Ethereum’s price has been on a roll after it moved past a crucial resistance barrier. If the bulls can sustain the recent run-up, there is a good chance ETH will revisit $4,000 with more opportunity for gains.

Significance of the $3,150-level for Ethereum’s price action

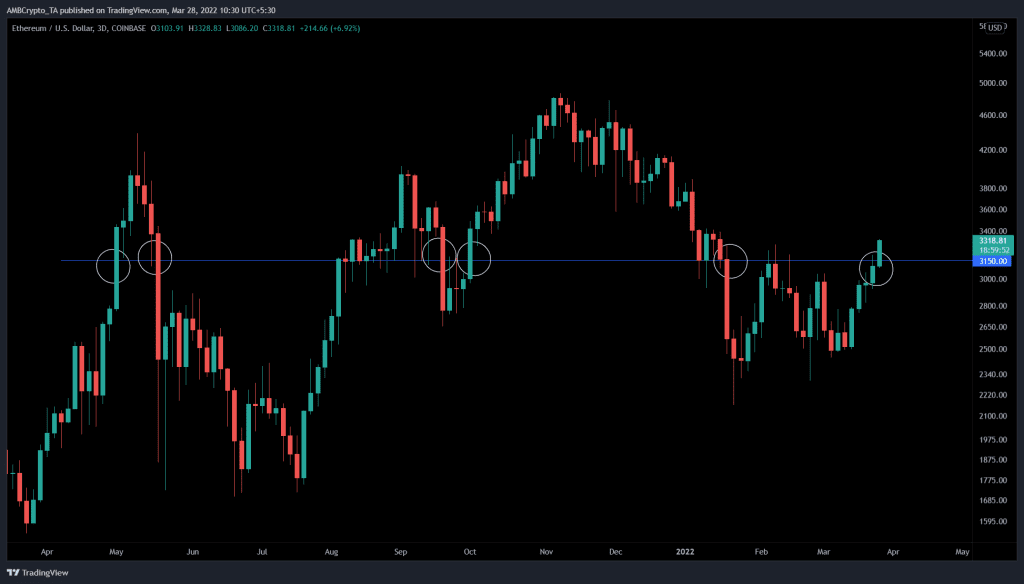

ETH has rallied by 34% over the past two weeks and shows no sign of stopping as it retested the $3,150-level for the 10th time in the last two months or so. Interestingly, the altcoin’s price has had a volatile relationship with this barrier and the recent move above is a testament to this connection.

The first time Ethereum’s price hit $3,150 was in May 2021 and the three-day candlestick saw 23% returns as it moved above the said level. Since then, any move – above or below relative to $3,150 – has seen immense volatility, causing massive gains/losses.

The most recent breach of this level to the downside was in January, which led to a -18% loss in a single three-day candlestick. Now that the price is back above this level, investors can expect a similar outlook to occur. Assuming history repeats, investors can expect ETH to retest $3,600.

However, if bulls manage to flip this hurdle into a support level, there is a high chance this uptrend will continue until Ethereum’s price hits the $4,000 psychological level.

Identifying what the supply is like

Supporting this massive explosion for ETH’s price is the supply on exchanges. This metric tracks the number of ETH held on centralized entities and is used to determine the potential sell-side pressure.

Therefore, a massive inflow of ETH to such platforms often depicts investors’ interests and serves as a proxy for their investments. For ETH, however, the number of tokens on exchanges has been on a downtrend since May 2021, decreasing from 22.09 million to 15.64 million.

This decline indicates a net outflow of 6.45 million and effectively denotes a drop in the sell-side pressure. Hence, market participants, especially long-term holders, are optimistic about the performance of ETH prices.

To add to the already bullish narrative for ETH is the upcoming event known as the “Merge,” which is the migration of the Ethereum blockchain from proof-of-work to proof-of-stake. Such a development will cause validators and investors to stake their ETH to earn interest, further reducing the selling pressure available on exchanges.