Ethereum (ETH) tumbled during the crypto market crash of May and this led to a substantial decrease in the market value of the first smart contracts-backed blockchain technology.

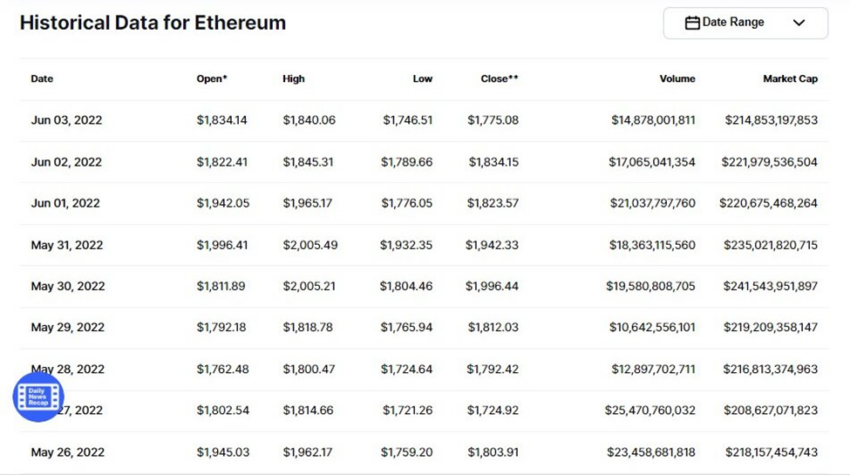

Ethereum remains the second-largest digital asset by market capitalization in June 2022. According to Be[In]Crypto research, ETH closed the fifth month of the year with a market capitalization of around $235 billion.

This was a 31% decline from the opening day’s market value. On May 1, ETH saw an impressive trading volume of $15.33 billion which corresponded to a market capitalization in the region of $341.05 billion.

Why the waning market capitalization?

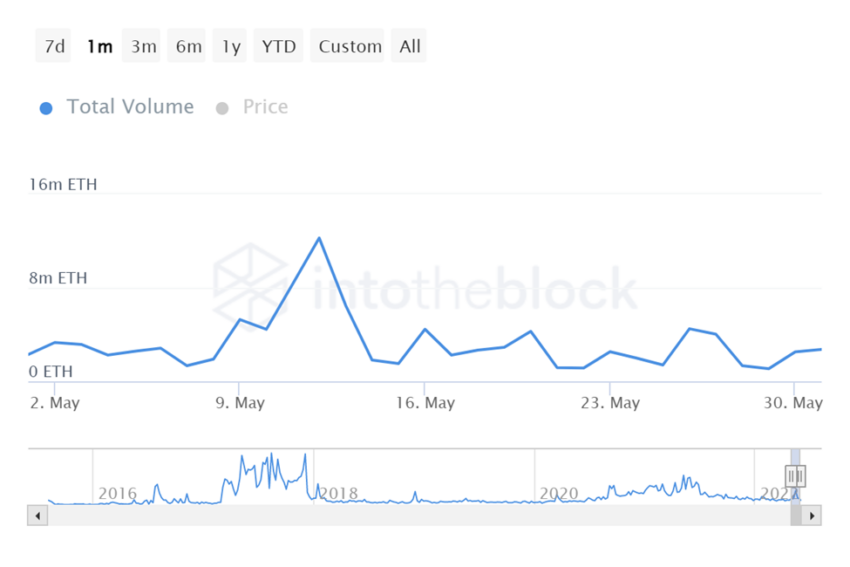

A broader sell-off of digital assets by holders in 2022 which was deepened during the week of May 9 to 13 can be attributed as the cause for the sinking market capitalization of Ethereum.

Some of the primary factors that led to the negative market sentiment include rising interest rates, inflation, and the economic uncertainty that has mired the entire financial system due to Russia’s unprovoked invasion of Ukraine.

In May, the number of large transactions involving Ether reached a peak of 16,950 at a price of $1,947 on May 12.

This corresponded with a large transaction volume of 12.25 million ETH (1 ETH was $1,947) which was around $23.86 billion.

On May 12, ETH opened at $2,072 and reached an intraday low of $1,748. Trading volume was around $42.46 billion and corresponded to a market capitalization of approximately $236.88 billion.

This was a 30% drop in Ethereum’s opening day market value. Due to the dip in price that saw ETH reach its lowest point since July 2021, the coin could not recover from its local lows for the rest of the month.

ETH price reaction

Ether opened on May 1, at $2,730, reached a monthly high of $2,957 on May 5, tested a monthly low of $1,721 on May 27, and closed the month at a price of $1,942.

Overall, this equates to a 28% decrease between the opening and closing price of ETH in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.