Ethereum (ETH) price gains for a second straight day on Wednesday. ETH has formed some bullish technical setup anticipating a short-term upside rally toward $3,200.

- Ethereum (ETH) price trades modestly higher on Wednesday.

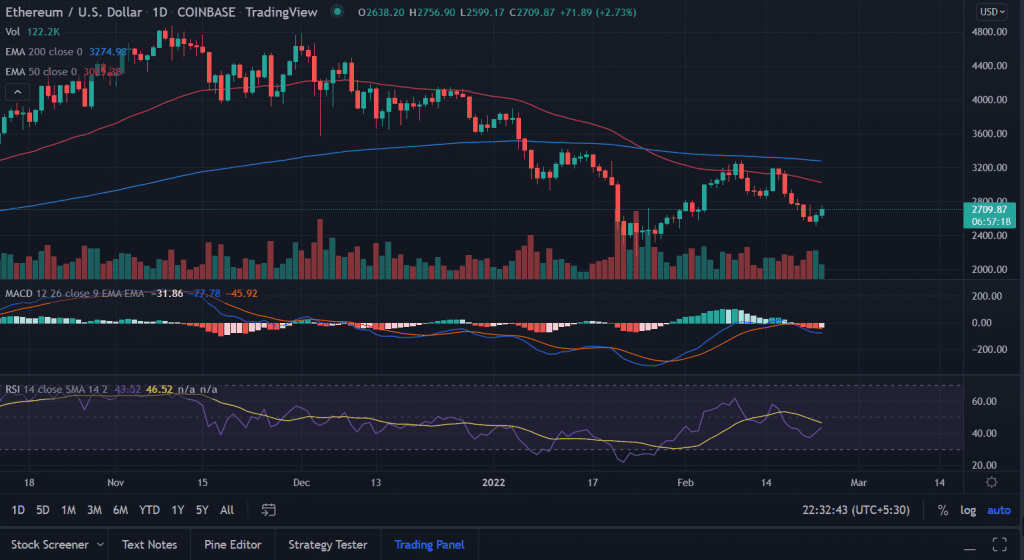

- Investors need to push above $2,800 with above an average volume to sustain the gains.

- Immediate upside hurdles are placed at 200 and 50-day EMAs.

The world’s second-largest digital asset has not been on the radar of the institutional inflows as Bitcoin remained their top priority. As per the CoinShares fund manager, there have been $109 million inflows. 81% of this total fund or $88.5 million has gone into Bitcoin (BTC) based funds.

On the other hand, Ethereum-based funds witnessed an outflow of $15.2 million according to the report.

As of press time, ETH/USD is trading at $2,708.38, up 2.65% for the day.

ETH anticipate upside continuation

On the daily chart, Ethereum’s (ETH) price has rallied 52% from the January lows of $2,159 to the swing highs of $3,284.75. However, ETH bulls remain unwilling to carry forward the gains as sellers return to collect the liquidity near $2,550.

The formation of ‘inverted hammer’ followed by two green candlesticks suggests bulls are ready to take another leap to test the upside filters.

With above an average volumes ETH/USD looks comfortable to test the first resistance hurdle at 50-day EMA (Exponential Moving Average) at $3,025.55 followed by the 200-EMA at $3,317.23.

Although the above-mentioned scenario looks possible for now but a reversal toward $2,500 could invalidate the bullish theory.

On the downside, the ETH price could retest the January lows of $2,159.0.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) still hovers below the mid-line while reading at 41.

MACD: The Moving Average Convergence Divergence (MACD) held below the midline with a neutral bias.

Conclusion: Momentum oscillators paint a mixed picture. The price must produce a daily candlestick close above $2,800 to sustain the upside gains.