A recent Bloomberg Intelligence report published by Mike McGlone, Senior Commodity Strategist, presents a bullish thesis for Ethereum vis-à-vis the current macro environment. The Russia-Ukraine conflict, potential interest rates hikes, and uncertainty surround the markets, but McGlone believes BTC, and ETH could come out on top.

Related Reading | How Vitalik Buterin Will Use $100M In SHIB To Fight COVID-19

The report claims Ethereum has won an advantage over traditional assets. Specifically, McGlone compares ETH’s price performance versus the Nasdaq 100 which could continue to fall behind the cryptocurrency if the Russia-Ukraine conflict extends.

The expert claims Ethereum’s rally has been supported by a boom in adoption for non-fungible tokens (NFTs), and decentralized finance (DeFi) protocols. In the digital space, this network has also supported the deployment of U.S. dollars in the form of stablecoin, a digital asset pegged to the value of the currency. McGlone said:

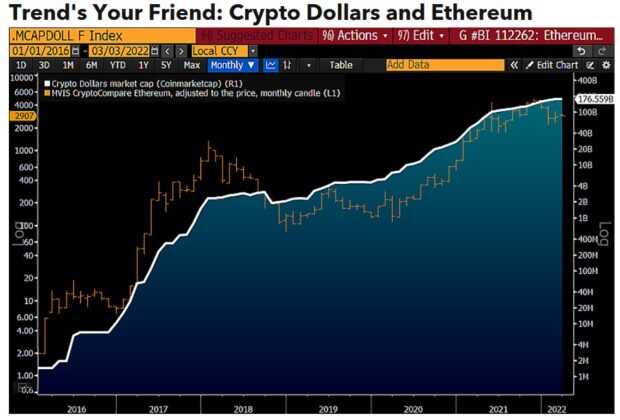

Around $176 billion on March 2, the market cap of the top six crypto dollars listed on Coinmarketcap is up about 5x from the start of 2021. We see little to stop market cap from reaching the trillions.

As stablecoin increase, their market cap, and adoption levels, ETH’s price should follow suit. As seen below, there is an apparent correlation between the market of stablecoins and the rise in ETH’s price.

When compared to the Nasdaq Index, there seems to be a correlation between the cryptocurrency, its volatility levels, and price appreciation. Volatility, in the chart below, is a metric used by McGlone to measure risk associated with Ethereum. The expert said:

Ethereum’s 260-day volatility has been generally declining vs. the same risk measure of the Nasdaq since peaking at about 11x in 2018. Closer to 3x now, the relative risk of the nascent technology/asset is poised to keep falling, particularly if the war increases recession risks and stock market volatility.

The Biggest Obstacle For Ethereum

Its correlation with the legacy financial markets, the Nasdaq Index, could play out against Ethereum, McGlone believes. If the Index trends lower in the coming months, due to the macro-economic pressures, ETH’s price could break below its critical support sitting at around $2,000.

Ultimately, ETH’s increased demand versus declining supply, after the implementation of EIP-1559, supports this cryptocurrency’s bullish fundamentals. In case of further decline, $1700 should hold as critical support.

The cryptocurrency revisited that price point back in mid-2021 before resuming its bullish trend into uncharted territory. McGlone said:

If equities drop fast, Ethereum could repeat last summer and revisit about $1,700. Once the weaker leveraged long positions were purged, the resolution was a new high around $4,800 in November.

Ethereum’s Biggest Strenght

In any case, a bearish trend for Ethereum seems unlikely to affect its levels of adoption and more importantly the number of people jumping into its ecosystem. Further data provided by McGlone indicates a 76% increase in developers working in DeFi in 2021 alone.

Unlike the bear market of 2017-2018, the expert argued, many of the concepts and proposals of previous years have been deployed. Data from DeFi Pulse records a total value locked of the DeFi sector stands at $75 billion, a massive increase achieved in under two years.

Related Reading | MetaMask And Infura Clarify On Connectivity Complaints, Problem Solved?

As of press time, ETH’s price trades at $2,673 with a 1.5% profit in the last 24 hours.