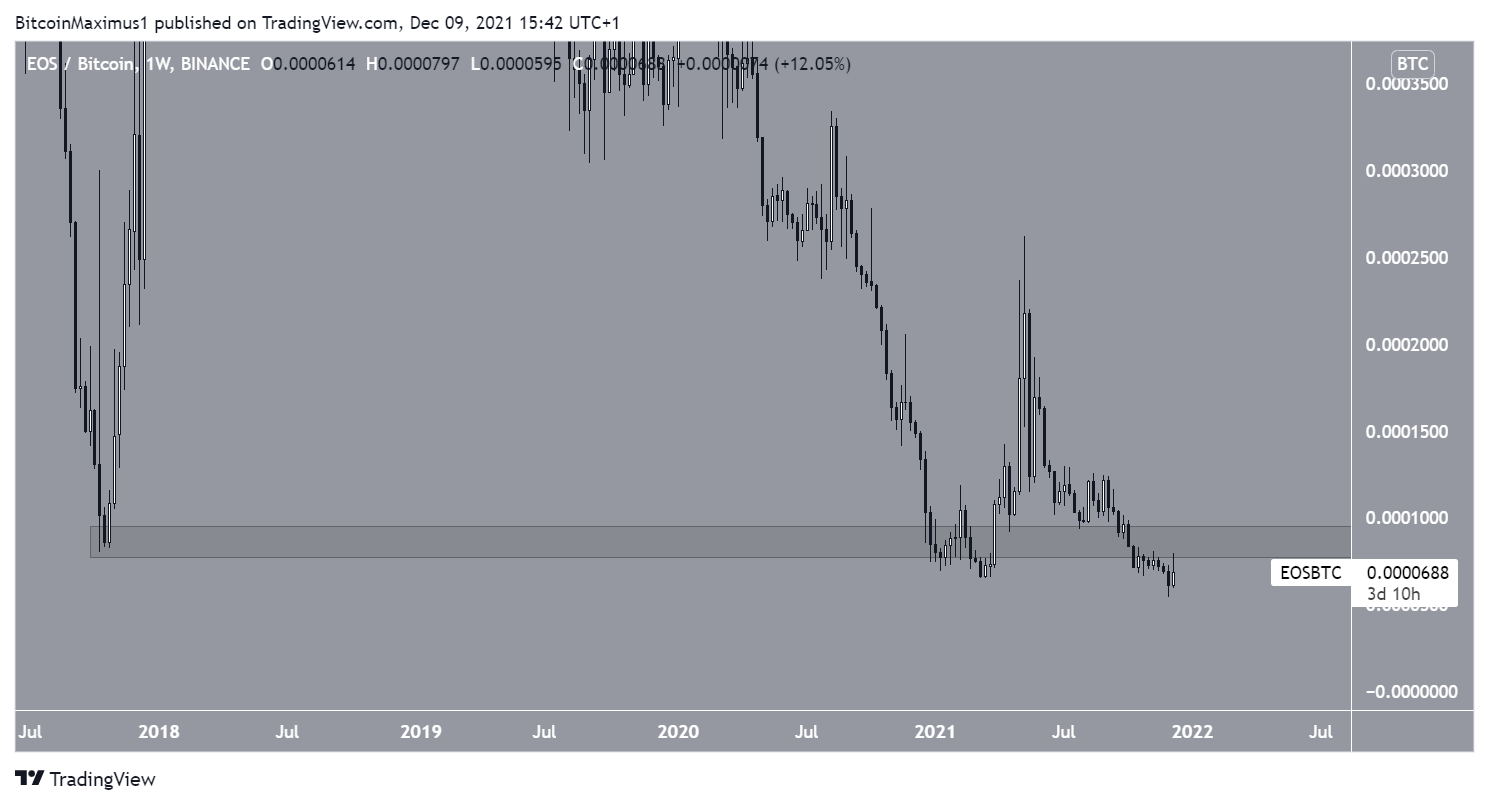

EOS/BTC

The EOS/BTC chart is decisively bearish, since the token reached a new all-time low of 5420 satoshis on Dec 4. Therefore, the token is now in bearish price discovery.

Until EOS manages to reclaim the 8000 satoshi horizontal area, the long-term trend is considered bearish.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.