Deposits in ETH 2.0 reached an all-time high on 30 June. This comes after the largest altcoin took a hit in light of the 3AC liquidation. As ETH hovers near the make-or-break level, investors question where will Ethereum [ETH] go from here?

No break over here

Ethereum just had one of the most torrid months since its inception. Still fresh from the Terra scars, it had to undergo the implications of the 3AC crash in June. While the fate of the coin continues to look into the abyss, the anticipated Merge is providing hope to investors.

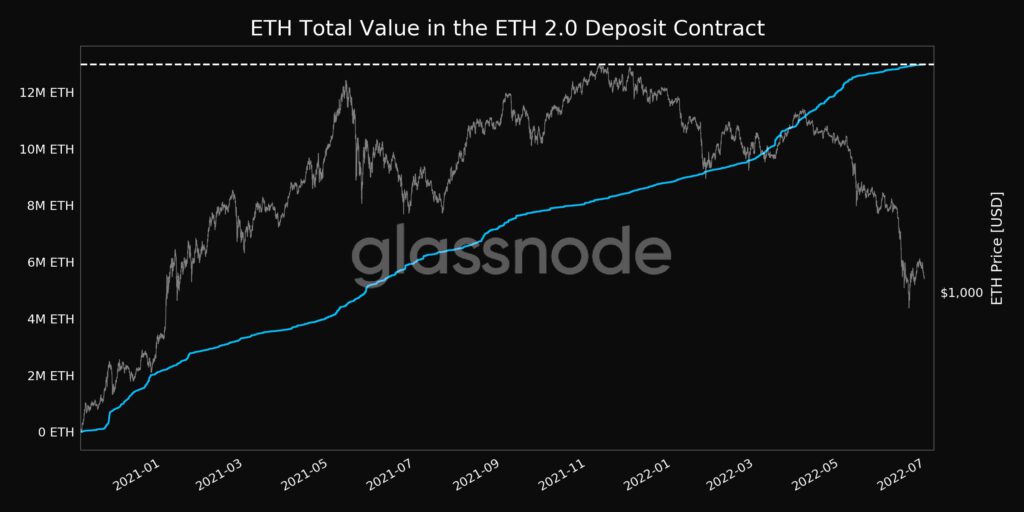

That being said, as per reports from Glassnode, the total value in the ETH 2.0 deposits reached an all-time high of 12,976,933 ETH. As we edge closer to the Merge, investors are increasing and are continuing to deposit their holdings in the staking contracts.

What happens to ETH now?

Despite an increasing interest in staking ETH 2.0, the native ETH continues to struggle amid market volatility. ETH has taken a 5.25% dip since 29 June. And, it was struggling to hold the $1,100 level, at press time- it was trading at $1,063, ETH’s latest dip comes after news of 3AC’s insolvency.

Amidst the dip, accumulation has been triggered on all fours during the June crash. Furthermore, as per data from Santiment, Ethereum shark and whale addresses have added 1.1% to their bags since 7 June.

During this period, the price of ETH fell by 39% marking a huge opportunity for investors to ‘buy the dip.’ Historical evidence points to this tier group having alpha on future price movement.

Additionally, upon observing the behavior of the metrics, we can get an idea about investors’ movement. The volume on the Ethereum network has diminished recently.

The aforementioned whale movement was also at its highest during mid-June and has slowed down in the past few days. The social dominance of Ethereum has also surfed at a low point in June. This metric hit the monthly high at the peak of the 3AC/ Celsius crash on 14 June. But, more recently, online chatter about Ethereum has reduced significantly.

ETH 2.0 may hit a home run with its accumulation gaining speed. But a dipping price and falling metrics are creating a strange situation for Ethereum right now. So where does Ethereum go from here? We would need to be patient and watch the market.