The Ethereum blockchain is slated for one of the most significant updates since its inception as it transitions from its current proof-of-work mining consensus to a proof-of-stake (PoS) one.

The Merge date is scheduled for Sept. 15, after the successful Goerli testnet integration — the final testnet merger before the actual transition. Ether (ETH), Ethereum’s native token, saw a bullish surge in July after the announcement of the Merge date, with its price rising to a new six-month high of over $2,000 but failing to consolidate at the critical resistance.

The bullish enthusiasm in terms of token price and market sentiment seems to be on a decline as the Merge nears. There has been a sharp decline in the holdings of a significant number of ETH whales.

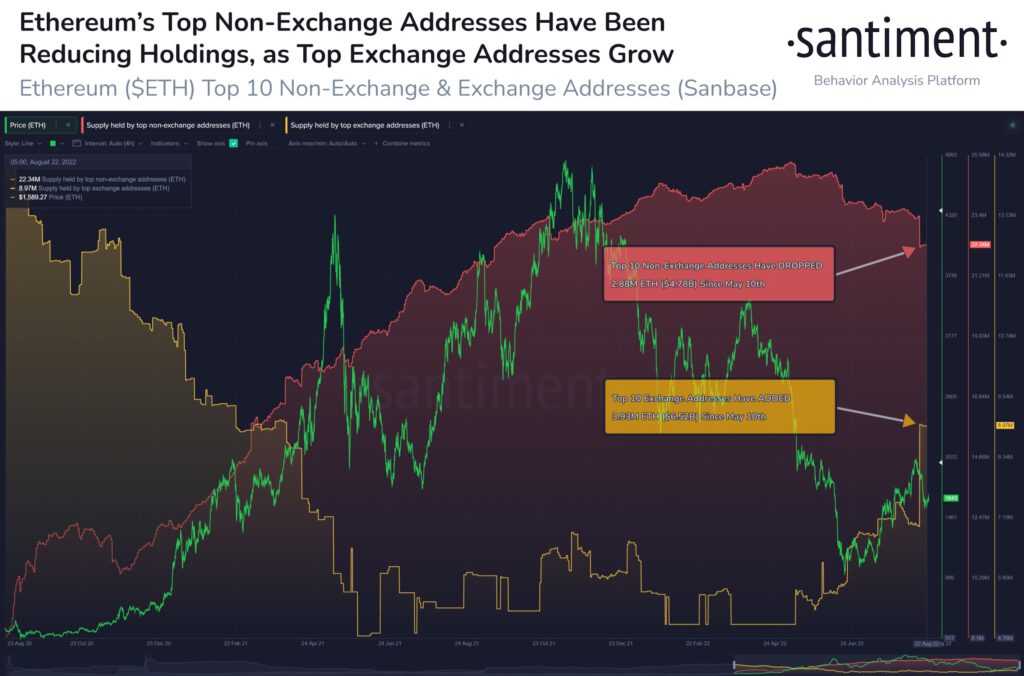

Data from crypto analytics firm Santiment indicates that the gap between Ethereum’s top 10 largest non-exchange addresses and exchange addresses is closing. Over the past three months, top whale addresses have sent a significant amount of ETH onto exchanges. Non-exchange addresses have declined 11%, while exchange-based addresses have surged by 78%.

The flow of crypto onto exchanges generally reflects bearish sentiment and is often done by traders to take a profit by selling their tokens, possibly indicating that whales expect the price to go lower in the near future.

Many market analysts also believe the Merge will be a “buy the rumor, sell the news” event. The saying means that if good news is expected sometime in the future, the price will often move higher in anticipation of that date, but not necessarily after. The market rallied in the aftermath of the Merge date confirmation, but it could eventually see a price decline after the key event.

I think #Ethereum will drop so hard on the Merge day.

The whole anticipation is getting not bought up on the spot market but on the futures market.

Be warned.

— Crypto Rover (@rovercrc) August 23, 2022

The Merge will mark the completion of the second of three phases in Ethereum’s transition to PoS. The process began in December 2020 with the launch of the Beacon Chain.

Related: Monthly Ethereum options data suggests $2K will remain an elusive target

The current phase was scheduled to be completed by mid-2021. However, due to several delays, it is now slated for the third quarter of 2022. The third phase will be the most crucial, as it will introduce several scalability features such as sharding and significantly reduce the blockchain’s energy consumption.

The Sept. 15 event is a significant milestone for Ethereum, but the Merge only means a change of mining consensus. Key benefits such as high transaction capacity, lower gas fees and a reduction in energy consumption will come after the completion of the third phase.