The crypto market is closely watching developments around Ethereum 2.0 as it is set to introduce a major upgrade around June 2022. As we proceed towards ‘The Merge’ one of the key positive development is the drop in the ETH fee.

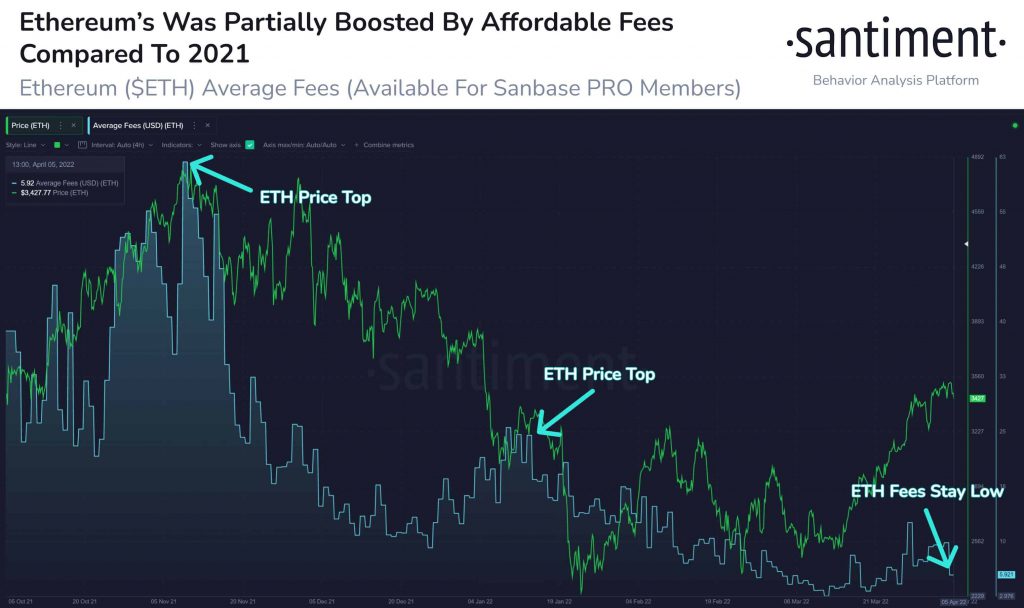

As per on-chain data provider Santiment, the ETH fee has dropped by a staggering 90% over the last six months alleviating user concerns. It adds that this could have also contributed to the ETH price surge. The data provider mentions:

Ethereum fees have been much more affordable than we’ve seen for the past 8+ months. The average gas fee sits at just $5.81. For comparison, average fees bloated to $69.57 on May 11, 2021, and $62.85 on November 8, 2021.

Besides, data provider Santiment also mentions that Ethereum (ETH) has been showing a greater correlation to the S&P 500 over Bitcoin (BTC). It adds:

Ethereum, not Bitcoin, is the top asset staying tightly correlated to the #SP500‘s performance. And since the #FOMC announcement 3 weeks ago, this has been good news for $ETH. Watch if #fed news causes any downswings for the May #FOMC update.

In the case of a Fed rate hike, the equity market can head for a correction in the short term. We can see the same spillover in the crypto market and the price of Ethereum (ETH). Crypto market analyst Michäel van de Poppe states that in case of a correction, ETH has a buy zone at around $3,100 levels.

This is what I mean on #Ethereum.

Might be that we’re looking for that HL in the coming week if the market starts to make a slight correction.

If it continues, I’m looking for the green area around $3,100 (just below the recent low) to take the liquidity and reverse. pic.twitter.com/ALyjXs5lGm

— Michaël van de Poppe (@CryptoMichNL) April 5, 2022

Ethereum 2.0 and The Merge

One of the key developments around Ethereum has been the introduction of the EIP-1559 protocol which introduces a burn mechanism and brings deflationary pressure on the Ethereum (ETH) price. Market analyst Lark Davis explains:

“At -2.8% supply growth a year post Merge, #ethereum will see about 3.3 million ETH a year burned. By the end of the decade total ETH supply will drop under 100 million. Or put another way, we will burn the equivalent of ALL ETH currently sitting on exchanges!!!!”

He further adds that when Ethereum 2.0 staking feature went live last year, the ETH price appreciated by 68%. Davis expects some major ETH price surge post the upgrade in June.

When #ethereum 2.0 staking went live the price rallied by 68% in the month leading up to it, and then by nearly 600% in the following 6 months.

Next major ETH upgrade coming at the end of June… pic.twitter.com/xMiybBg4OB

— Lark Davis (@TheCryptoLark) April 6, 2022