Ethereum [ETH], the largest altcoin, has HOLDers that have placed their faith in the upcoming Merge to aid the bleeding price. At press time, ETH declined by a staggering 16% as the price dropped to the $1,238 mark. Now, given the delay in this transition, ETH could have a different journey ahead…

Is there light at the end of this dark tunnel?

Ethereum network developers have decided to delay the difficulty bomb, a major step leading up to the highly anticipated Merge upgrade. They set the delay to two months to “be sure that we sanity check all the numbers before selecting an exact delay and deployment time,” according to core developer Tim Beiko.

In short, we agreed to the bomb delay. We were already over time, and want to be sure that we sanity check all the numbers before selecting an exact delay and deployment time, but we are aiming for a ~2 month delay, and for the upgrade to go live late June.

— Tim Beiko | timbeiko.eth 🐼 (@TimBeiko) June 10, 2022

This so-called bomb would make mining profitability plummet to disincentivize miners ahead of the long-awaited Merge. Given this delay, many would portray bearish viewpoints concerning the largest altcoin. But, the scenario here could be a different one by looking at ETH’s network traction growth.

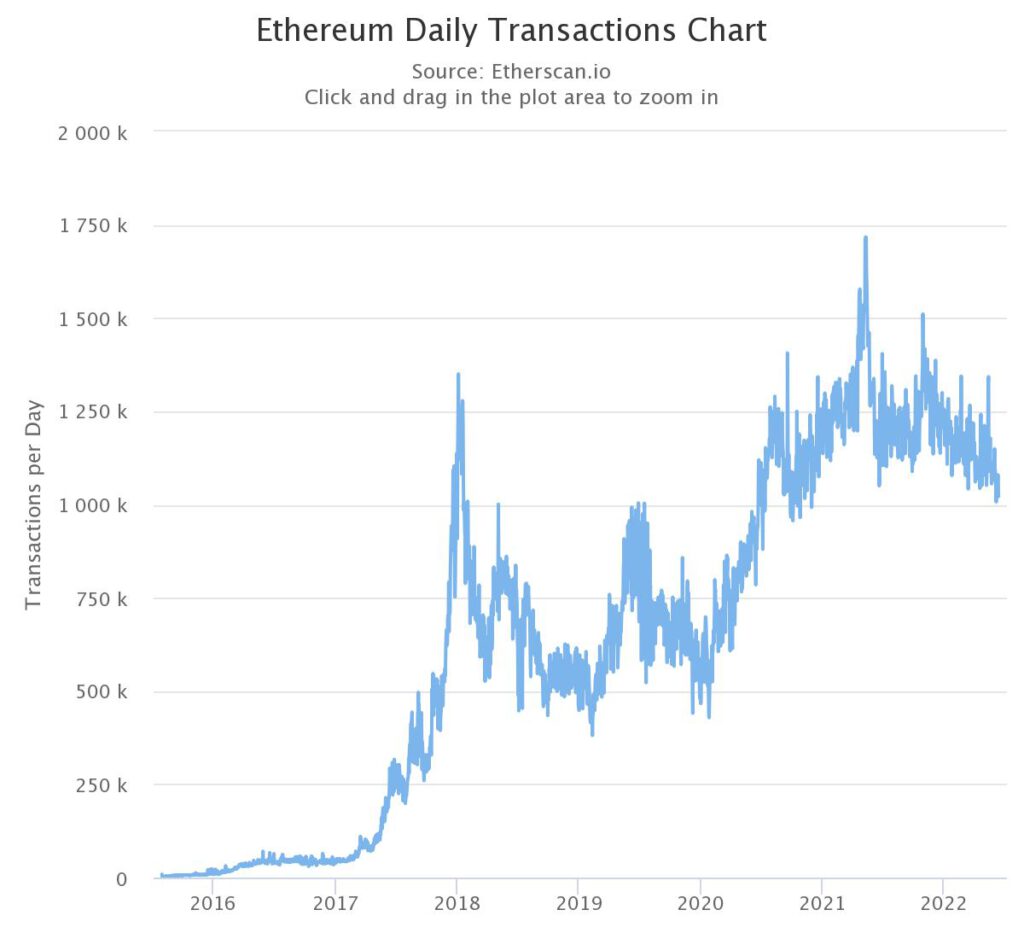

ETH’s daily transactions chart as showcased below saw a constant growth within a range of one million to two million in 2022. This could signify that the network has been incorporating or handling transaction load efficiently.

Meanwhile, the number of addresses piling on the network painted a similar picture as well. The number of Ethereum addresses with a non-zero balance has hit a new all-time high—just like it did at this time last year.

Despite the poor reaction of prices to the first successful merge on the Ropsten testnet, ETH 2.0 staking has been stable. Total deposits to the ETH 2.0 deposit contract rose continuously.

Indeed, a much-needed support for the Merge and its eventual consequences.

Be AWARE!!!

While, the aforementioned developments might act a brief support for the bleeding token, but not for long. Consider this for instance:

Glassnode’s lead on-chain analyst, known by the pseudonym Checkmate, highlighted a potential decentralized finance (DeFi) disaster that could crash Ether’s price further into 2022.

Ratio is now at 80%

Market Cap of:#Ethereum = $181.58B

Top 3 Stablecoins = $144.28B

TVL in DeFi = $101.67B$ETH at $1215 makes for equal Ethereum and Top 3 stablecoin market caps.The principle risk here is levered $ETH collateral in DeFi loans getting liquidated in a cascade https://t.co/26u0vXnMMY pic.twitter.com/q555clRaap

— _Checkɱate 🔑⚡🦬🌋 (@_Checkmatey_) June 12, 2022

The ratio between Ethereum’s and the top three stablecoins’ market capitalization grew to 80%.

(Ethereum is the platform hosting over $100 billion worth of leveraged loans and DeFi positions. Most people borrow stablecoins. If the network is worth less than the stablecoins built on-top, means debt is very high relative to collateral. Risk of cascade are high.)