The upcoming Ethereum [ETH] Merge has been highly anticipated and so far all the test runs have been successful. Although this suggests that the Merge might turn out smooth, Grayscale highlighted an area of concern that investors should consider.

Grayscale expressed concerns over the potential impact on the Merge, especially on tokens that run natively on Ethereum. The crypto investment firm believes that the Merge may lead to a fork that might have unexpected and unfavorable outcomes.

7. A PoW fork of the current Ethereum network would bring duplicate instances of all of this and more, which could present meaningful challenges to developers and market participants, and an existential risk to DeFi on the new chain.

— Grayscale (@Grayscale) August 16, 2022

Blockchain network hard forks have historically yielded two networks, with each having its own native token. There are a variety of ERC-20 tokens that operate within the Ethereum network, which means that a fork would likely affect them too. This includes the USDT stablecoin.

Grayscale’s concern is that the Merge might create a scenario where stablecoins and tokens locked in smart contracts might not be redeemable.

The crypto investment firm also notes that token and stablecoin holders might panic and start liquidating their holdings. Such an outcome would create a substantial amount of sell pressure.

8. Consider an ERC-20 token backed by another asset. Which token is redeemable for the underlying asset after the fork?

— Grayscale (@Grayscale) August 16, 2022

Are these legitimate concerns?

Grayscale’s argument holds merit with regard to previous hard forks and their outcomes. There have also been rumors that the Ethereum POW chain will remain active after the Merge, perhaps even running parallel to the new network.

This is the first time that a network is transitioning from one consensus to another, hence there are a lot of unknowns. Such concerns might explain why the total value of ETH locked in DeFi dropped substantially in the last six months.

Many ETH holders might have decided to move their coins in anticipation of the potential disruptions that might be associated with the Merge.

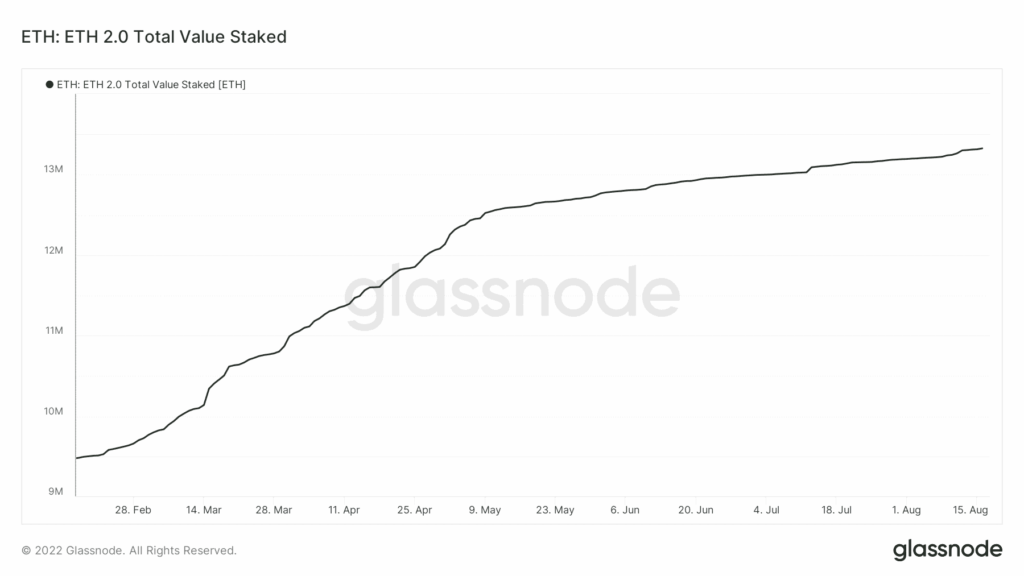

Additionally, a large amount of ETH shift into ETH 2.0 staking pools was also witnessed during the same period.

Meanwhile, the amount of ETH flowing into ETH 2.0 staking facilities increased drastically during the last six months.

The above outcomes confirm that many ETH holders have taken measures to protect their interests once the Merge takes place.

Where does ETH stand then?

While Grayscale’s concerns are legitimate, Ethereum developers have likely taken such concerns into consideration.

The Merge will likely carry over data from the PoW Ethereum and act as a handover.

Note that a parallel chain would certainly lead to duplication.

However, the strategy and measures for addressing such concerns remain to be seen.