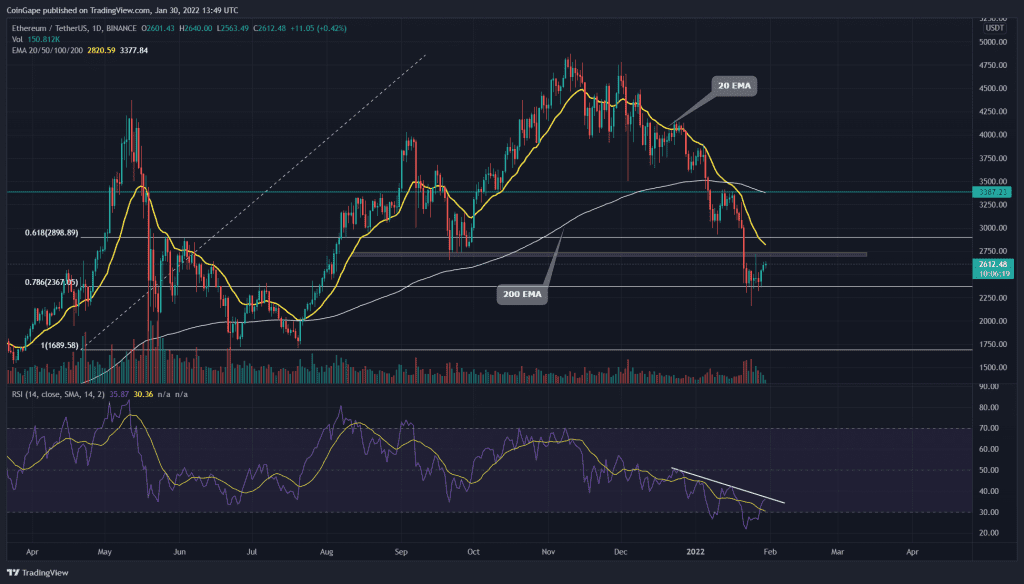

The Ethereum sellers mark their new lower low at the $2170 mark, indicating a 55% devolution from the All-Time High of $4891. The ETH price currently shows a relief rally, registering a 12% gain in the last three days. The price action approaching the nearest resistance of $2700, would test if buyers are ready for genuine recovery.

Key technical points:

- The ETH price acquired dynamic support from the 20-day EMA

- The daily-RSI recovery from the oversold region

- The intraday trading volume in ETH/USD is $10.4 Billion, indicating a 17.4% fall.

Source- Tradingview

In our last week’s coverage of Ethereum technical analysis, the ETH/USD pair experienced a sudden sell-off which plunged the coin price to 0.786 Fibonacci retracement level. The buyers spend the majority of this week sustaining above the bottom support($2360); however, the weekends have given a positive outlook.

- The ETH price lowering below the trend defining 100 and 200 EMA, indicates bears are dominating. In addition, the 20 EMA line provides constant resistance to the coin price.

The daily-Relative Strength index(35) surged above the oversold region and is approaching the midline. However, the RSI slope has to breach the resistance trendline beginning in November 2021

ETH Price Chart In 4-hour Time Frame

Source-Tradingview

The ETH price is currently charging towards the immediate resistance near $2700. A Bullish breakout from this resistance would provide the first sign of recovery. However, if the bear stepped in again the coin price will slide back to $2350 support.

The moving average convergence/divergence displays the recent recovery has pumped the MACD and signal above the neutral. If the buyers could maintain the bullish momentum, the ETH price could surge to the $3000 mark.

- Resistance levels- $2700, $3000

- Support levels are $2350 and $2170.