Ethereum saw a steep decline in sales volume due to a lack of investor appetite for digital collectibles throughout July.

Ethereum struggled in July but remained the biggest selling blockchain by NFT sales volume by around $535.7 million, according to Be[In]Crypto Research based on data from CryptoSlam.

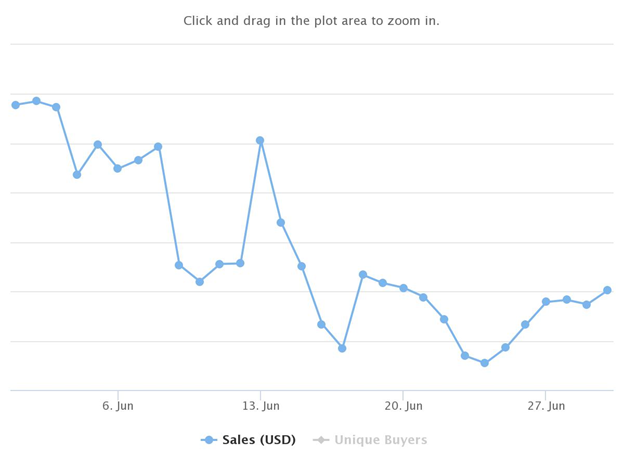

Despite grossing more than half a billion dollars, sales were down by 25% from June. In June, digital collectibles sales on Ethereum were approximately $722.4 million.

With that said, July’s metric was miles ahead of competing chains such as Ronin, Flow, Polygon, Immutable X, and Binance Smart Chain (BSC).

Why the drop in sales?

The dip in the number of unique buyers (229,930), transactions (1.17 million), and average sale value ($458.81) of NFT projects housed in Ethereum such as CryptoPunks, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Art Blocks, Otherdeed, Azuki, CloneX, Moonbirds, and VeeFriends, explains the drop in sales volume.

Compared to Jan. of this year when Ethereum reached a yearly high, there were 356,922 unique buyers, 1.29 million transactions, and an average sale value of $2,922.

ETH price reaction

ETH opened on July 1, with a trading price of $1,068.32, reached a monthly high of $1,759.88, tested a monthly low of $1,019.22, and closed the month at $1,681.52.

Overall, despite the massive drop in volume, there was a 57% increase between the opening and closing price of ETH in July.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.