According to Santiment data, both the ETH exchange inflow and outflow have been declining. This is symptomatic of the sluggish behavior of on-chain and off-chain wallet holders.

The Ethereum development team, on the other hand, has been moving quickly to begin the Shanghai upgrade, the next phase of the Ethereum merge.

Here comes Shanghai

The core Ethereum development team is starting to work on Shanghai, the next major upgrade to the Ethereum network.

To that effect, a testnet, called Shandong, has been built to get things rolling. Many Ethereum Improvement Proposals (EIPs) will be implemented in Shandong for testing before being narrowed down by Ethereum’s core developers to a smaller set of changes for inclusion in Shanghai when it goes online.

With the Merge as the first phase in a five-phase upgrade, the Surge will see the introduction of sharding on Ethereum.

Sharding is a crucial step in improving the scalability of the blockchain’s data storage and retrieval mechanisms. Sharding will be utilized by Ethereum in conjunction with layer-2 rollups to distribute the massive data sets across the network.

Following the Merge, the next three phases of Ethereum’s continuing development — Verge, Purge, and Splurge — will occur over the course of the next few years.

Ethereum dominates DeFi

At the time of writing, DefiLlama data showed that Ethereum held a 57% share of the Total Value Locked (TVL) across all chains.

As rival smart contract networks have emerged, Ethereum’s once-dominant 90% market share in the nascent Decentralized Financial Technology industry has been eroded (DeFi).

With these planned changes and the cryptocurrency market’s potential recovery, Ethereum’s TVL, which was over $30 billion, might rise.

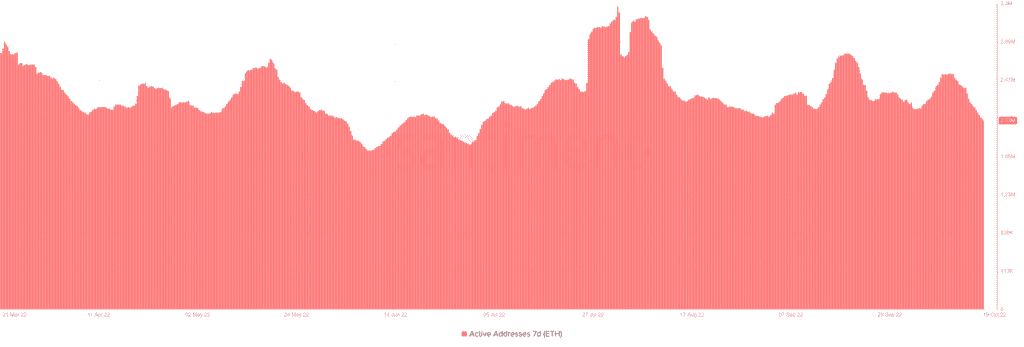

The number of active addresses exceeded two million, according to the 7-day active address metric.

ETH downtrend continues

After the rise from around June to mid-August, during which it nearly reached $2000, ETH has been in a fall recently.

The decrease that started in mid-August has continued, according to a daily time frame analysis of the ETH chart.

At the time of writing, ETH was trading for about $1,300, down more than 35% from where it was before the fall began.

After ETH’s decline persisted, a new level of support was observed between $1,269 and $1,190. The area between $1,337 and $1,400 was the resistance, which was evidently the previous support level.

Additionally, the price movement was noticed below the yellow and blue moving averages, which stood in for the 50 and 200 MAs, respectively.

Looking on the brighter side

The market value to realized value ratio, however, paints a less gloomy image for holders despite the asset’s apparent decrease.

The 30-day MVRV ratio metric displayed a reading of -1.49. Consequently, less than 2% of the asset’s value was lost by buyers and holders during the course of the previous 30 days.

The Ethereum network is expected to improve as a result of the Shanghai upgrade and following Ethereum updates.

Although it continues to be the world’s largest smart contract network, these improvements may allow it to explore new possibilities for blockchain and smart contract applications.

As a result, ETH will have a wider range of applications, which may help its price.