The broader cryptocurrency market is now eyeing to regain the $1 trillion valuation. After a solid correction earlier in June, altcoins posed a good recovery led by Ethereum (ETH).

The ETH price is more than 13% on the weekly chart as the world’s second-largest crypto finds strong support at its 200-week moving average i.e. $1,200. As of press time, ETH is trading 1.2% down at a price of $1219 with a market cap of $148 billion.

The ETH price recovery comes amid sizeable short liquidations taking place in the world’s second-largest crypto. As per data on CoinGlass, more than $60 million in short liquidations took place last Friday.

In a note to clients, Genesis Trading’s Ainsley To, Gordon Grant and Noelle Acheson wrote:

A major options expiration on Friday had been watched as a potential source of volatility. However, “short risk cleared surprisingly efficiently” for Ether amid “perhaps unexpected stability”.

Trending Stories

Ethereum Profit Taking

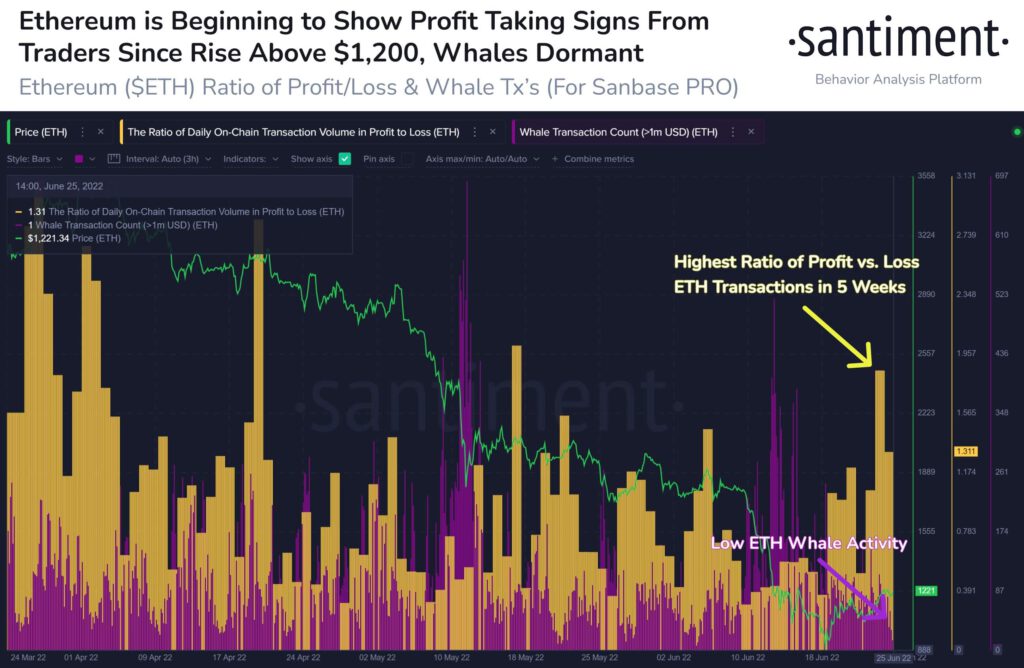

After a strong recovery last week, there have been some signs of profit-taking for the world’s second-largest cryptocurrency. On-chain data provider Santiment reported:

Ethereum is enjoying a nice weekend rise, and the #2 market cap asset’s price is now up +30% in the past week. It appears there is quite a bit of profit-taking on this mid-sized bounce, and the low whale activity indicates it isn’t coming from them.

Amid the BTC price correction since the beginning of May, the ETH short positions have been on a decline while long positions have been on the rise. Citing data from Datamish, crypto analyst Colin Wu explains:

The current Bitfinex ETH short position is 19,132.4 pieces. Since May 9, Bitfinex ETH short positions have continued to decline, with a cumulative decrease of 243,000 ETH; long positions have continued to rise, with a cumulative increase of 245,000 ETH.

Ethereum has been on a major downfall since the beginning of the year and still continues to trade more than 60% down year-to-date.