The world’s second-largest cryptocurrency Ethereum (ETH) has faced strong correction during the current market fall. While Ethereum continues to hover around the $2,000 level, on-chain data hints at a possible price surge in the near term.

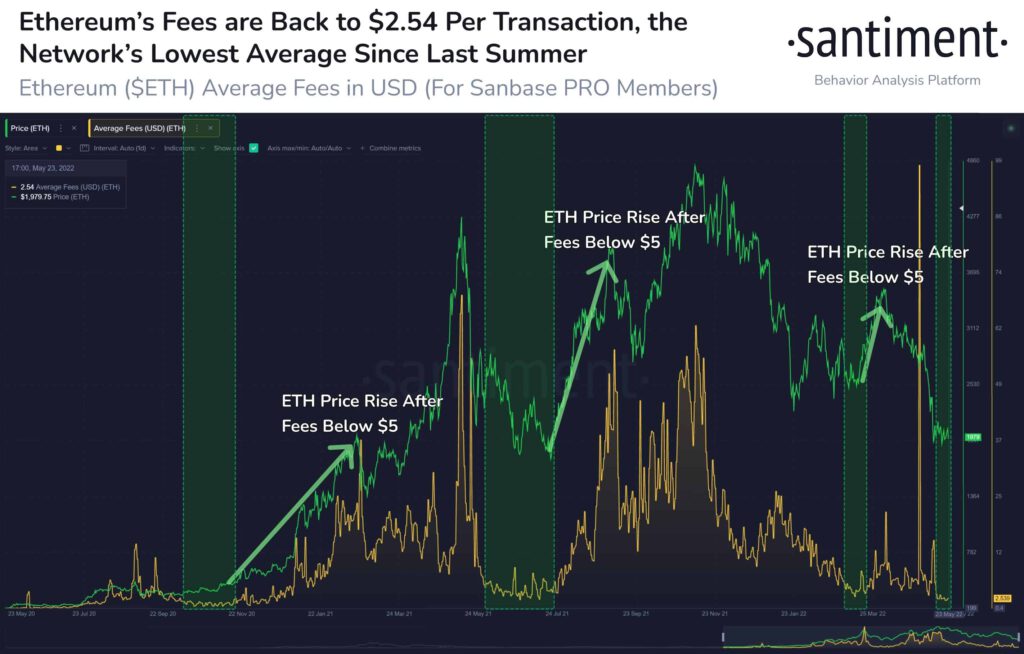

On-chain data provider Santiment reported that the Ethereum gas fee has dropped to a ten-month low of $2.54. It adds:

Ethereum’s average fees are at an extreme low, costing traders just $2.54 per transaction currently. This is the lowest $ETH cost level since July. Historically (but by no means automatically), $ETH prices rise after average transactions dip below $5.

Ether (ETH) Under Accumulation Phase

On-chain data shows that Ethereum has been under strong accumulation recently. The whale group of addresses holding anywhere between 10k and 100k ETH in their wallets have grown their balance from 28.3M of ETH in March to 29.0M of ETH as of date.

It means the whales have purchased more than 700K ETH worth nearly $1.4 billion. These whale addresses currently hold nearly one-fourth of the total ETH supply.

Trending Stories

From the above image, the divergence is clear with whales accumulating at every price fall. However, along with the whales, the Ethereum retail investors have also participated equally. The Ethereum whale addresses holding anywhere between 1 to 10 ETH have grown considerably during this period.

Over the last one month and a half, the ETH whale addresses holding between 1 to 10 ETH have grown from 1.14 million addresses to 1.19 million addresses.

Industry experts are suggesting that after the recent price crash there could be a relief rally in the crypto market. If Ethereum manages to sustain above $2,000 on a daily closing basis, the ETH price could hit immediate price targets of $2,300.

However, if the relief rally sustains supported by a broader market upside, the ETH price could move to the high of $3,000 or closer to that.