Ethereum TVL fell steeply in the second week of May due to decreased investor interest in decentralized finance and the entire crypto finance market.

Ethereum has dominated the decentralized finance (DeFi) space for a long time. According to Be[In]Crypto research, the blockchain that controls DeFi has lost 36% in total value locked (TVL) since the first day of the year. On that day, Ethereum had a TVL of approximately $146.77 billion, and this decreased to around $93.9 billion on May 10, 2022.

Ethereum is a blockchain platform that is home to several decentralized applications (dApps) and global payments systems. As a community, Ethereum built one of the most exciting digital economies that have created opportunities for developers and investors.

In addition to being the king of DeFi, Ethereum is also the biggest NFT blockchain by sales volume.

What contributed to the decrease in TVL?

Ethereum TVL has sunk in the second week of May due to dApps in its ecosystem crashing to new lows.

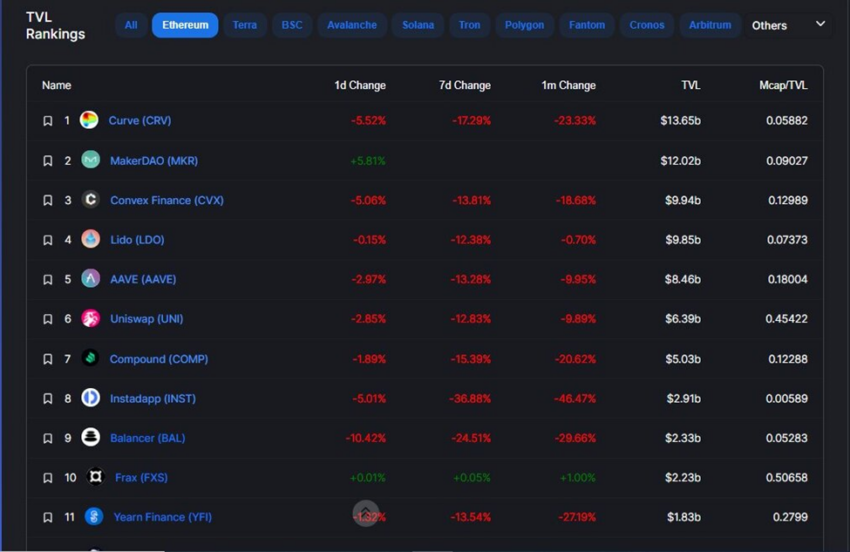

The stablecoin exchange, Curve (which has the most TVL in Ethereum) has fallen by more than 20% in the last month. Convex Finance has shed more than 18% of its TVL within the same period. Lido Finance and Aave have lost more than 12% and 13% of their respective total values locked.

Others that have contributed to the decline in total value locked include but are not limited to yield aggregation platform Yearn Finance, Balancer, Instadapp, decentralized lending platform Compound, and decentralized exchange Uniswap.

After tanking by more than $50 billion thanks to the aforementioned dApps, Ethereum still leads Terra and Binance Smart Chain by more than $80 billion and is miles ahead of Avalanche, Solana, TRON, and Polygon.

Ethereum has been named by Meta Platforms Inc. as one of the blockchains whose non-fungible tokens (NFTs) will be integrated with Instagram. Other platforms named for this integration included Solana and Polygon.

ETH price reaction

ETH opened in 2022 with a trading price of $3,683, reached a yearly high of $3,877 on April 3, and closed on May 9 at $2,245. Overall, this equates to a 39% loss in the price of ETH since the start of 2022.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.