The largest altcoin has continued to take important steps concerning preparation ahead of the Merge. But Ethereum’s on-chain activity has barely seen any growth.

And, you might ask is it calm before the storm, or just an overall crisis in the industry caused by the lack of inflows?

Emptiness could be the answer

On-chain activity concerning the second largest cryptocurrency witnessed a significant decline at the time of writing.

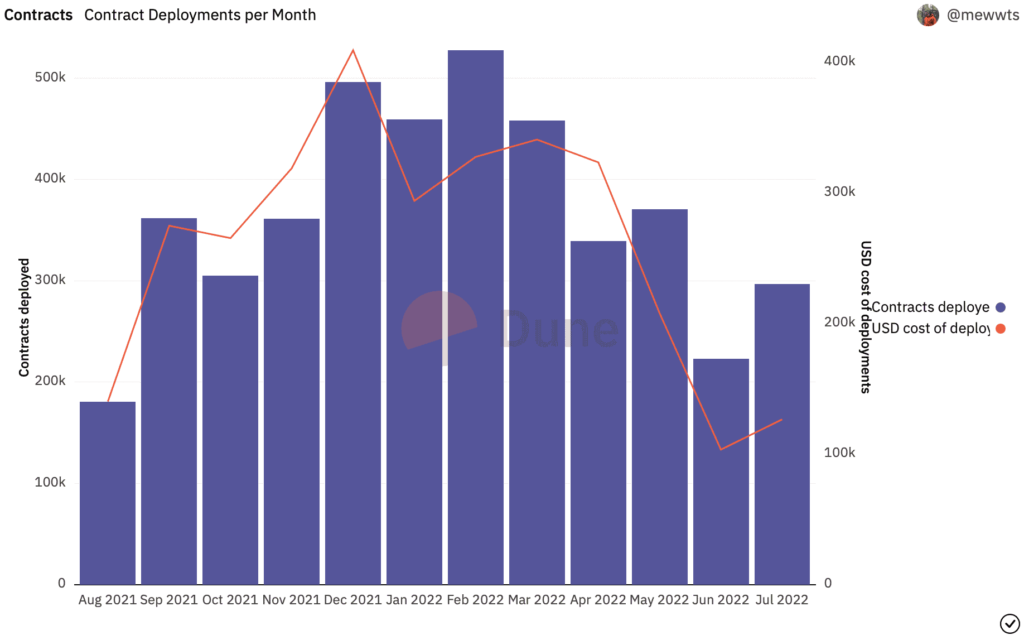

Dune Analytics, an online analytics platform, recorded the number of contracts deployed on Ethereum over the last 12 months. The metric decreased below 300,000 deployments as seen in the graph below.

Notably, the number of smart contracts deployed on the Ethereum network had reached 1,971,632 in March, hitting a new all-time high and marking a 75% increase from the previous month.

This could suggest that the adoption of the Ethereum platform has been on the rise. Ergo, signaling strong support for the coming upgrade to Ethereum 2.0.

Following Merge, the network would switch from a Proof-of-Work consensus protocol to a Proof-of-Stake.

This transition could remove the scalability problem which currently discourages many developers from deploying on the network.

Using the same enthusiasm, ETH 2.0 saw deposits surge from about eight million in mid-May 2022 to a press time value of over 13 million.

To be specific, according to the analytics platform Glassnode, the number of staking ETH 2.0 deposit contract addresses has reached 13,302,229.

Are HODLers excited?

Well, undeniably, ETH holders are excited. Consider this- an Ethereum wallet that had been dormant for around three years has now become active and is transferring tokens.

Over the past day, the whale moved approximately 145k ETH to different wallets.

The initial source of ETH for this whale was to participate in the Ethereum Genesis ICO, and a total of 150,000 ETH was obtained, of which 5,000 ETH was transferred out to the Bitfinex3 exchange address on July 31, 2019 ($ETH=219).

— Wu Blockchain (@WuBlockchain) August 15, 2022

At the same time, the number of addresses with a non-zero balance has attained an all-time high (ATH) of 85 million. Did this help the price in any way? Well, not really.

Even though ETH surpassed the $2k mark at one point on 14 August, it couldn’t really sustain the level. At press time, ETH suffered a fresh 5% correction over the last day as it traded around the $1.9k mark.