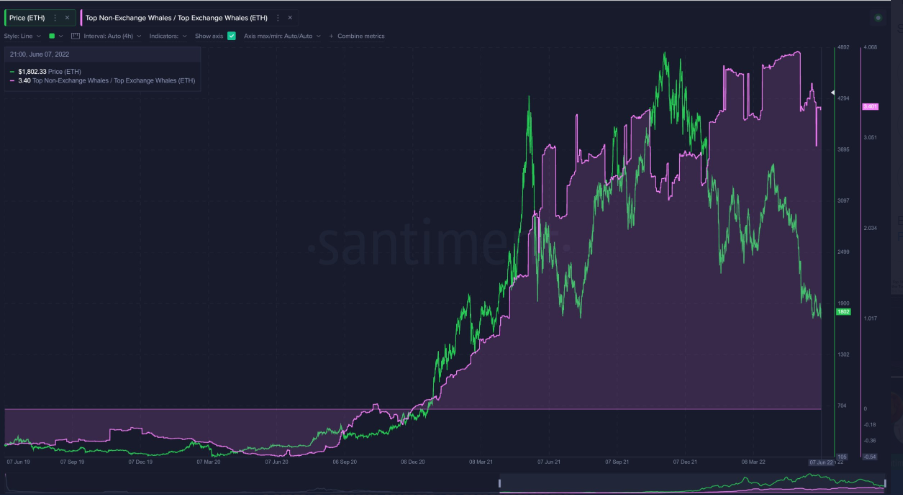

- Ethereum’s top 10 non-exchange vs exchange addresses are maintaining a high ratio of ETH.

- The fact that the non-exchange addresses outnumber the exchange addresses could mean that investors have a bullish outlook on ETH.

- According to CoinMarketCap, ETH is second on the list in terms of market capitalization and is currently worth $1,801.37.

In a Twitter post on June 9, Santiment revealed that “Ethereum’s top 10 non-exchange vs exchange addresses are maintaining a high ratio of ETH owned over the top 10 non-exchange whales. With a tremendous 3.4x more coins held, there still appears to be a belief that prices can stabilize.”

The fact that the non-exchange addresses outnumber the exchange addresses could mean that investors have a bullish outlook on ETH. This might be a hint that investors are not planning on trading their holdings any time soon.

Furthermore, Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS), also known as The Merge, is just around the corner. This could also contribute to the assumption that ETH could stabilize in the near future.

Developers also recently ran a practice run of the PoS chain, and it seems to have been very successful.

According to CoinMarketCap, ETH is second on the list in terms of market capitalization and is currently worth $1,801.37 after a 0.24% increase in price over the last 24 hours, and after reaching a high of $1,827.56 over the same time period. This price translates to around 0.05929 BTC.

ETH also saw a 1.51% drop in price over the last week.

With regards to market cap, ETH currently has $218,153,318,638, which is a 0.12% increase over the last day.

ETH also saw a 24-hour trading volume of $14,111,871,197. This is a 36.47% drop from yesterday’s number.