Ethereum (ETH) price trades negatively consecutively for the second session amid geopolitical tensions. The mounting selling pressure and lack of buyers conviction could lead the price to probe further lower. Investors anticipate Ethereum’s sell-off to continue in the coming few days.

- Ethereum’s (ETH) price fell almost 300 points on Thursday.

- In a quick reaction to Russia attacking Ukraine, ETH broke below $2,500.

- Expect further depreciation of 20% if the price slips below $2,300.

As of press time, ETH/USD is trading at $2,366, down 8% for the day. The second-largest cryptocurrency by market cap held a 24-hour trading volume of $22,164,876,265 with 46% gains. The fall in prices along with higher volumes is a bearish signal.

Ethereum price looks for signs for reversal

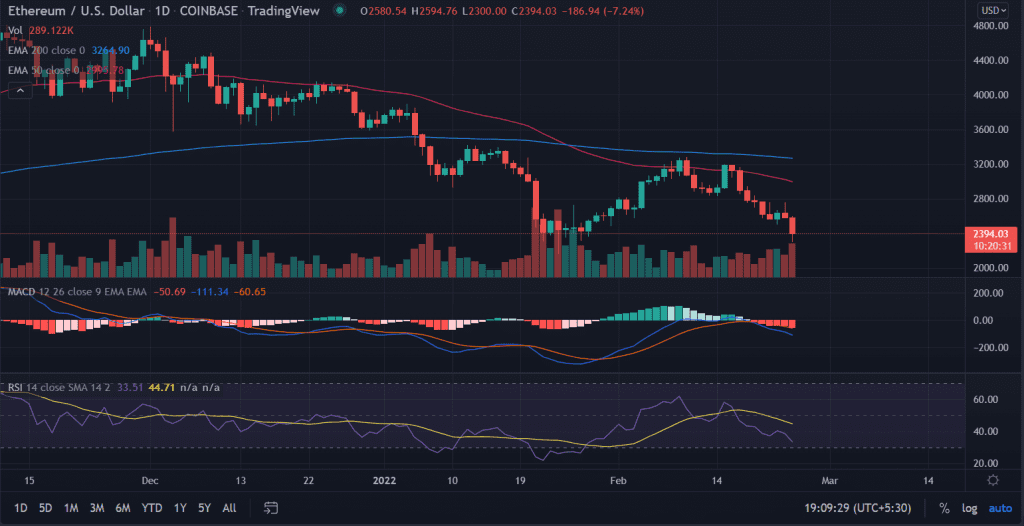

On the daily chart, Ethereum (ETH) has been pressured below the crucial 200-day and 50-day EMA since December 4 suggesting investors collect the liquidity toward the crucial demand turned supply zones.

Recently, ETH peaked at $3,284.75 but could not sustain the higher levels and retraced back to the $2,300 demand zone.

On above volume accompanied the recent price action indicating the continuation of the downside momentum.

A daily close below the session’s low would drag the price toward January’s low at $2,159.0

Furthermore, a resurgence in the selling pressure could seek another 20% downfall to the lows of $1,718.41.

Till now, everything seems to favor the bearish sentiment but if the price makes an effort to pierce above the critical $2,500 level then a reversal is plausible. Market participants shall ask for $2,800 next.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) continues to trade lower, currently reading at 30.

MACD: The Moving Average Convergence (MACD) falls below the midline with bearish momentum.