Ethereum, the largest altcoin within the crypto market possesses one of the strongest enthusiasts/holders within this domain. Despite many headwinds, these holders have maintained an undeterred narrative regarding holding their coins. Just recently, on 4 May, nearly 2.56 million ETH had left centralized exchanges since January.

Can this trend continue to show amidst the growing concerns regarding interest rate hike?

Up or down but ‘piling on’

ETH investors, traders or stakers have anticipated the upcoming ‘Merge‘ since last year. Capitalizing on this anticipation, the total value in the ETH 2.0 deposit contract just reached an ATH. The amount of Ethereum staked on the Beacon Chain reached another milestone despite asset prices tumbling at an alarming rate.

According to on-chain data from crypto analytics platform Glassnode, the total value in the ETH 2.0 deposit contract stood at an all-time high of 12,374,946 ETH. This also signified that over 10% of ETH’s supply has been sent into the Ethereum 2.0 deposit contract.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 12,374,946 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/3jeHudJHeq

— glassnode alerts (@glassnodealerts) May 6, 2022

Moreover, the staking reward is around 4.4% annual percentage yield. This might be a lot less than the double-digit returns early Ethereum stakers enjoyed in the past. Nonetheless, the demand remains significant. As per ultrasound.money, 2.27 million ETH burned so far, worth an estimated $6.25 billion.

Are there ETH liquidation concerns?

Well, 100% yes. Unfortunately for investors, none of these bullish metrics had made a difference to price action this week. ETH dumped more than 7% in just 24 hours as it traded around the $2.7k mark.

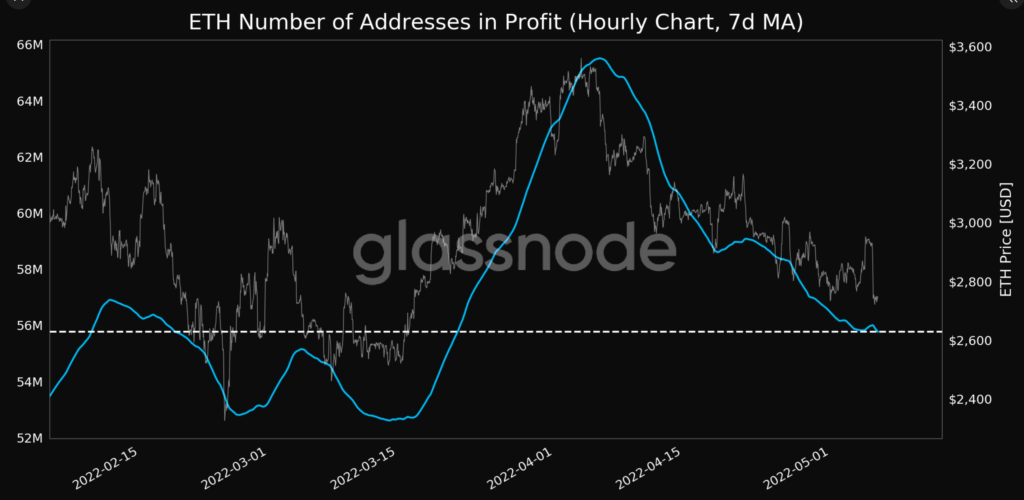

ETH holders that enjoyed profit, for instance, suffered a massive blow as number of addresses in profit (7d MA) reached a 1-month low of 55,775,513.583.

In fact, the Daily active addresses went down by 3%. This suggested that investors’ interaction with ETH scaled at a minimal rate during the past week. Likewise, this affected interest among new participants.

Even the large holders’ Netflow showed a grim picture as the metric fell by 50% for the week. This signified that large holders sold more ETH than accumulating them.

Nonetheless, one aspect didn’t change – Ethereum acceptance amongst institutions. The owner of a $6.5 million Greenwich estate has decided to accept cryptocurrencies, namely Bitcoin or Ethereum, as payment for the property.