Ethereum (ETH) has suffered heavy falls in the last two weeks, pushing it to trade below the $1800 level. However, the prices can stabilize at current levels due to several factors, such as a successful Merge on the Ropsten testnet, positive on-chain data, increased whale holdings, and other positive factors.

Ethereum (ETH) Price Could Show Major Price Movement

Ethereum’s team has successfully completed the Merge on the Ropsten testnet on June 8, without any bugs or difficulties after the Merge. Glassnode data reveals the value of ETH staked has reached over $22.78 billion and is ready for the upcoming main-net Merge to proof-of-stake (PoS). This represents 12.8 million ETH equal to 10.78% supply.

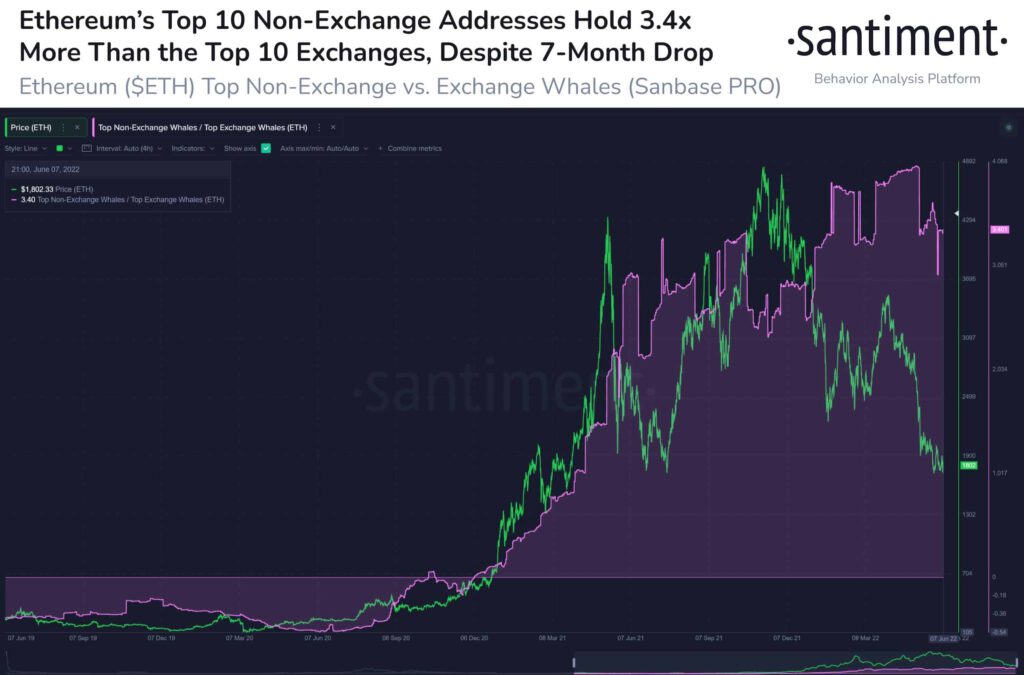

Moreover, according to the on-chain platform Santiment, the top 10 Ethereum whales are holding more ETH than the top 10 crypto exchange addresses despite a decrease in Ethereum prices. It shows whales’ confidence in the Ethereum (ETH) price could stabilize at current levels.

“Ethereum‘s top 10 non-exchange vs. exchange addresses are maintaining a high ratio of ETH owned over the top 10 non-exchange whales. With a tremendous 3.4x more coins held, there still appears to be a belief that prices can stabilize.”

Moreover, the ApeCoin community has agreed to keep ApeCoin (APE) within the Ethereum ecosystem, after receiving 54% votes in favor. Also, the market-making giant Wintermute plans to launch the Bebop decentralized exchange (DEX) on Ethereum. Therefore, an increase in the number of projects supporting the blockchain will increase the chances of price increases.

Trending Stories

Investors Should Wait Until May Inflation Report

ETH price seems to have stabilized at current levels and awaits upward movement. However, investors should wait until Friday’s Fed report on May’s inflation data to continue investing at these low levels.

At the time of writing, the ETH price is trading at $1,795, down just 1.11% in the last 24 hours.