The world’s second-largest cryptocurrency Ethereum (ETH) has come under major pressure during the crypto market rout. Despite the success of the Ropsten testnet Merge upgrade, the ETH price has remained stable.

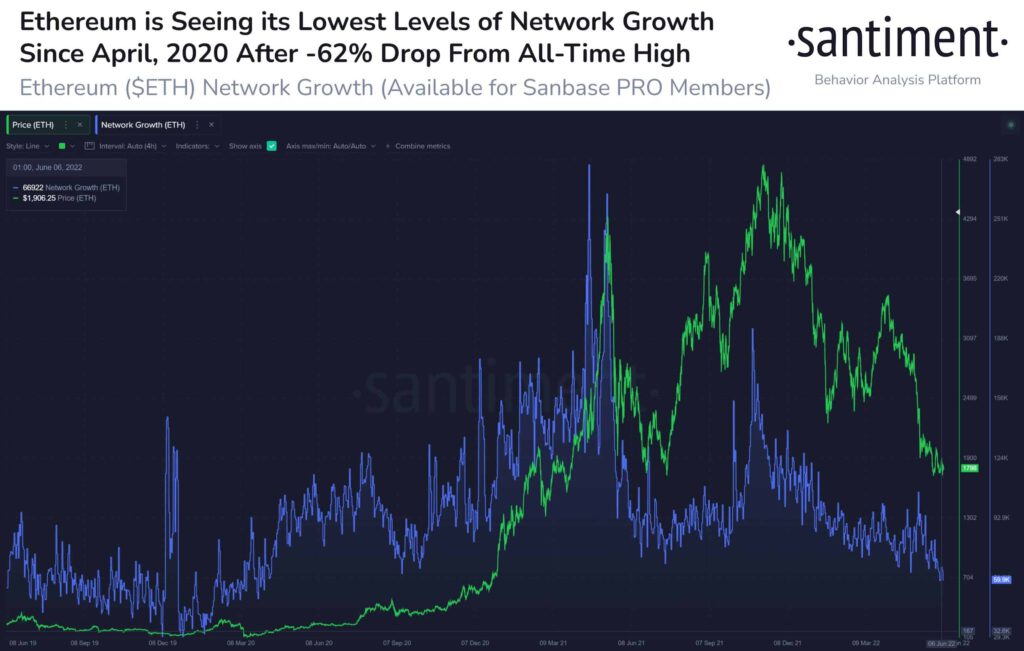

On the other hand, the on-chain address activity isn’t supporting to support a price surge. As per the data from Santiment, the Ethereum address activity and network growth have dropped to their two-year lows. Santiment reports:

As #Ethereum crept back above $1,800 once again a few minutes ago, we’re monitoring long-term fundamentals that would signal a turnaround for the #2 asset in #crypto. $ETH is still seeing very low levels of new addresses, the lowest in over 2 years.

On the other hand, there seems to be a fight between Ethereum non-exchange whales and exchange whales. However, the ETH non-exchange whales seem to be taking a marginal lead while holding three times the coins that with the exchange whales. Santiment reports:

Ethereum’s top 10 non-exchange vs. exchange addresses are maintaining a high ratio of $ETH owned over the top 10 non-exchange whales. With a tremendous 3.4x more coins held, there still appears to be a belief that prices can stabilize.

Trending Stories

Ethereum Gets Closer to PoS Transition

While the ETH price continues to suffer, the Ethereum blockchain is seeing some good fundamental developments. Earlier on Wednesday, June 8, Ethereum core developers successfully conducted The Merge upgrade on the Ropstent testnet.

As a result, the Ethereum development team will now proceed toward implementing the same upgrade on the Ethereum mainnet by August 2022. The Merge upgrade is key for Ethereum’s successful transition to the Proof-of-Stake Ethereum blockchain.

The upgrade will help the Ethereum blockchain to improve its network efficiency and scalability to a great extent. In the next few months, we can expect a smooth transition to the PoS network. It will also help to boost DeFi activity on the platform.