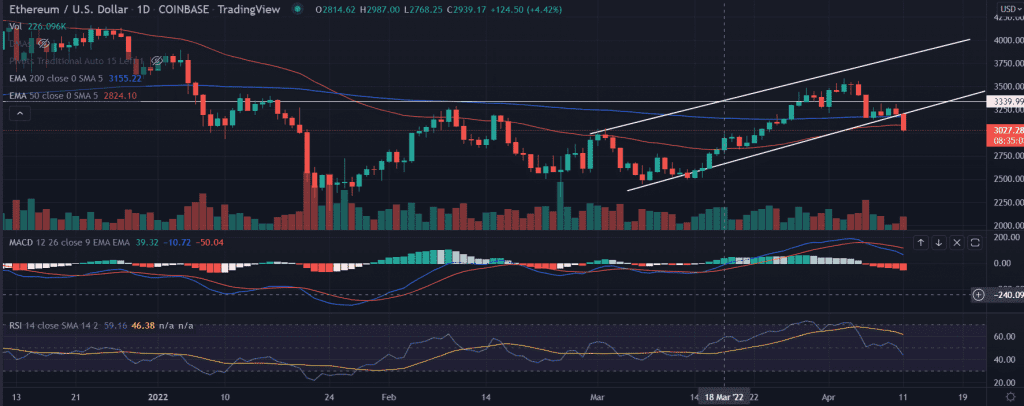

ETH price shows a massive decline in the price as the fresh trading week begins. The pair opened the new trading session on a lower note. A further retracement seems to be on the way for ETH before a move to key levels.

- ETH price slides into the negative zone with high volumes on Monday.

- The price breaches the ascending channel indicating the selling pressure in the pair.

- The momentum oscillators turn in favor of bears.

ETH price moves south

On the daily chart, the ETH price flipped the crucial 200-day and the 50-day EMAs (Exponential Moving Average) indicating the buyers are on the backfoot in the altcoin. In addition to that, the ETH price crashed nearly 11% since April 4.

Now, the price took a little breather around the vital support of around $3,000. A daily close below the mentioned level would invite more sellers on the board.

On the downside, the first lower target is placed at $2,750 with no in-between stoppages.

Furthermore, a break of the mentioned level could see the token crash to $2,000 before reassessing the directional bias.

While Ethereum price action might seem pessimistic, the bearish outlook will face invalidation if ETH is sliced above the ascending trend line on the daily chart. The price channel extends from the lows of $2,445.00.

Investors could explore the supply zone extending from the $3,400 and $3,750 in a highly optimistic scenario.

As of press time, ETH/USD reads at $3,037, down 5.32$ for the day.

Technical indicators:

MACD: The Moving Average Convergence Divergence indicates an increased selling momentum still holds above the mid-line.

RSI: The daily Relative Strength Index reads at 45. The outlook remains bearish for the indicator.