After Fed Chairman Jerome Powell’s speech last Friday, the broader equity markets and cryptocurrencies have come under severe pressure. The world’s second-largest cryptocurrency Ethereum (ETH) has seen a 12% drop in its price over the last weekend. As of press time, ETH is trading 2.66% down at a price of $1453 with a market cap of $177 billion.

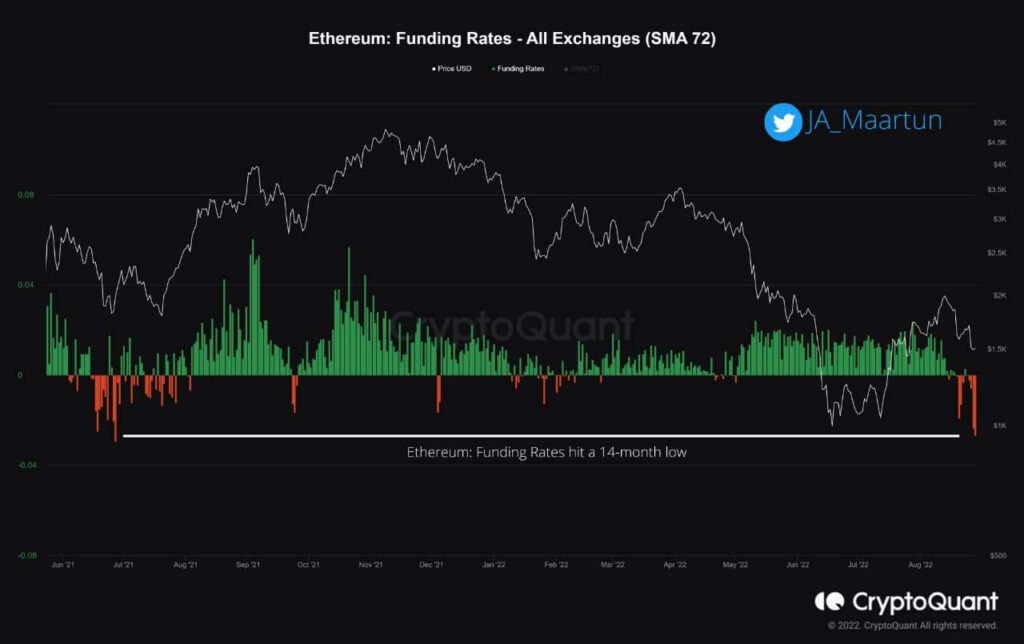

As per data from CryptoQuant, the ETH funding rate has dropped to negative hitting a new 14-month low. A negative funding rate indicates strong “bearish” sentiment among ETH traders. As CryptoQuant explains:

Ethereum Funding Rates are at a 14-month low, which means short-traders are paying long-traders. The last time Funding Rates were this negative, it was in July ’21 just before a huge short-squeeze on Bitcoin & Ethereum.

Ethereum Inflation Rate Drop

Since the implementation of the EIP-1559 protocol last year in 2021, the annual rate of inflation has dropped by 50.77%. Currently, the amount of ETH burned in the Ethereum network has exceeded 2.6 million. This amounts to $3.76 billion in total value as of the current ETH price.

However, as per the Glassnode data, the total value of ETH in Deposit contracts has touched a one-month low. As reported by Glassnode:

Trending Stories

Ethereum Total Value in the ETH 2.0 Deposit Contract just reached a 1-month low of $19,475,077,788.75 Previous 1-month low of $19,589,437,125.96 was observed on 27 August 2022.

Macro Influence Growing

The ETH price witnessed a strong rally over the optimism surrounding the Merge upgrade. From the June low of $1,000, ETH rallied more than 90% before retracing back. Currently, the macro factors have taken over by shadowing the optimism of the Merge upgrade.

Last week, Fed Chairman Jerome Powell said that the central bank won’t shy away from further interest rate hikes. Powell pointed out that the inflation rate, even if declining, is still very much high for a normal consumer.

Thus, further quantitative tightening measures could put greater pressure on equity and the crypto market. Ethereum’s growing correlation to S&P 500 could also impact the ETH price.