The Ethereum network is days away from the highly anticipated Ethereum 2.0 Merge. This is one of the most anticipated crypto events which is considered good for the network’s overall performance. However, the impact on Ethereum Classic [ETC] has been largely overlooked.

To really understand the impact of the Merge on the Ethereum Classic, we have to look at how the Merge will affect Ethereum’s operations.

For example, miners will be forced to either shut down their mining rigs or switch to other compatible proof-of-work (PoW) networks.

Ethereum Classic happens to be one of the suitable alternatives since it uses the same consensus algorithm as Ethereum (Et-hash algorithm). In contrast, Bitcoin uses the SHA-256 which is not suitable for Ethereum GPUs.

The potential risks

An exponential increase in the number of GPUs mining will increase Ethereum Classic’s hash rate. However, it also means more competition among miners, and fewer profits to go around.

Such an outcome may force miners to sell off their ETC holdings to cover the cost of running their mining hardware. As a result, ETC’s price might take a hit due to the increased sell pressure.

The above outcome depends on whether there will be enough ETC dumped by miners. There is a significant chance that most miners might simply shut down their GPUs for the price to reach their breakeven price.

The potential upside

On the plus side of things, Ethereum Classic miners looking to ramp up their capacity can leverage the sale of second-hand GPUs and ASIC miners at cheaper prices. This will allow them to leverage higher hashing power, giving them a competitive advantage.

There might also be a price advantage triggered by the migration of miners to Ethereum Classic.

The cryptocurrency might experience an increase in its popularity which might attract more ETC investment, especially from PoW enthusiasts.

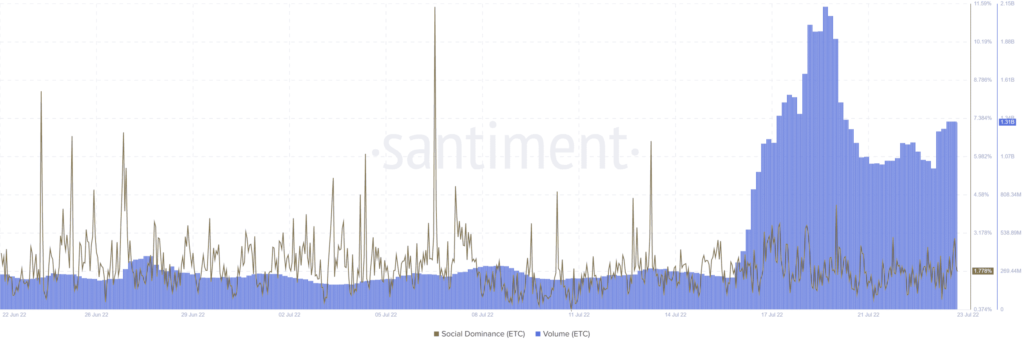

Investors can keep an eye out for such an outcome by closely watching the volume and social dominance metrics.

Additionally, ETC’s on-chain volume increased substantially since mid-July, but its social dominance metric remained within normal levels.

However, the cryptocurrency has enjoyed noteworthy spikes in social volume, especially as the conversation around proof of work gained intensity.

The ETC outcome

While the hash rate disruptions might be short-term, Ethereum Classic’s potential for long-term growth might increase in the long run.

At the end of the day, real demand and utility are the key growth drivers.

Thus, Ethereum Classic has a chance of becoming more attractive, especially to projects that prefer proof of work consensus mechanism for decentralization purposes.