Amidst preparations for the Ethereum Merge, ETC Group made a shocking announcement on Wednesday. The digital assets and blockchain equity provider declared its plan to continue using Ethereum’s proof-of-work consensus for its current Ethereum exchange-traded products.

Meanwhile, ETC Group recently published a paper in August titled: ‘why structure matters in crypto ETPs.’ The publication identifies the differences between its crypto ETPs and its rival European crypto ETP offerings. It also described its perception of the failures of its rival crypto ETPs.

A report cited that ETC Group achieved growth of 34,259% from its launch on June 8, 2020, to June 1, 2021. In addition, the company reached its peak in assets of $1.7 billion and won the ETF Express Editors award in March 2022 European awards.

Then, it claimed to be the most liquid and 100% physically-backed Bitcoin ETP in the world.

Details of the ETC Group’s Ethereum Exchange-Traded Product (ETP)

According to the announcement, the newly launched Ethereum ETP of ETC Group will rely on the Ethereum POW hard fork. This is meant for a group of miners opposed to the transition to POS. The proof-of chain will have a new token called ETHW.

The ETHW will provide a base for ETC Group’s new physically-backed ETP called ETHWetc (ETC Group’s Physical EthereumPoW. According to the Group’s report, ETHWetc is expected to be enlisted on the Deutsch Boerse’s electronic trading platform, Xetra. Therefore, its ticker symbol will be ZETW.

The company stated that it anticipates the listing to occur soon after the ETH fork event on September 16. ETC Group also revealed that ZETW would naturally replace the original ETC Group’s ZETH in the ratio of 1:1 units on brokerage accounts.

Why ETC Group Decided to Retain the Ethereum’s PoW

The founder of ETC Group, Bradley Duke, explained that the firm’s original vision was to benefit from the hard forks of existing cryptocurrencies. He added that holders of their Ethereum would receive accessible, equal units of the new Ethereum PoW ETP. This will be after the Ethereum hard forks merge happens.

The CEO said that they believe their investors deserve to receive the gains from the fork. As various companies are looking for new mining options, ETC Group released this announcement.

Speaking of investors, Swiss-regulated Cryptocurrency platform SEBA Bank authorized ETH staking services for institutional investors on Wednesday. The Bank stated that it is an institutional-category offering to enable clients to produce monthly rewards on their ETH holdings.

Apart from ETC Group, other organizations want to seize the opportunity to introduce new tokens. Recently, Hive Blockchain, a Canadian-based crypto miner, announced that it is planning to replace the mining of ETH with other mineable coins in the course of the ETH merge.

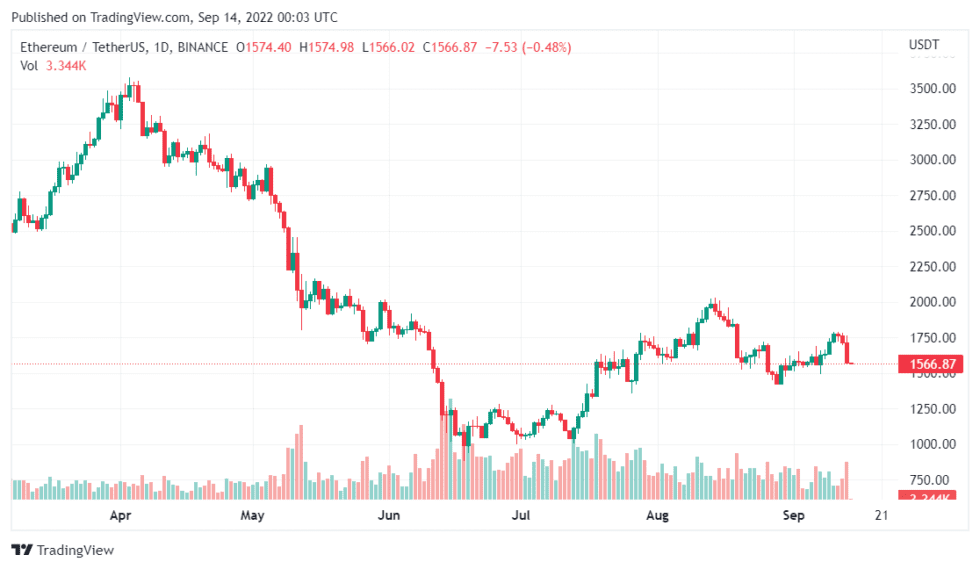

Featured image from The Pixabay, chart from TradingView.com