Ethereum and the larger market continued to see red signals in terms of price after witnessing short-term gains. However, despite the cautionary tales and price headwinds, stakers and holders continued to build the post-Merge Ethereum castle.

In the years leading up to the Ethereum blockchain’s historical shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS), the optimistic anticipations from price failed to pan out. The much-anticipated Merge went live on September 15 — just two days after the United States CPI data which pulled ETH’s price down by close to 20% in the two days leading up to the Merge.

Nonetheless, on-chain activity pointed towards a healthier picture in quite a few spheres for the top altcoin network.

Growing investor confidence

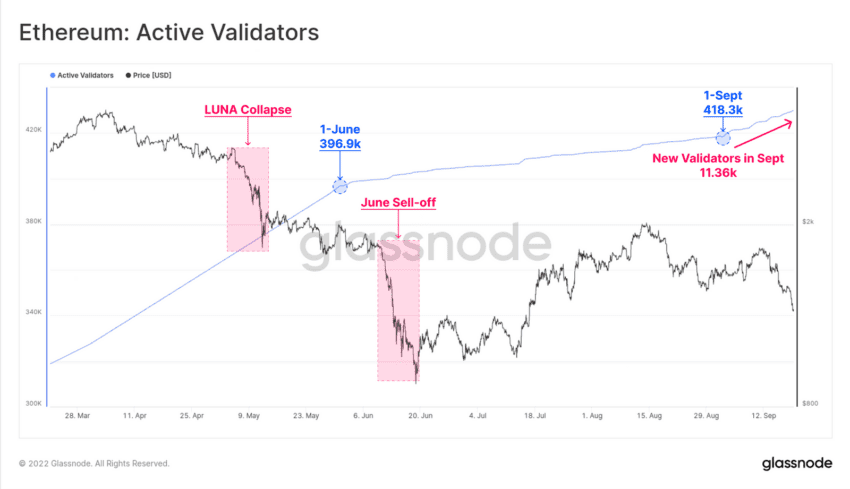

Recent Glassnode data presented that over 11.36k validators have come online in September alone, signifying growing investor confidence as technical challenges of the Merge de-risked.

Until mid-September, Ethereum had over 429.6K active validators on the network. Additionally, increased interest from newcomers too was seen in the rising number of new validators on the network. Over the last 6-months, the gradient of new validators increased markedly in the lead-up to and following the Merge.

One of the most notable developments was that roughly 150,00 ETH, worth $195 million was staked over the past week. This led to the Total Value in the ETH 2.0 Deposit Contract reaching an ATH of 13,919,623 ETH.

Institutional activity picking up

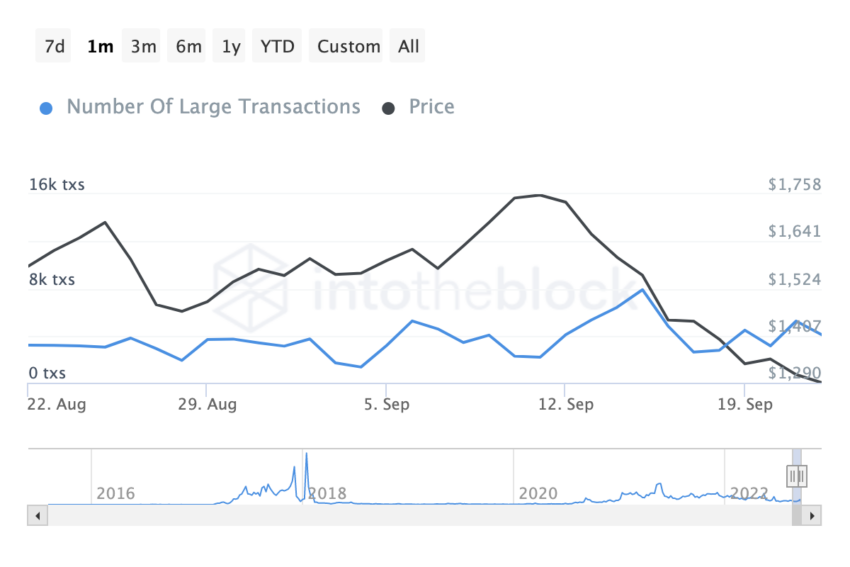

The number of large transactions on the Ethereum network, greater than $100,000, was in an uptrend. The number of large transactions is an indicator that acts as a proxy for the number of whales’ and institutional players’ transactions.

Thus, while whales and institutional entities seemed to be circling back to the network as large transactions spiked, the retail side still saw slowed down momentum owing to the price pullback post the Merge.

Can a reversal be expected?

On Sept. 23 the market finally let a sigh of relief as top crypto assets saw some gains on their short-term charts.

ETH price charted its first green candle on a daily chart at press time which points in a positive direction for the top altcoin. Additionally, RSI’s recovery from the oversold also pointed towards an easing sell-side pressure.

However, reversal was still in question looking at ETH’s 27% price pullback since the Merge.

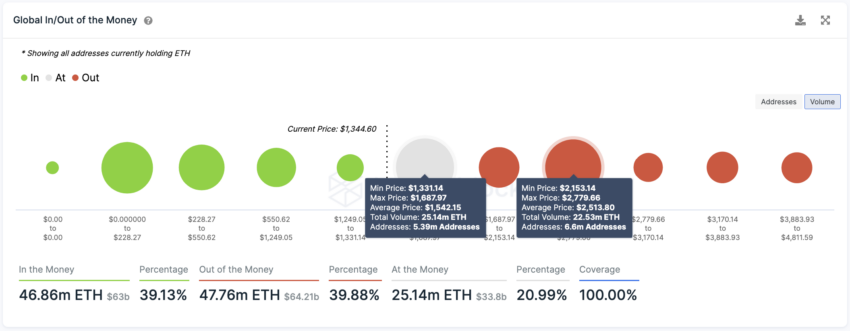

Despite the glimmering activity from stakers and whales, ETH still faced some crucial resistance barriers ahead. A look at In and Out of Money indicator suggested that Ethereum faced stiff resistance at the $1,542 mark where 5.39 million addresses hold over 25 million ETH.

In the near term, if bulls can push ETH price to break through the $1,542 supply wall, the next crucial area of resistance will be at the $2,500 mark, where 6.6 million addresses had previously purchased 22.5 million ETH.

However, in case of another headwind, ETH’s price could fall down to the $1,200 support level.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.